Initial 2 final consultants report 2 PDF

| Title | Initial 2 final consultants report 2 |

|---|---|

| Course | Partim Competentie- en talentmanagement III |

| Institution | Hogeschool Gent |

| Pages | 54 |

| File Size | 1.3 MB |

| File Type | |

| Total Downloads | 82 |

| Total Views | 145 |

Summary

Download Initial 2 final consultants report 2 PDF

Description

THE FRESH CONNECTION

Final Consultant Report Client: Dr Gary Mortimer The Fresh Connection KKLM Consultant

Consultant: Yuen Ki Kevin Chan (n9216120) Lee-Anne Rice (n91303222) Leonardo Flores Gonzales (n8934860) Maria Brandt (n8900141) Researcher Executive Top Research Alliance Word count: 1,595 11. October 2016

Table of Conten

Table of Content.......................................................................................................................................2 1.

Executive Summary......................................................................................................................4

2.

Introduction and Background......................................................................................................5

3.

Collaborative Decision-Making...................................................................................................6

3.1.

Supply Chain Manager’s Report.............................................................................................6

3.2.

Sales Manager’s Report...........................................................................................................7

3.3.

Operations Manager’s Report.................................................................................................8

3.4.

Purchasing Manager’s Report...............................................................................................10

4.

Conclusion and Team Management Considerations................................................................12

5.

Reference list................................................................................................................................13

6.

Appendices...................................................................................................................................15

6.1.

Reflection Reports...................................................................................................................15

6.1.1.

Appendix 1: Reflection Report Leo One (Round Three)................................................15

6.1.2.

Appendix 2: Reflection Report Leo Two (Round Four).................................................16

6.1.3.

Appendix 3: Reflection Report Leo Three (Round Four)...............................................17

6.1.4.

Appendix 4: Reflection Report Leo Four (Round Five).................................................18

1.1.1.

Appendix 5: Reflection Report Leo Five (Round Six)....................................................19

1.1.2.

Appendix 6: Component – Demand per Week................................................................21

1.1.3.

Appendix 7: Bottling Line utilisation rate.......................................................................21

1.1.4.

Appendix 8: Finance Overview.........................................................................................21

1.1.5.

Appendix 9: Reflection Report Kevin One (Round Three)............................................22

1.1.6.

Appendix 10: Reflection Report Kevin Two (Round Four)............................................23

1.1.7.

Appendix 11: Reflection Report Kevin Three (Round Five)..........................................24

1.1.8.

Appendix 12: Reflection Report Kevin Four (Round Six)..............................................25

1.1.9.

Appendix 13: Reflection Report Kevin Five (Round Seven)..........................................26

1.1.10.

Appendix 14: Reflection Report Lee-Anne One (Round Three)....................................27

1.1.11.

Appendix 15: Reflection Report Lee-Anne Two (Round Four).....................................28

1.1.12.

Appendix 16: Reflection Report Lee-Anne Three (Round Five)...................................29

1.1.13.

Appendix 17: Reflection Report Lee-Anne Four (Round Six).......................................30

1.1.14.

Appendix 18: Reflection Report Lee-Anne Five (Round Seven)...................................31

1.1.15.

Appendix 19: Reflection Report Maria One (Round Three)..........................................32

1.1.16.

Appendix 20: Reflection Report Maria Two (Round Four)...........................................33

1.1.17.

Appendix 21: Reflection Report Maria Three (Round Five).........................................35

1.1.18.

Appendix 22: Reflection Report Maria Four (Round Six).............................................36

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four 1.1.19.

Appendix 23: Reflection Report Maria Five (Round Seven).........................................37

1.2.

Appendix 24: Supplier Delivery Reliability..........................................................................39

1.3.

Appendix 25: Delivery Reliability and Rejection Rate........................................................40

1.4.

Appendix 26: Transport cost overview.................................................................................41

1.5.

Weekly Group Meetings.........................................................................................................42

1.5.1.

Appendix 27: Weekly Summary Round One...................................................................42

1.5.2.

Appendix 28: Weekly Summary Round Two...................................................................44

1.5.3.

Appendix 29: Weekly Summary Round Five...................................................................46

1.5.4.

Appendix 30: Weekly Summary Round Six.....................................................................48

1.5.5.

Appendix 31: Weekly Summary Round Seven................................................................50

3

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four

1. Executive Summary This final consultant report examines the operational activities, strategies, and tactics The Fresh Connection Company's managers have adopted for the last periods of the company. It includes report outcome for each section of the company, including purchasing, sales, supply chain management, and operations. Initial proposed strategies and directions for the company and actual results of the objectives and targets discovered through the simulation rounds. In addition, the report includes critical reflection explanations for each area of management, which were vital for the progress leading to our objective goals as a company and as individual managers. A process which was achieved by descriptive and collaborative decision-making strategies, implemented between the team managers on a cross-functionally level to ultimately improve the value chain of the Fresh Connection Company.

4

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four

2. Introduction and Background The following report will disclose the performance of the Fresh connection company. The company's supply chain, sales, operating and purchasing department have undergone a different strategic direction over the phase of eight weeks under new management. The initial intended strategic direction of the Fresh Connection Company was to source high-quality supplies that ensure availability while maintaining cost efficiency to deliver a premium product. Selecting the right supply source was crucial in order to ensure the right materials are sourced with timely delivery. The selection of the supplier had to meet the company's main focus which is quality. Since the initial phase of the business this strategic direction changed minimally. The ROI goal was 4% and above as we intended to steadily increase about one to two percent each round. Sales: Strategic direction was clear throughout the takeover, but results of sales performance proved it did not reach full potential due to an emphasis on achieving high levels of 95% in service agreements, the team finished with 93.6%. Operations objective was based on cube utilisation, the production adherence. Target's set by the operation manager was keeping utilisations at 80%. Operations finished with cube utilizations of 85.8% in raw materials and 90.6% utilisation in finished goods warehouses which was higher than the set goal. The purchasing department has reaches its aim to obtain 95% supplier delivery reliability at least.

5

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four

3. Collaborative Decision-Making 3.1. Supply Chain Manager’s Report The initial proposal for the supply chain main strategy was to decrease costs, increase efficiency, keeping high components and product availability, implementing a cost efficient supply chain strategy. This strategy would utilise maximum capacity, reducing inventories, based on costs while relying on reliability from the purchasing department (Fischer, 1997). The implementation of this strategy can be observed in round 3 (see Appendix 1) with a positive ROI of 4.82%. Decreasing unused components and finished goods by calculation of demand and value per week (see Appendix 6); consulting the operations manager, reducing warehousing and stock costs increasing operating profit margins. A group planning approach was vital to estimate a healthy amount of safety stock and lot sizes needed per period; reducing obsoletes and stock costs where necessary, and increasing overall profit (Lee & Billington, 1992).The following rounds aimed to increase stock value, reducing indirect costs, keeping a healthy stock, and maintaining almost the 100% in availability of components in order use efficiently the production line (See Appendixes 2 to 4). Following rounds 5, 6, and 7, there was a problem regarding obsoletes that was turned in the last round 8 (See Appendix 5) by reducing safety stock and increasing production intervals. Calculating efficient production intervals and stock for the finished products in the DC Netherlands warehouse for availability and distribution in

the

sales

department

(Meyer

&

Bishop,

2016)

The initial objective for the supply chain was to manage the costs of keeping the correct amount of stock, space and interest costs. Aiming to reduce Stock costs below 150,000€. This was not completely achieved at 250,000€ in stock costs in the last round, but managed to keep a reliable availability of components through all rounds and low costs in rounds 3 and 7 (See Appendix 8). Aiming for 95% utilisation rate on the bottling lines that resulted in 70%. As well as managing frozen period of production times to have more fixed production plans ensuring deliveries and production times (See Appendix 7).

6

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four

3.2. Sales Manager’s Report From the collection of information through critical reflections and weekly reviews, it was evident that our teams’ strategic approach surrounded joint operational objectives, especially in providing a premium product to the market. This strategy was set from the beginning of the takeover. As research suggest (D.A. & & Prioni, 2002), the most effective way of judging premium pricing comes from using service quality as an index for assessing actual contract performance. Changes in round three (See Appendix 9) saw an increase in contract indexes due to increased shelf life and service level agreements. Such actions allowed a higher product quality perception to the market. In relation, promotional pressure was only used lightly to guide premium prices. For example, In round three (see Appendix 11) we shifted promotions for our largest

customers

Food

and

Grocers

from

medium

to

low.

Researchers find that fresh produce in particular face unexpected spoilages that can lead to excess waste and thereby economic losses as products are perishable (Bruckner, Albrecht, Petersen, & Kreyenschmidt, 2013). To make sure our quality approach was effective, we discussed new agreements with our customers. Contracted sales revenue remained strong throughout the takeover, but penalties lured

around

(see

Appendix

9

to

11).

Some decisions that did not work so well for the fresh connection became evident by the final round; Penalty rates were a sign of over promising in our agreements with customers, while research (Eriksson et al., 2013) states that penalties are a case of ineffective management of the customers expectation. In other words, service level agreements were not altered accordingly to performance. The initial sales objective of obtaining a service level of 95% was not achieved as we just fell short finishing on 93.3%, but we learnt from round 4 (see Appendix 10) when our service levels were at 98.6% that our consumers receive most satisfaction from receiving realistic agreements in areas such as shelf life and on-time delivery. Overall, setting these high benchmarks allowed The Fresh Connections full potential to be exposed, now sitting in a profitable position.

7

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four

3.3. Operations Manager’s Report The following summary of weekly critical reflections is based on decisions made by the company (See Appendix 16). Initially the facilities and warehouse management strategies from round one to three focused on increasing capacity usage (See Appendix 14) as utilisation fluctuated. An overflow of 50% pallet locations in round one. Thereafter in rounds two and three reducing wastage was the focus (See Appendix 14 and 15). Additional mixers and bottling lines then became available in round three. Selecting the most cost-effective strategy became an ongoing issue. Onwards from rounds four to six managing wastage was the focus in pallet locations (See Appendix 15 to 17). The decisions made in operations during these rounds confirmed with joint forecasting gained through meetings with the supply chain and marketing managers on a constant basis (See Reflection). The company gained good profit. However, our small efforts to expand saw the team ’s ROI decline. (See Appendix 16) This lead to more reductions in capacity and exhibited that our waitand-see approach in expanding supply chains and operations was not effective. Round six results proved problematic as our team’s ROI was at a low of 2.56% since the initial training round ROI of -11.93 (See Appendix 17). This elevated our attention to more aggressive expansion as the team re-evaluated the wait-and-see approach we had undertaken. Life cycle and capacity are tightly linked and as our decisions did not account for the life cycle changes and being limited by time (See appendix 17) the appraised changes in operations such as new bottling lines and mixers to reduce costs and improve efficiencies were not feasible. The strategy for operations was to maintain flexible operations leading to low costs, high reliability and product availability. Referring to research (Simchi-Levi & ebrary, 2010), the company aimed to move from a static sourcing strategy to a dynamic one through optimising production sourcing decisions, taking into account demand, supply, various costs and the company's constraints. Through lateral linkages between functional departments flexibility was gained (Mills & Harvard University. Graduate School of Business, 1985). However, there was a shortfall in reaching full flexibility due to organisational structure that did not plan to expand. Flexibility was incorporated in the goal of 80%. This allowed leeway for changes and fluctuations

8

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four

but contributed to wastage. Taking a leaner approach would be highly recommended for future.

9

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four

3.4. Purchasing Manager’s Report The procurement primary assist with quality, availability and cost and waste elimination, low prices and high product component reliability. To ensure this, supplier reliability of 95% at least is required. As all supplier must be constantly evaluated to ensure the products fit for use. There are several criteria to consider. Firstly, the correlation between supplier reliability and contract index must be taken into account. Supplier reliability developed well since round 6 as three from five could meet the delivery reliability of 99% and 4 hours’ delivery windows (see Appendix 24). With the further rounds, the delivery reliability had developed better and all five suppliers could meet the agreed delivery reliability of 95% and 4 hours’ delivery window. It can be assumed, that the supplier might have been high pressured to delivery in too high terms as well as other changes such as dual sourcing, certification or shorter lead time have influenced the excellent performance in the last round. It can be said that the best contract index is 95% and 4 hours’ delivery, as supplier had the best performance based on the average and median with the lowest value below 50% and the greatest amount of above 80% (see Appendix 25). The contract index should be considered carefully as it affects sales department. In round three, the index effects Dominick`s in their performance. However, the largest cost factor was the dual sourcing. This is commonly applied to allow supply flexibility and availability of a high demand product. However, it leads to higher cost and has not improved lead times. Based on the financial figures in round six, the activity has increased cost in transport and therefore results in termination of the activity (see Appendix 26). Based on the round figure, dual sourcing lead to high cost, high wastage and there is no evidence for higher product component reliability. The focus on shorter lead time in the supply source can be seen. It has benefited the company with the flexibility in its order schedule, enhance fewer lost orders and increases cash flow. As research suggest inventory shortage is less likely to occur if lead-time is under 7 days (Bandaly, Satir, & Shanker, 2016). It is recommended to prioritise this as a criterion when evaluating supplier.

10

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Four

The implementation of the contract index of 95% and 4 delivery window; shorter lead time; and elimination of dual sourcing, has help the organisation to lower prices, eliminate low wastage within the supply source process and enhance high product component reliability to assist the supply chain department with the availability of products.

11

AMB304 Logistics Operations The Fresh Connection - Final Consultant Report KLLM Consultant: Team Fo...

Similar Free PDFs

Initial 2 final consultants report 2

- 54 Pages

Chem 2 Initial Lab Report #2

- 9 Pages

Initial Report

- 2 Pages

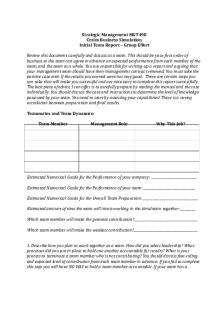

Cesim - Initial Team Report

- 2 Pages

Project 2 Final Lab Report

- 10 Pages

Lab Report 2-2

- 2 Pages

Lab report-2 - Lab report-2

- 2 Pages

Experiment-2 - lab report 2

- 9 Pages

Lab Report 2 - Lab 2

- 2 Pages

LAB 2 Report circuits 2

- 9 Pages

Grow Management Consultants

- 6 Pages

Final Exam (Pt 2/2)

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu