MHC500 Time Value of Money Discussion PDF

| Title | MHC500 Time Value of Money Discussion |

|---|---|

| Course | MBA Essentials for Healthcare |

| Institution | Franklin University |

| Pages | 2 |

| File Size | 47.2 KB |

| File Type | |

| Total Downloads | 11 |

| Total Views | 152 |

Summary

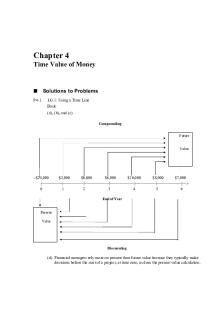

Assignment where we had to explain what Time Value of Money is and why it is important and impactful in our daily lives....

Description

How does the time value of money affect you personally and professionally? What is the Rule of 72? How is knowing this concept helpful to you?

The time value of money is an important concept to investors because a dollar that is received today will be worth a lot more than a dollar that is given in the future. The dollar you have today can be used to invest and earn interest. The money that you may receive in the future can end up being worth much less than what you have today, due to inflation. Time value of money demonstrates that although both amounts are equal, it is better to have money now rather than later (Beers, 2018). As a medical student who has to pay loans in the future and as someone who is looking to go into a private practice, it is a very helpful tool that will enable me to find ways to invest and manage money the right way.

The Rule of 72 is a quick and useful formula that is used in order to estimate the number of years that is required to double the invested money at an annual rate of return. The Rule of 72 is highly useful for mental calculations to quickly come up with an approximate value of something. It can also compute the annual rate of compounded return from an investment by how many years it will take to double that investment (Kenton, 2020). The formula for the Rule of 72 is Years to Double = 72/Interest Rate, where Interest Rate = Rate of Return on an Investment.

Knowing this concept is helpful to me because it is a very simple and effective way to be able to determine how long an investment will take to double by being given a fixed annual rate of interest (Banton, 2019). By dividing 72 by the annual rate of return, investors are able to acquire a rough estimate of how many years it will take for the investment to duplicate itself. Dividing 72 by the interest rate will show how long it will take the money, investment, debt and interest rate to double within a certain time frame.

References:

Banton, C. (2019, June 20). Making Sense of the Rule of 72. Retrieved February 11, 2021, from https://www.investopedia.com/ask/answers/what-is-the-rule-72/

Beers, B. (2018, April 02). Why the Time Value of Money (TVM) Matters to Investors. Retrieved February 11, 2021, from

https://www.investopedia.com/ask/answers/033015/why-time-value-money-tvmimportant-concept-investors.asp

Kenton, W. (2020, March 06). Understanding the Rule of 72. Retrieved February 11, 2021, from https://www.investopedia.com/terms/r/ruleof72.asp...

Similar Free PDFs

Time value of money

- 5 Pages

Time Value of Money Quiz

- 3 Pages

Oretan time value of money

- 30 Pages

04 Time Value of Money

- 45 Pages

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time value of money solutions gitman

- 31 Pages

Time Value of Money - Grade: A

- 4 Pages

214416988 04 Time Value of Money

- 45 Pages

Chapter 4 TIME Value OF Money

- 26 Pages

Economic Value Of Time

- 8 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu