FM414 Corporate Memo1 PDF

| Title | FM414 Corporate Memo1 |

|---|---|

| Author | Menghan Wang |

| Course | Corporate Investment and Financial Policy |

| Institution | The London School of Economics and Political Science |

| Pages | 2 |

| File Size | 87.2 KB |

| File Type | |

| Total Downloads | 44 |

| Total Views | 140 |

Summary

Memo for Week 1 Assignment...

Description

Memo 1 – Dell Case Dell was doing very well both financially and strategically. Industry analysts anticipated strong future growth in the PC market over the next three years and thus the outlook for Dell was greatly positive. Financially, Dell was doing relatively well compared to its competitors and the industry average. For the fiscal year ended 1996, Dell reported revenues of $5.3 billion and a net income of $272 million. From 1991 to 1995, it had reported impressive growth in sales which consistently beat the industry average by wide margins (e.g. 52% compared to an industry average of 31% in 1995). From 1992 – 1996 Dell’s net profit had increased five-fold from 51 million to a staggering 272 million, suggesting higher profitability of the company. Dell did make a loss in 1994 of 36 million. But its quick reversal in 1995 and continued increase in 1996 means it is little cause for concern. From 1994 to 1996, Dell’s current assets was significantly higher than its current liabilities, suggesting a positive net working capital. Its cash, short term investments and accounts receivables seemed more than enough to cover its payables and short-term debt. Thus, from a cash standpoint the company is doing strong and seems unlikely to have any shortages or go into financial distress. Strategically, Dell’s innovations and creative business model helps the firm to obtain greater market share and market power. Dell’s low-cost sales and distribution model allowed them to sell directly to customers and start the production cycle only after the company had received an order. This contrasted greatly with Dell’s competitors which forecasted and maintained sizable finished goods inventory in their stock. This allowed Dell to have a strategic edge as it enabled the firm to deliver a customized order within a few days, something Dell’s competitors could not. Furthermore, Dell invested in heavily in high-quality customer support, providing toll-free telephone and on-site technical support to differentiate themselves from their competitors. IN 1993 Dell made strategic adjustments to their business model to keep up with their rapid growth. This included a shift in focus from exclusively growth to liquidity, profitability, and growth, which saw them exit the low margin indirect retail channel. By upgrading its internal systems and bringing in more seasoned managers, it allowed Dell to re-enter into the notebook market and beat competition. From Exhibit 2, the working capital financial ratios for Dell are pretty good. Its efficient inventory management makes Dell competitive. Due to its build-to-order manufacturing process, Dell held low finished goods inventory balances compared with the industry, which helped them save space and absorb capital. In addition, the low finished good inventory allowed Dell to replace microprocessors or manufacture systems with updated chips more quickly. It was able to ship out updated Pentium chips when its competitors were still shipping out flawed systems. In essence, Dell stayed ahead to the game by bringing new component technology to the market faster than its competitors.

Internally, Dell could fund its growth through its retained earnings and returns obtained from its short-term investments. If Dell is short on cash and unable to raise the capital necessary, then it could also sell off some of its accounts receivable or fixed assets to bring in more cash and fund its growth in operations. To that extent, it could also renegotiate terms with its suppliers to see if payables can be further delayed. With an increase in sales of 50%, there should be a corresponding increase in the same proportion to operating assets (50%). In the year 1997, operating assets (2148 − 591) × 1.5 = 2335.5m. If we then assume that liabilities and net profit also increases by 50% then net profit increases to 1.5 × 272 = 408m. From a corporate finance perspective, I would recommend following the pecking order of capital structure. This means that the company should first look to its retained earnings and the amount cash and cash equivalents available to see if it can internally finance its growth in operations. If not then additional external finance should be considered....

Similar Free PDFs

FM414 Corporate Memo1

- 2 Pages

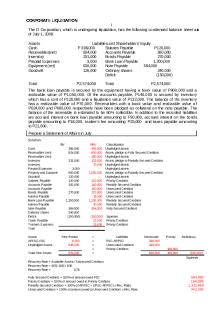

Corporate-liquidation

- 3 Pages

Corporate Liquidation

- 28 Pages

Corporate Parenting

- 3 Pages

Corporate finance

- 11 Pages

Strategie Corporate

- 2 Pages

corporate finance

- 72 Pages

Corporate Sustainability

- 10 Pages

Corporate Finance

- 19 Pages

CORPORATE-REPORTING.pdf

- 31 Pages

Divisione Corporate

- 5 Pages

Corporate Citizenship

- 6 Pages

Corporate governance

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu