Assetbeta note - Beta Calculation PDF

| Title | Assetbeta note - Beta Calculation |

|---|---|

| Course | Theory of Finance II |

| Institution | Concordia University |

| Pages | 2 |

| File Size | 42.2 KB |

| File Type | |

| Total Downloads | 62 |

| Total Views | 181 |

Summary

Beta Calculation...

Description

1. Question: XYZ INC is an all-equity firm and has several divisions operating in different industries. The one managed by Dr. Donaldson is engaged in the manufacture of printed circuity boards (PCBs), has an asset base of $4 million, and earnings after taxes is $2 million. A new project (Project V) by this division to expand its existing operations would require an investment of $5 million. ABC Corp is a competitor in the PCB industry and operates only in that category. ABC Corp has an equity beta of 1.2 and a debt-equity ratio of 1:1. XYZ is a zero-debt company, intends to remain zero-debt, and has an equity beta of 0.4. Assume all relevant debt has a beta of zero. The risk free rate is 3% and the expected return on a broad market index is 7%. What is the cost of capital (discount rate) that should be used to evaluate Project V?

2. Analysis A) First let us focus on the relevant information and figure out what is needed and not needed. Here the required parts are marked in green and not required ones in red. XYZ INC is an all-equity firm and has several divisions operating in different industries. The one managed by Dr. Donaldson is engaged in the manufacture of printed circuity boards (PCBs), has an asset base of $4 million, and earnings after taxes is $2 million. A new project (Project V) by this division to expand its existing operations would require an investment of $5 million. ABC Corp is a competitor in the PCB industry and operates only in that category. ABC Corp has an equity beta of 1.2 and a debt-equity ratio of 1:1. XYZ is a zero-debt company, intends to remain zero-debt, and has an equity beta of 0.4. Assume all relevant debt has a beta of zero. The risk free rate is 3% and the expected return on a broad market index is 7%. What is the cost of capital (discount rate) that should be used to evaluate Project V?

B) What this tells us is i) it is a project for which you must use industry beta to extract discount rate information. Reason – “several divisions operating in different industries”. Remember diversified firms and projects that diversify a firm’s operations are two main reasons to force you to use industry beta over firm beta. ii) Relevant industry beta is tagged by the industry – PCBs. And therefore you need to look at ABC. iii) Relevant information for industry beta is: ABC Corp has an equity beta of 1.2 and a debt-equity ratio of 1:1. Implying asset beta = 0.6 from the asset beta formula iv) And XYZ is a zero-debt company, intends to remain zero-debt... Assume all relevant debt has a beta of zero. Implying: asset beta of 0.6 will result in equity beta of 0.6 for project V (being part of XYZ). v) Last step is to plug this 0.6 into the CAPM equation and get r = 5.4%

C) Now that you have the process, let’s try changing the numbers a little: I) What if ABC Corp had an equity beta of 1.8? You would proceed exactly as before except you plug 1.8 instead of 1.2 in the asset beta formula step. So you would get required assets beta = 0.9 which would imply an equity beta of 0.9 for project V and then on to a required rate of 6.6% II) What if ABC Corp had a debt to assets ratio of 0.2 and equity beta of 1.2? Again, plug them into the asset beta formula. Note now we are using debt to assets – not debt to equity. So equity/assets = 0.8 and therefore asset beta = 0.96. Proceed as before after that. III) What else could change? You can also have project V have a targeted debt equity ratio. Let’s start from the original problem such that asset beta is 0.6. Suppose the only change now that project V is funded using 40% debt (and therefore 60% equity). We proceed as in the original solution till we have asset beta is 0.6. Now for equity beta of the project, we need to use the asset beta formula again, but this time with the project debt ratios. In this case: 0.6 = equity beta * 0.6 (+ debt beta which is equal to zero * 0.4) => equity beta for the project = 1.0. Solving for discount rate it equals 3% + 1.0*(7% - 3%) = 7% But we may not be done here as we can calculate WACC – after all now project V is part debt funded. We would need tax information to get WACC. In this case cost of debt is approximated as risk free (identical to beta of debt equals zero). Note that we could even have specific debt betas and you would just proceed as before, plugging those values in as the asset beta formula came up. D) At this point you know the drill: identify if you need asset beta; if you do, start by identifying the competitor; get asset beta by looking at equity beta for competitor and its debt equity ratio; if applicable use the exact form if you can get debt beta – if not use the approximate form; once you have the asset beta move on to equity beta for project – again it is the asset beta formula; finally see if you need to go from equity beta to WACC for the project. Remember – we are going to revisit this and get a slightly improved version of this when we do Chapter 18....

Similar Free PDFs

Alpha Beta and Beta Structures

- 7 Pages

Estimasi Beta

- 5 Pages

BETA BLOQUEANTES

- 13 Pages

Beta y Beta ll ficha tecnica

- 10 Pages

Beta oxidación (Resumen)

- 6 Pages

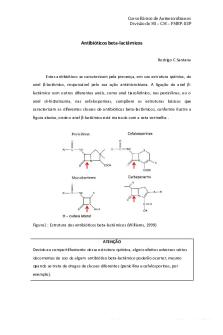

01. Antibióticos beta-lactâmicos

- 6 Pages

Riesgo, coeficiente beta.

- 13 Pages

SPI Calculation

- 2 Pages

Apheresis Calculation

- 3 Pages

Titration calculation

- 1 Pages

Calculation Questions

- 4 Pages

Note - Note

- 27 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu