427712166-ch25-pdf - Cost PDF

| Title | 427712166-ch25-pdf - Cost |

|---|---|

| Course | BS Accountancy |

| Institution | San Sebastian College-Recoletos de Cavite |

| Pages | 51 |

| File Size | 756.8 KB |

| File Type | |

| Total Downloads | 533 |

| Total Views | 608 |

Summary

CHAPTER 25STANDARD COSTS AND BALANCED SCORECARDSUMMARY OF QUESTIONS BY STUDY OBJECTIVES AND BLOOM’S TAXONOMYItem SO BT Item SO BT Item SO BT Item SO BT Item SO BTTrue-False Statements 1 K 9. 3 C 17. 3 C 25. 4 C sg33. 3 K 1 K 10. 3 K 18. 4 K 26. 5 K sg34. 4 K 1 C 11. 3 C 19. 4 C 27. 6 C sg35. 4 C 1 K...

Description

CHAPTER 25 STANDARD COSTS AND BALANCED SCORECARD SUMMARY OF QUESTIONS BY STUDY OBJECTIVES AND BLOOM’S TAXONOMY Item

SO

BT

Item

SO

BT

1 1 1 1 2 3 3 3

K K C K C C K C

9. 10. 11. 12. 13. 14. 15. 16.

3 3 3 3 3 3 3 3

C K C K K C K K

Item

SO

BT

Item

SO

BT

4 5 6 9 9 9 1 2

C K C C C C K K

108. 109. 110. 111. 112. 113. 114. 115. 116. 117. 118. 119. 120. 121. 122. 123. 124. 125. 126. 127. 128. 129. 130.

4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 5 5 6 6 6 7

AP AP AP AP AP AP AP AP AP K K C C K K K K C C K K C C

156. 157.

5 5

AP AP

Item

SO

BT

True-False Statements 1. 2. 3. 4. 5. 6. 7. 8.

17. 18. 19. 20. 21. 22. 23. 24.

3 4 4 4 4 4 4 4

C K C K K K C C

25. 26. 27. 28. 29. 30. sg 31. sg 32.

sg

33. 34. sg 35. sg 36. sg 37. sg 38.

sg

3 4 4 5 6 7

K K C K K K

Multiple Choice Questions 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61.

1 1 1 1 1 1 1 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 3

K K C C C K K C C C C C K K K K K K K C K C C

62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. 81. 82. 83. 84.

3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4

K C C K C AP C C K AP AP C AP AP AP K K C K K AP K K

85. 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. 101. 102. 103. 104. 105. 106. 107.

150. 151.

1 3

AP AP

152. 153.

4 4

AP AP

154. 155.

4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4 4

AP AP AP AP AP AP AP AP C C C C C C K AP AP AP AP AP AP AP AP

131. 132. 133. 134. 135. 136. a 137. a 138. st 139. st 140. st 141. sg 142. sg 143. st 144. sg 145. st 146. sg 147. sg 148. sg,a 149.

7 7 7 8 8 8 9 9 2 3 3 4 4 4 4 5 5 6 9

K K K K K K AP C K K K K K K C K K K K

Brief Exercises

sg st a

5 5

AP AP

This question also appears in the Study Guide. This question also appears in a self-test at the student companion website. This question covers a topic in an appendix to the chapter.

a

158. 159.

a

9 9

AP AP

25 - 2

Test Bank for Accounting Principles, Eighth Edition

SUMMARY OF QUESTIONS BY STUDY OBJECTIVES AND BLOOM’S TAXONOMY Exercises 160. 161. 162. 163. 164.

3 4 4 4 4

AP AP AP AP AP

165. 166. 167. 168. 169.

4 4 4,5 4,5 4,5

AP AP AN AN AP

183. 184.

1 3

K K

185. 186.

4 4

K K

170. 4,5 AP 171. 4,6,9 AP 172. 4,9 AP 173. 4,9 AP 174. 4,9 AP

175. 176. 177. 178. 179.

5 5 5 5 5

AP AP AP AP AP

180. 181. a 182.

5,9 7 9

AP AP AP

5 5

K K

191. 192.

5 6

K K

Completion Statements 187. 188.

4 5

K K

189. 190.

SUMMARY OF STUDY OBJECTIVES BY QUESTION TYPE Item

Type

Item

Type

Item

Type

Item

Type

Item

1. 2.

TF TF

3. 4.

TF TF

31. 39.

5. 32.

TF TF

46. 47.

MC MC

48. 49.

Study Objective 1 TF 40. MC 42. MC 41. MC 43. Study Objective 2 MC 50. MC MC 139. MC

16. 17. 33. 51. 52.

Study Objective 3 TF 53. MC 58. TF 54. MC 59. TF 55. MC 60. MC 56. MC 61. MC 57. MC 62.

6. 7. 8. 9. 10.

TF TF TF TF TF

11. 12. 13. 14. 15.

TF TF TF TF TF

18. 19. 20. 21. 22. 23. 24. 25. 34. 35. 67. 68.

TF TF TF TF TF TF TF TF TF TF MC MC

69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80.

MC MC MC MC MC MC MC MC MC MC MC MC

81. 82. 83. 84. 85. 86. 87. 88. 89. 90. 91. 92.

26. 36. 115. 116. 117.

TF TF MC MC MC

118. 119. 120. 121. 122.

MC MC MC MC MC

123. 124. 125. 126. 146.

Study Objective 4 MC 93. MC 105. MC 94. MC 106. MC 95. MC 107. MC 96. MC 108. MC 97. MC 109. MC 98. MC 110. MC 99. MC 111. MC 100. MC 112. MC 101. MC 113. MC 102. MC 114. MC 103. MC 142. MC 104. MC 143. Study Objective 5 MC 147. MC 167. MC 154. BE 168. MC 155. BE 169. MC 156. BE 170. MC 157. BE 175.

Type

Item

Type

Item

Type

MC MC

44. 45.

MC MC

150. 183.

BE C

MC MC MC MC MC

63. 64. 65. 66. 140.

MC MC MC MC MC

141. 151. 160. 184.

MC BE Ex C

MC MC MC MC MC MC MC MC MC MC MC MC

144. 145. 152. 153. 161. 162. 163. 164. 165. 166. 167. 168.

MC MC BE BE Ex Ex Ex Ex Ex Ex Ex Ex

169. 170. 171. 172. 173. 174. 185. 186. 187.

Ex Ex Ex Ex Ex Ex C C C

Ex Ex Ex Ex Ex

176. 177. 178. 179. 180.

Ex Ex Ex Ex Ex

188. 189. 190. 191.

C C C C

Standard Costs and Balanced Scorecard

27. 37.

TF TF

127. 128.

MC MC

129. 148.

38.

TF

130.

MC

131.

Study Objective 6 MC 171. Ex MC 192. C Study Objective 7 MC 132. MC 133.

134.

MC

135.

MC

136.

Study Objective 8 MC

138. 149.

Study Objective 9a MC a158. BE a171. MC a159. BE a172.

a a

28. 29.

TF TF

a

a

30. 137.

TF MC

a a

Note: TF = True-False MC = Multiple Choice

MC

Ex Ex

BE = Brief Exercise Ex = Exercise

181.

a a

173. 174.

25 - 3

Ex

Ex Ex

a a

180. 182.

Ex Ex

C = Completion

The chapter also contains one set of ten Matching questions and four Short-Answer Essay questions.

CHAPTER STUDY OBJECTIVES 1. Distinguish between a standard and a budget. Both standards and budgets are predetermined costs. The primary difference is that a standard is a unit amount, whereas a budget is a total amount. A standard may be regarded as the budgeted cost per unit of product. 2. Identify the advantages of standard costs. Standard costs offer a number of advantages. They (a) facilitate management planning, (b) promote greater economy and efficiency, (c) are useful in setting selling prices, (d) contribute to management control, (e) permit "management by exception," and (f) simplify the costing of inventories and reduce clerical costs. 3. Describe how companies set standards. The direct materials price standard should be based on the delivered cost of raw materials plus an allowance for receiving and handling. The direct materials quantity standard should establish the required quantity plus an allowance for waste and spoilage. The direct labor price standard should be based on current wage rates and anticipated adjustments such as COLAs. It also generally includes payroll taxes and fringe benefits. Direct labor quantity standards should be based on required production time plus an allowance for rest periods, cleanup, machine setup, and machine downtime. For manufacturing overhead, a standard predetermined overhead rate is used. It is based on an expected standard activity index such as standard direct labor hours or standard machine hours. 4. State the formulas for determining direct materials and direct labor variances. The formulas for direct materials variances are: (Actual quantity × Actual price) – (Standard quantity × Standard price) = Total materials variance (Actual quantity × Actual price) – (Actual quantity × Standard price) = Materials price variance (Actual quantity × Standard price) – (Standard quantity × Standard price) = Materials quantity variance The formulas for the direct labor variances are: (Actual hours × Actual rate) – (Standard hours × Standard rate) = Total labor variance (Actual hours × Actual rate) – (Actual hours × Standard rate) = Labor price variance (Actual hours × Standard rate) – (Standard hours × Standard rate) = Labor quantity variance

25 - 4

Test Bank for Accounting Principles, Eighth Edition

5. State the formulas for determining manufacturing overhead variances. The formulas for the manufacturing overhead variances are: Actual overhead – Overhead applied = Total overhead variance Actual overhead – Overhead budgeted = Overhead controllable variance Fixed overhead rate × (Normal capacity hours – Standard hours allowed) = Overhead volume variance

6. Discuss the reporting of variances. Variances are reported to management in variance reports. The reports facilitate management by exception by highlighting significant differences. 7. Prepare an income statement for management under a standard costing system. Under a standard costing system, an income statement prepared for management will report cost of goods sold at standard cost and then disclose each variance separately, 8. Describe the balanced scorecard approach to performance evaluation. The balanced scorecard incorporates financial and nonfinancial measures in an integrated system that links performance measurement and a company’s strategic goals. It employs four perspectives: financial, customer, internal processes, and learning and growth. Objectives are set within each of these perspectives that link to objectives within the other perspectives. a

9. Identify the features of a standard cost accounting system. In a standard cost accounting system, companies journalize and post standard costs, and they maintain separate variance accounts in the ledger.

Standard Costs and Balanced Scorecard

25 - 5

TRUE-FALSE STATEMENTS 1.

Inventories cannot be valued at standard cost in financial statements.

2.

Standard cost is the industry average cost for a particular item.

3.

A standard is a unit amount, whereas a budget is a total amount.

4.

Standard costs may be incorporated into the accounts in the general ledger.

5.

An advantage of standard costs is that they simplify costing of inventories and reduce clerical costs.

6.

Setting standard costs is relatively simple because it is done entirely by accountants.

7.

Normal standards should be rigorous but attainable.

8.

Actual costs that vary from standard costs always indicate inefficiencies.

9.

Ideal standards will generally result in favorable variances for the company.

10.

Normal standards incorporate normal contingencies of production into the standards.

11.

Once set, normal standards should not be changed during the year.

12.

In developing a standard cost for direct materials, a price factor and a quantity factor must be considered.

13.

A direct labor price standard is frequently called the direct labor efficiency standard.

14.

The standard predetermined overhead rate must be based on direct labor hours as the standard activity index.

15.

Standard cost cards are the subsidiary ledger for the Work in Process account in a standard cost system.

16.

A variance is the difference between actual costs and standard costs.

17.

If actual costs are less than standard costs, the variance is favorable.

18.

A materials quantity variance is calculated as the difference between the standard direct materials price and the actual direct materials price multiplied by the actual quantity of direct materials used.

19.

An unfavorable labor quantity variance indicates that the actual number of direct labor hours worked was greater than the number of direct labor hours that should have been worked for the output attained.

20.

Standard cost + price variance + quantity variance = Budgeted cost.

21.

The overhead controllable variance relates primarily to fixed overhead costs.

25 - 6

Test Bank for Accounting Principles, Eighth Edition

22.

The overhead volume variance relates only to fixed overhead costs.

23.

If production exceeds normal capacity, the overhead volume variance will be favorable.

24.

There could be instances where the production department is responsible for a direct materials price variance.

25.

The starting point for determining the causes of an unfavorable materials price variance is the purchasing department.

26.

A two-variance analysis of overhead consists of a controllable variance and a volume variance.

27.

Variance analysis facilitates the principle of "management by exception."

28.

A credit to a Materials Quantity Variance account indicates that the actual quantity of direct materials used was greater than the standard quantity of direct materials allowed.

29.

A standard cost system may be used with a job order cost system but not with a process cost system.

30.

A debit to the Overhead Volume Variance account indicates that the standard hours allowed for the output produced was greater than the standard hours at normal capacity.

Additional True-False Questions 31.

In concept, standards and budgets are essentially the same.

32.

Standards may be useful in setting selling prices for finished goods.

33.

The materials price standard is based on the purchasing department's best estimate of the cost of raw materials.

34.

The materials price variance is normally caused by the production department.

35.

The use of an inexperienced worker instead of an experienced employee can result in a favorable labor price variance but probably an unfavorable quantity variance.

36.

The overhead controllable variance is the difference between the actual overhead costs incurred and the budgeted costs for the standard hours allowed.

37.

In using variance reports, top management normally looks carefully at every variance.

38.

The use of standard costs in inventory costing is prohibited in financial statements.

Standard Costs and Balanced Scorecard

25 - 7

Answers to True-False Statements Item

1. 2. 3. 4. 5. 6.

Ans.

F F T T T F

Item

7. 8. 9. 10. 11. 12.

Ans.

T F F T F T

Item

13. 14. 15. 16. 17. 18.

Ans.

F F F T T F

Item

19. 20. 21. 22. 23. 24.

Ans.

T F F T T T

Item

25. 26. 27. 28. 29. 30.

Ans.

Item

T T T F F F

31. 32. 33. 34. 35. 36.

Ans.

T T T F T T

Item

Ans.

37. 38.

F F

MULTIPLE CHOICE QUESTIONS 39.

What is a standard cost? a. The total number of units times the budgeted amount expected b. Any amount that appears on a budget c. The total amount that appears on the budget for product costs d. The amount management thinks should be incurred to produce a good or service

40.

A standard cost is a. a cost which is paid for a group of similar products. b. the average cost in an industry. c. a predetermined cost. d. the historical cost of producing a product last year.

41.

The difference between a budget and a standard is that a. a budget expresses what costs were, while a standard expresses what costs should be. b. a budget expresses management's plans, while a standard reflects what actually happened. c. a budget expresses a total amount, while a standard expresses a unit amount. d. standards are excluded from the cost accounting system, whereas budgets are generally incorporated into the cost accounting system.

42.

Standard costs may be used by a. universities. b. governmental agencies. c. charitable organizations. d. all of these.

43.

Which of the following statements is false? a. A standard cost is more accurate than a budgeted cost. b. A standard is a unit amount. c. In concept, standards and budgets are essentially the same. d. The standard cost of a product is equivalent to the budgeted cost per unit of product.

44.

Budget data are not journalized in cost accounting systems with the exception of a. the application of manufacturing overhead. b. direct labor budgets. c. direct materials budgets. d. cash budget data.

25 - 8

Test Bank for Accounting Principles, Eighth Edition

45.

It is possible that a company's financial statements may report inventories at a. budgeted costs. b. standard costs. c. both budgeted and standard costs. d. none of these.

46.

If standard costs are incorporated into the accounting system, a. it may simplify the costing of inventories and reduce clerical costs. b. it can eliminate the need for the budgeting process. c. the accounting system will produce information which is less relevant than the historical cost accounting system. d. approval of the stockholders is required.

47.

Standard costs a. may show past cost experience. b. help establish expected future costs. c. are the budgeted cost per unit in the present. d. all of these.

48.

Which of the following statements about standard costs is false? a. Properly set standards should promote efficiency. b. Standard costs facilitate management planning. c. Standards should not be used in "management by exception." d. Standard costs can simplify the costing of inventories.

49.

Which of the following is not considered an advantage of using standard costs? a. Standard costs can reduce clerical costs. b. Standard costs can be useful in setting prices for finished goods. c. Standard costs can be used as a means of finding fault with performance. d. Standard costs can make employees "cost-conscious."

50.

If a company is concerned with the potential negative effects of establishing standards, it should a. set loose standards that are easy to fulfill. b. offer wage incentives to those meeting standards. c. not employ any standards. d. set tight standards in order to motivate people.

51.

A standard which represents an efficient level of performance that is attainable under expected operating conditions is called a(n) a. ideal standard. b. loose standard. c. tight standard. d. normal standard.

52.

...

Similar Free PDFs

FULL COST :: Direct COST

- 1 Pages

Cost Behavior - Cost Accounting

- 78 Pages

COST Acctg 2 - cost

- 1 Pages

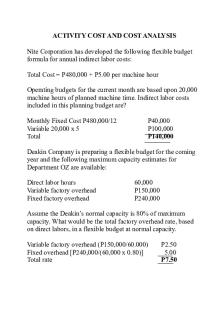

Activity COST AND COST Analysis

- 5 Pages

Cost hw - Cost accounting homework

- 18 Pages

cost Accounting

- 6 Pages

Cost Allocation

- 4 Pages

More on Costs - Cost and cost

- 10 Pages

Historical cost

- 3 Pages

Operating Cost

- 2 Pages

Cost Accounting

- 5 Pages

Cost Accounting

- 3 Pages

cost accounting

- 37 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu