Case 3- CCC PDF

| Title | Case 3- CCC |

|---|---|

| Author | Vaibhav Goel |

| Course | Anglais MGT |

| Institution | Université de Lille |

| Pages | 6 |

| File Size | 182.1 KB |

| File Type | |

| Total Downloads | 14 |

| Total Views | 173 |

Summary

Download Case 3- CCC PDF

Description

MNG 604: Corporate Finance-1

Case Study

Working Capital: A Summary of Ratios by Industry, 2016

Submitted by : Group 3A Shifa Shamsi (179278025) Priya Sharma (179278027) Aman Bansal (179278028) Jainarasiman E R (179278030) Abhay Kukade (179278032)

Masters of Management Shailesh J. Mehta School of Mehta IIT Bombay

February 2018

Exhibit 1 The industries mentioned in the above exhibit vary from highly capital intensive in which capital is tied up for a very long period as a portion of the operating cycle to industries where cash conversion cycle is less. Industries like Construction and Manufacturing-Industrial & Commercial Machinery are capital intensive industries. In these industries, the DPO is low as suppliers must be paid within a short time but the returns from the initial investment are realized after a long time as it takes time for the products to be made. Agriculture, Forestry and Fishing- this industry has low operating cycle as compared to above industries but still large with respect to other low operating cycle industries as agriculture or forestry requires a certain number of days that are fixed and can’t be reduced to get the finished product, thus keeping the days in inventory considerably more. Manufacturing Apparel- most apparel manufacturing industries have high days in inventory because of the various processes involved and high DSO as the retailers will be having credit terms with them. This increases their operating cycle. Retail Automotive- the comparative high operating cycle of retail automotive industry is because of the high days in inventory and DSO as it takes time for the cars to be delivered to customers. Manufacturing Electronics and Transportation Equipment- the high operating cycle in this industry is due to the fact that the days in inventory is high because of the large variety of products that are manufactured by these industries and the high DSO. Manufacturing Food- the operating cycle for this industry as well is high as the DSO is higher because the cash is received by the manufacturer comes through other parties and thus takes time. Wholesale Trade- the operating cycle is comparatively low as the days in inventory is reduced as they just have to procure and supply goods. Retail General and Apparel- Same is the case with Retail as well and also for them the DSO is increased as some retailers provide credit to the customers which increases their days receivables Manufacturing Petroleum Refining- the operating cycle is decreased as the days in inventory is less because of the few steps in manufacturing. Larger portion of the operating cycle is DSO.

Electric and Gas Utilities- in this industry the days in inventory is very less as the service is provided instantaneously to the customers but the DSO takes the major part because of the time taken in receipt of the payments. Transportation- Freight, Air, Railroad- in all these industries the operating cycle is less as the DSO comprises of very small portion of the operating cycle as the payments are made instantaneously by the customers. Communications- the cash conversion cycle for this industry is the lowest i.e. 1 because of the high DPO allowed by the suppliers for in this industry. Also, the DSO in this industry is very less as most customers use prepaid service. Retail-Restaurants- the operating cycle is lowest in restaurant industry as DSO is very less as almost all orders are paid real time and the time taken for the finished good to be made is less. The only time taken is in procuring in the products.

Exhibit 2: Manufacturing Industry Four year Trend: In manufacturing industry, the value of cash conversion cycle and operating cycle is generally high and therefore requires high capital investment as compared to other industries. The trend graph shows a significant fall from 110 in year 2012 to 83 in the year 2013 implying that the bargaining power of suppliers must have reduced during this period and they have to wait for a longer time for the final settlement process. In the year 2015, CCC increased to 117 implying that the company has to some keep extra cash in hand than the previous years to sustain their core operational activities. Retail Industry Four Year Trend: In retail industry usually the cash conversion cycle is less as many retail chains get the payment from customers almost immediately. Few retail stores give some credit time to the customer leading to industry’s cash conversion cycle as a whole to be in the range of 54 to 63. As The retail stores maintain an optimal inventory to avoid stock-outs, the DIO value raises and because of this the cash conversion cycle raises to the above mentioned level. Retail stores usually buy their supplies from the supplier at a credit payment scheme. They usually pay after 40-70 days. Due to this the Operating cycle of the retail industry adds up to a range of 95-102.

Exhibit 3: This exhibit represents the stark contrast between the cash conversion cycle of amazon and Walmart. Walmart, instead of being one of the largest retailers, has managed to convert cash

through the cycle in 11.7 days. But Amazon has managed their cash conversion cycle even more efficiently. Amazon holds its inventory for 52.3 days plus 14.7 days to collect receivables or 67 days in total but then pays accounts payable in 107.4 days thus achieving a negative cash conversion cycle for Amazon.com of -40.7 days. Due to this, Amazon doesn’t have to keep too much cash into their hands as they can pay the suppliers with the cash earned from inventory sold to the customers. Higher DPO represents that the Amazon keep their suppliers waiting for their payment.

Exhibit 4 Apple, as it is maker of small products compared to Boeing has less DIO. Apple’s DIO is also small because of its operational efficiency that is achieved by cutting excess costs and built-up stock. Also because of big orders, it is able to negotiate better credit terms with suppliers. Boeing’s products take a long time to be manufactured. Hence, the high DIO and the orders made by it are contract based (made to order) so it is paid within less time.

Exhibit 5 Dell and HP work as per very different strategy. Dell works on a pull model whereas HP works on push model. For Dell, DIO is very small as it is able to make/assemble the order within very few days as compared to HP because of its efficient supply chain. Dell maintains a negative cash cycle as it pays its suppliers after a long time because of good relations with the suppliers. This way it is able to keep the cash for itself. As HP works on a push model and manufactures products for a diverse customer base, its DIO increases. The operating cycle has increased for both the companies between 2004 and 2012 as both started offering innovative products to meet diverse need of customers which increased their cost and order cycle time.

Exhibit 6 Ford has higher and faster sales due to very high demand for its car from its customer base. In US alone ford sold 239,854 units of cars during 2016. Ford was named as the best selling brand by volume in US. The pace at which sales are made is very high. Also “One Ford” strategy of Ford allows cars produced across the world to be of the same type and can be transported to

satisfy the demand wherever needed. This strategy helps Ford in cancelling out the situation of stock-out and the need to maintain very high inventory Because of these reasons Ford has a very less DIO value of 24.3.Ford has a DSO value of 231.2 which shows that it allows more number of days for credit payment to its clients through various financing options that are self-managed and are not outsourced. In the automobile industry Ford, Ferrari and Toyota have high DSO. The high DSO value increases Ford’s Cash conversion cycle. Like all other automobile companies Ford also pays its suppliers after almost 2 months (DPO-59.1) Tesla manufactures its own automobile components which are fitted into their car during manufacturing. As they produce their own components their inventory takes a lot of time. DIO value is very high (175.5 days). Tesla is a unique car manufacturer as it produces electric cars. Customers are ready to pay as soon as possible for this kind of technology and also Tesla doesn’t give more time for its clients for credit payment. Due to this, their DSO is very low for an automobile manufacturing company. Tesla buys usually takes a considerable time to pay its suppliers and the current report considers the accrued liabilities because of which the DPO value is very high.

Exhibit 7 Departmental stores usually have optimal inventory as to avoid a stock-out situation. Nordstrom Nordstrom is known for having an efficient inventory management mechanism. The following are the reasons for it: Faster delivery of online purchases through fulfillment centers and Nordstrom stores Procurement of a product that is unavailable in one store from the inventory at another store Incremental sales generated by the Nordstrom Rewards program. Because of better inventory management their DIO value is pretty decent (77.6) Nordstrom manages its own credit card operations and hasn’t outsourced it like most department stores do. Because of this their DSO value is high compared to other department stores. Nordstrom like any other Department store pays to suppliers after few days and becaus e of that its DPO value is 58.4

JC Penney JC Penney has many Stock Keeping Units and many stores. So, the need to maintain a large inventory is high as to avoid a stock-out situation. Because of this reason their DIO is very high (117) JC Penney gets payment from their customers almost immediately. Although they have a credit card option they don’t manage it by themselves since they have outsourced it. Because of this their DSO values is very less (0.4) JC Penney like any other Department store pays to suppliers after few days and because of that its DPO value is 44.1

Exhibit 8 The operating cycle of grocery retailers is comparatively smaller to other industries as the products are generally perishable and inventory turnover ratio is high. The product portfolio of Kroger includes greater number of food items; therefore, the DIO for Kroger is less than the DIO of Costco. The business model of Costco is based on selling high volume of products at lower margins. They offer low variety of goods at their stores in comparison to Kroger but order in bulk quantities from the suppliers. Therefore, the bargaining power of Costco on suppliers is high which is very much significant from the value of DPO (31.8 in case of Costco and 22.6 in case of Kroger). Due to the significant difference in the value of DPO, the Kroger takes more time to convert cash through the operating cycle as compared to Costco....

Similar Free PDFs

Case 3- CCC

- 6 Pages

Tutorial 3 - ccc

- 1 Pages

Week 3 CCC Parts 2 & 3 Template

- 3 Pages

CCC revision

- 106 Pages

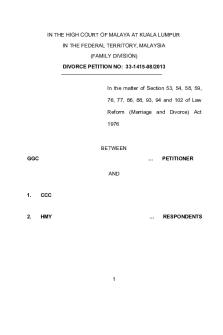

GGC v CCC & Anor - A case law.

- 75 Pages

Lala2011 - ccc

- 18 Pages

Cuenta 16 - ccc

- 4 Pages

CCC Written Essay Assignment

- 5 Pages

VI Manual ACTy CCC

- 190 Pages

CCC Computer online Test

- 24 Pages

Case 3 - Case study 3

- 2 Pages

Final DE T2 Costo - ccc

- 18 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu