Unit 11 Research Project Hnd Level 5 Assignment PDF

| Title | Unit 11 Research Project Hnd Level 5 Assignment |

|---|---|

| Author | Anonymous User |

| Course | Corporate and Business Law |

| Institution | The Millennium Universal College |

| Pages | 33 |

| File Size | 442.8 KB |

| File Type | |

| Total Downloads | 29 |

| Total Views | 131 |

Summary

HND Assignment, Got merit and distinctions in these, I hope it will help you guys in acing your assignments...

Description

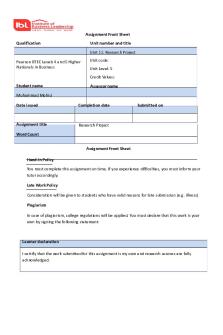

Assignment Front Sheet Qualification

Unit number and title Unit 11: Research Project

Pearson BTEC Levels 4 and 5 Higher Nationals in Business

Unit code: Unit Level: 5 Credit Values:

Student name

Assessor name

Muhammad Mohid Date issued

Completion date

Assignment title

Research Project

Submitted on

Word Count Assignment Front Sheet Hand-in Policy You must complete this assignment on time. If you experience difficulties, you must inform your tutor accordingly. Late Work Policy Consideration will be given to students who have valid reasons for late submission (e.g. illness) Plagiarism In case of plagiarism, college regulations will be applied. You must declare that this work is your own by signing the following statement:

Learner declaration I certify that the work submitted for this assignment is my own and research sources are fully acknowledged.

Student signature: _______________________

Date: ___________________________

Contents Research Project:.........................................................................................................................................4 Task P1 examine research methodologies and approaches for research process........................................5 Financial Services Industry:........................................................................................................................6 Fundamentals of Islamic Finance and Banking........................................................................................11 By Syeda Fahmida Habib............................................................................................................................11 Task P2Important approaches of research methodologies:.......................................................................11 Task P3 conduct a primary research and secondary research by covering their cost data access and ethical issues:............................................................................................................................................13 Prepare PowerPoint presentations and research report to communicate outcomes of your project to the identified audience.............................................................................................................................13 Research report:.......................................................................................................................................14 Answer: It’s the best use for my money. Bank keeps my money relatively safe in case I need it anytime soon....................................................................................................................................15 Data analysis using qualitative and quantitative tools:..............................................................................15 Quantitative Research:......................................................................................................................15 Qualitative Research:........................................................................................................................16 Sample selection in qualitative research is usually based on a smaller number of not-necessarily representative cases..........................................................................................................................16 Task P4......................................................................................................................................................17 a) Effectiveness of research methods applied for meeting research objectives:.....................................17 b) Suggest alternative research methods and lessons you have learned................................................30 Bibliography...............................................................................................................................................32

Research Project: Now a day there is global business environment competition is very high only those business would survive and work which work with innovation and creativity as well as with strong managerial and leadership skills business process. Reengineering is required to ensure efficiency and effectiveness in business operations. Research is very important for growth of business research helps in business new product development as well as processes improvement my research project is regarding digitalization trends in modern business environment and how it is helping to achieve business success in current business environment. There are different types of tools and techniques through which we can digitalizeour operations e.g. inventory management can be shifted on J.IT system and on economic order quantity. Marketing function can be transformed by digital marketing as compared to conventional marketing There are different types of tools and techniques through which we can digitalize our operations. For example, inventory management can be shifted on Just in Time (JIT) system and on economic order quantity (EOQ). Marketing function can be transformed by digital marketing as compared to conventional marketing. Sales system can be automated by putting e-commerce solution on our web portal. We can have centralized our resource management and strategy making by using enterprise resource planning software. We can automate our accounting department by using Quick book system. Sales system can be automated by putting Ecommerce solutions on our web portal. We can centralize our resources management and strategy making by using enterprise resource planning software we can automate our accounting department by using quick book system.

My research project is regarding digitalization trends in modern business environment and how it is helping to achieve business access in current business environment. We can take care of customers by using customer relationship management software’s. We can also use different business intelligence software’s to explore full potential of the business. We can use knowledge management tools to explore hidden potential of the business. We can also use big data management to get competitive advantage over our competitors. In addition to this there are other operational management techniques like balance score cards, kaizen theory, BPR, 6-Sigma to increase quality level of our operations. We can also use strategic human resource management tools to ensure success of business by having good leadership talent for business continuity and succession.

Following are important components of my research project: Task P1 examine research methodologies and approaches for research process Research proposal: My major focus s is on the cross comparison of performance of financial institutions in the global financial crisis and how they performed under financial stress conditions following are important research questions.

Following are important research questions. 1. Islamic financial intuition product is stronger structured and having good risk management qualities as compared to interest based financial institution products.

2. The performance of Islamic financial institution is more stable as compared interest based institution Hypothesis (assumptions) Our assumption is that external factors have the same opportunities, threats and equal competition level for all financial institutions. Following are important further assumptions of my research project 3. Literature Review: Important books and articles on financial institutions, Islamic banks, conventional banks. Financial Services Industry: The term financial services relate to the various services that are provided to clients by the financial industry. It covers a wide range of institutions that are involved in the management of money and finances. These institutions can be in the form of banks, credit unions, insurance companies, credit card companies, investment funds, stock brokerages and consumer finance companies. The financial service industry affords many different services to its clients. Different institutions provide different types of services to the clients; some cater to commercial clients, whereas some cater to individuals. There are various financial institutions that lend money, each for different purposes. The financial service industry is a direct result of the Gramm-Leach-Bliley Act of 1999, which granted banks the right to branch out into areas of the financial industry that were previously off limits to them. It gave them the opportunity to either merge with other financial institutions or set up their own new divisions. Some banks bought, merged with or acquired insurance companies, brokerage firms, investment banks and holding companies, thereby diversifying their operations. Some simply created their own new divisions that began selling various financial products to their clients.

Banks comprise the largest section of the financial services industry. The main function of a bank is to provide a safe and secure place for people to put their money. The banks will invest the money that is deposited with them, usually for their own gain, and give the depositor a miniscule amount of interest if the money is placed in a savings account. There are various types of banks, but the most common ones are private/savings banks and commercial banks. Private or savings banks offer their clients many services such as checking services, lending services, mortgage services, depository services and credit card services. Commercial banks also take deposits and provide checking services, but make loans mainly to corporate or commercial customers for their business needs. The loans made by commercial banks are usually to finance major projects or business expansions. Another branch of the banking sector is called investment banking. This refers to the part of corporate finance that enables large corporate clients to raise the necessary funds which they may require for their projects. This is done by issuing securities or bonds to the public, in lieu of equity or debt. Investment banks will also advise their customers during various financial transactions or during mergers and acquisitions. Investment banks also provide investment services such as hedge funds, asset management and custodial services. Insurance companies provide risk coverage services to their clients. Risk coverage service is intended to cover various risks that are associated with a person's life or property. Besides providing security to the individual, many insurance plans also provide a monthly or yearly income to the individual by way of dividends. There are a number of insurance policies available, such as life insurance, general insurance and commercial insurance. Advisory services companies generally provide investment services to their customers. There are many investment opportunities and options available to customers, but not every type of investment is right for every individual. Not every investor is right for every type of investment. There are many factors that must be considered before an investment is made. Some of these considerations are the security of the investment, risk of the investment and return on the investment. Advisory investment companies advise the investors to choose the

correct investment that will suit their plans along with assessing all the risk factors. They also handle their clients' money and invest it according to the instructions of the clients. A new phenomenon in the financial service industry is the birth of a concept called Money Center Banks. This term was given to massive institutions that have begun to operate in many different service areas of the banking industry. They have been named "one-stop shops" because, besides providing regular banking services, they also handle asset management, investment banking and brokerage services. Another type of financial service company is the credit card company. These companies offer the necessary credit lines to their customers and charge interest for the money borrowed whenever a purchase is made with the credit card. When a purchase is made by the customer the credit card company immediately pays the seller for the item purchased and charges the customer a high rate of interest for the loan.[ CITATION que20 \l 1033 ] Current Financial Crises: A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types:

Banking crisis: When a bank suffers a sudden rush of withdrawals by depositors, this is called a bank run. Since banks lend out most of the cash they receive in deposits, it is difficult for them to quickly pay back all deposits if these are suddenly demanded, so a run renders the bank insolvent, causing customers to lose their deposits, to the extent that they are not covered by deposit insurance. An event in which bank runs are widespread is called a systemic banking crisis or banking panic. Currency crisis: A currency crisis, also called a devaluation crisis, is normally considered as part of a financial crisis. Kaminsky et al. (1998), for instance, define currency crises as occurring when a weighted average of monthly percentage depreciations in the exchange rate and monthly percentage declines in exchange reserves exceeds its mean by more than three standard deviations. Frankel and Rose (1996) define a currency crisis as a nominal depreciation of a currency of at least 25% but it is also defined as at least a 10% increase in the rate of depreciation. In general, a currency crisis can be defined as a situation when the participants in an exchange market come to recognize that a pegged exchange rate is about to fail, causing speculation against the peg that hastens the failure and forces a devaluation. Speculative bubbles and crashes: A speculative bubble exists in the event of large, sustained overpricing of some class of assets.One factor that frequently contributes to a bubble is the presence of buyers who purchase an asset based solely on the expectation that they can later resell it at a higher price, rather than calculating the income it will generate in the future. If there is a bubble, there is also a risk of a crash in asset prices: market participants will go on buying only as long as they expect others to buy, and when many decide to sell the price will fall. International financial crisis:

When a country that maintains a fixed exchange rate is suddenly forced to devalue its currency due to accruing an unsustainable current account deficit, this is called a currency crisis or balance of payments crisis. When a country fails to pay back its sovereign debt, this is called a sovereign default. While devaluation and default could both be voluntary decisions of the government, they are often perceived to be the involuntary results of a change in investor sentiment that leads to a sudden stop in capital inflows or a sudden increase in capital flight. Wider economic crisis: Negative GDP growth lasting two or more quarters is called a recession. An especially prolonged or severe recession may be called a depression, while a long period of slow but not necessarily negative growth is sometimes called economic stagnation. Some economists argue that many recessions have been caused in large part by financial crises. One important example is the Great Depression, which was preceded in many countries by bank runs and stock market crashes. The subprime mortgage crisis and the bursting of other real estate bubbles around the world also led to recession in the U.S. and a number of other countries in late 2008 and 2009. Some economists argue that financial crises are caused by recessions instead of the other way around, and that even where a financial crisis is the initial shock that sets off a recession, other factors may be more important in prolonging the recession. In particular, Milton Friedman and Anna Schwartz argued that the initial economic decline associated with the crash of 1929 and the bank panics of the 1930s would not have turned into a prolonged depression if it had not been reinforced by monetary policy mistakes on the part of the Federal Reserve, a position supported by Ben Bernanke. Causes and consequences: Strategic complementarities in financial markets

Leverage

Asset-liability mismatch Uncertainty and herd behavior Regulatory failures Contagion Recessionary effects[ CITATION wik201 \l 1033 ]

Books: Financial Intermediation in the 21st Century By Zuhayr Mikdashi Palgrave, 2001 Issues in Money and Banking By George Macesich Prager Publishers, 2000 The New Financial Architecture: Banking Regulation in the 21st Century By Benton E. Gap Quorum Books, 2000 Fundamentals of Islamic Finance and Banking By Syeda Fahmida Habib Released August 2018 Publisher(s): Wiley Banking by Roy C. Smith; Ingo Walter Oxford University Press, 1997 Management By Alan S. GuttermanQuorum Books, 1994

Task P2Important approaches of research methodologies: Research is a systematic investigation to find answers to a problem. Sociological research is a systematic, careful, and controlled process of collecting information and answering questions. The different approaches we follow in Research Methodology are:

1. Quantitative approach 2. Qualitative approach. 3. Pragmatic approach (mixed methods)

Primary research: Primary research is any type of research that you collect yourself. Examples include surveys, interviews, observations, and ethnographic research. A good researcher knows how to use both primary and secondary sources in their writing and to integrate them in a cohesive fashion. Strengths: Primary data is reliable way to collect data because the researcher can do it again as they know the procedures, how it was collected and analyzed since they did it themselves. Also, the chances are it will also be more up to date too. Data gathered years previously (e.g. Milgram) are less likely to provide reliable answers to the questions your data needs to address. Since it is direct from the population in question, it is one of the best types of data to collect for research methods like the survey. Weaknesses: Researchers may be subjective in what kinds of data they look for in particular data that fits the hypothesis they are trying to test. For example, Milgram may have used primary data from his experiments to back up Agency Theory. The data has to be gathered from scratch which involves finding a large enough population to make the sample credible and generalizable and in turn can collect a large volume of data. This usually makes it costlier and time consuming than collecting secondary data.[ CITATION Meg20 \l 1033 ] Secondary research: Secondary research involves the summary, collation and/or synthesis of existing research. Secondary research is contrasted with primary research in that

primary research involves the generation of data, whereas secondary research uses primary research sources as a source of data for analysis

Strengths Already gathered so may be quicker to collect. May be gathered on a much larger scale than possible for the firm. In some cases it can be very cheap or free to access.

Weaknesses Information may be outdated, therefore inaccurate. The data may be biased and it is hard to know i...

Similar Free PDFs

Level 5 leader - assignment

- 13 Pages

Unit 5 Project

- 2 Pages

Unit 11 - Apuntes 5

- 12 Pages

Assignment Unit 5

- 6 Pages

Written Assignment unit 5

- 5 Pages

Discussion Assignment Unit 5

- 2 Pages

Written Assignment UNIT 5

- 6 Pages

Unit 5 - Assignment

- 3 Pages

Written Assignment Unit 5

- 7 Pages

Written Assignment Unit 5

- 3 Pages

Unit 5 Assignment

- 1 Pages

Written Assignment Unit 5

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu