TVM Tables (Time Value of Money Tables) PDF

| Title | TVM Tables (Time Value of Money Tables) |

|---|---|

| Author | DEVYANSH GUPTA |

| Course | Corporate Finance |

| Institution | Lovely Professional University |

| Pages | 129 |

| File Size | 4 MB |

| File Type | |

| Total Downloads | 7 |

| Total Views | 176 |

Summary

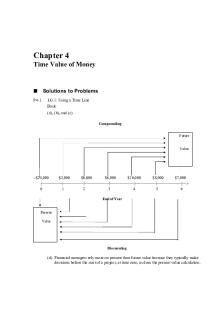

The time value of money (TVM) is the concept that a sum of money is worth more now than the same sum will be at a future date due to its earnings potential in the interim....

Description

Formulae And Tables

The Icfai University Press

Formulae and Tables Board of EditorS

: Prof. V R K Chary, CFA Mr. S Sarkar, CFA Mr. Prakash Bhattacharya, CFA Ms. V D M V Lakshmi, CFA

ISBN

: 81-7881-261-4

©The ICFAI University, All rights reserved. This book contains information obtained from authentic and highly regarded sources. Although every care has been taken to avoid errors and omissions, this publication is being sold on the condition and understanding that the information given in this book is merely for reference and must not be taken as having authority of or binding in any way at the editors, publishers or sellers. Neither this book nor any part of it may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, microfilming and recording or by any information storage or retrieval system, without prior permission in writing from the copyright holder. Trademark notice: Product or corporate names may be trademarks or registered trademarks, and are used only for identification and explanation without intent to infringe. Only the publishers can export this book from India. Infringement of this condition of sale will lead to civil and criminal prosecution. Published by ICFAI University Press, 52, Nagarjuna Hills, Hyderabad, India – 500 082. Phone : (+91) (040) 23430 – 368, 369, 370, 372, 373, 374 Fax : (+91) (040) 23352521, 23435386 E-mail : [email protected], [email protected] Website : www.icfaipress.org/books First Edition : 2004 Printed in India

Bulk Discounts ICFAI Books are available at special quantity discounts when purchased in bulk by libraries, colleges, training institutions and corporates. For information, please write to Institutional Marketing Division, ICFAI Books, 52, Nagarjuna Hills, Hyderabad, India – 500 082. Phone Fax E-mail

: (+91) (040) 234353 - 87, 88, 89, 90, 23430 – 368, 369, 370, 372, 373, 374 : (+91) (040) 23352521, 23435386 : [email protected], [email protected], [email protected].

Contents Preface A.

Formulae Section I: Actuarial Principles and Practice

1

•

Measurement of Interest

1

•

Introduction to Annuities

2

•

Demography

8

•

Survival Models

9

•

Mortality Tables

9

•

Assurance and Annuity Benefits

10

•

Premiums for Assurance and Annuity Plans

13

•

Credibility Theory

16

•

Loss Distributions and Risk Models

17

•

Policy Values

19

•

Surplus and it’s Distribution

19

Section II: Economics

20

•

Supply and Demand Analysis

20

•

Consumer Behavior and Analysis

21

•

Production Analysis

22

•

Analysis of Costs

22

•

Market Structure: Perfect Competition

23

•

Market Structure: Monopoly

24

•

Market Structure: Oligopoly

24

•

Measurement of Macro Economic Aggregates

24

•

The Simple Keynesian Model of Income Determination

25

•

Income Determination Model including Money and Interest

25

•

Money Supply and Banking System

26

•

The Open Economy and Balance of Payments

26

•

Modern Macro Economics: Fiscal Policy,

27

Budget Deficits and Government Debt Section III: Financial Management

28

•

Time Value of Money

28

•

Risk and Return

29

•

Valuation of Securities

31

•

Financial Statement Analysis

32

•

Financial Forecasting

33

•

Leverages

34

•

Cost of Capital

35

•

Capital Structure

36

•

Dividend Policy

37

•

Estimation of Working Capital Needs

38

•

Inventory Management

39

•

Receivables Management

39

•

Cash Management

41

•

Capital Expenditure Decisions

41

Section IV: Financial Risk Management

43

•

Corporate Risk Management

43

•

Futures

43

•

Options

45

•

Swaps

48

•

Sensitivity of Option Premiums

48

•

Value at Risk

49

Section V: International Finance

50

•

The Foreign Exchange Market

50

•

Exchange Rate Determination

50

•

International Project Appraisal

51

•

International Equity Investments

51

•

Short-term Financial Management

52

Section VI: Investment Banking and Financial Services

53

•

Money Market

53

•

Rights Issues

53

•

Lease Evaluation

53

•

Hire Purchase

55

•

Consumer Credit

56

•

Housing Finance

57

•

Venture Capital

57

Section VII: Management Accounting

58

•

Cost-Volume-Profit Analysis

58

•

Standard Costing and Variance Analysis

59

Section VIII: Portfolio Management

61

•

Capital Market Theory

61

•

Arbitrage Pricing Theory (APT Model)

61

•

Asset Allocation

62

•

Delineating Efficient Frontiers

62

•

Portfolio Analysis

62

•

Portfolio Performance

64

•

Bond Portfolio Management

65

Section IX: Project Management

66

•

Appraisal Criteria

66

•

Risk Analysis in Capital Investment Decisions

66

•

Application of Portfolio Theories in Investment Risk Appraisal

67

•

Social Cost Benefit Analysis

67

•

Options in Investment Appraisal

67

•

Project Scheduling

68

•

Project Monitoring and Control

68

Section X: Quantitative Methods

70

•

Basics of Mathematics

70

•

Calculus

70

•

Interpolation and Extrapolation

72

•

Central Tendency and Dispersion

73

•

Probability

75

•

Probability Distribution and Decision Theory

76

•

Statistical Inferences

78

•

Simple Linear Regression and Correlation

79

•

Multiple Regression

80

•

Time Series Analysis

80

•

Index Numbers

81

•

Quality Control

82

•

Chi-Square Test and Analysis of Variance

83

Section XI: Security Analysis

85

•

Bond Valuation

85

•

Equity Stock Valuation Model

87

•

Technical Analysis

87

•

Warrants and Convertibles

88

•

Real Assets and Mutual Funds

88

Section XII: Strategic Financial Management

89

•

Capital Structure

89

•

Decisions Support Models

89

•

Working Capital Management

90

•

Firms in Financial Distress

91

•

Valuation of Firms

91

•

Mergers and Acquisitions

91

B.

C.

Tables

93

1.

95

Interest Rate Tables: •

Future Value Interest Factor

95-96

•

Future Value Interest Factor for an Annuity

97-98

•

Present Value Interest Factor

•

Present Value Interest Factor for an Annuity

99-100 101-102

2.

Standard Normal Probability Distribution Table

103

3.

t Distribution Table

104 2

4.

Area in the Right Tail of a Chi-Square (χ ) Distribution Table

105-106

5.

F Distribution Table

107-108

6.

Control Chart Factors Table

7.

Table for Value of Call Option as Percentage of Share Price

110-111

8.

Table for N(x)

112-113

9.

Table for Relationship between Nominal and Effective Rates of Interest and Discount

114-115

Formulae Index

109

116

FORMULAE

I. Actuarial Principles and Practice 1.

Measurement of Interest i.

Future Value of a lump sum (Single Flow) FVn = PV(1 + i) n Where, FVn

=

Future value of the initial flow n years hence

PV

=

Initial cash flow

i

=

Annual Rate of Interest

n

=

Life of investment

69 Interest Rate

ii.

Doubling Period = 0.35 +

iii.

Future value of a lump sum with increased frequency of compounding FVn = PV(1 +

i m ×n ) m

Where,

iv.

FVn

=

Future value after ‘n’ years

PV

=

Cash flow today

i

=

Nominal Interest Rate per Annums

m

=

Number of times compounding is done during a year

n

=

Number of years for which compounding is done

The relationship between Effective vs. Nominal Rate of Interest r = (1+

i m ) –1 m

Where,

v.

r

=

Effective rate of interest

i

=

Nominal rate of interest

m

=

Frequency of compounding per year

Accumulated value of an Annuity

(1 + i) n −1 FVAn = A = sn i Where, FVAn =

vi.

Accumulation at the end of n years

A

=

Amount deposited/invested at the end of every year for n years

i

=

Rate of interest (expressed in decimals)

n

=

Time horizon or number of installments

sn

=

Accumulated value of an annuity

i Sinking Fund factor = n (1 +i) −1 Where, i = Rate of interest n

=

Number of years

Formulae and Tables

vii.

Present Value Interest Factor of an Annuity, a n =

(1 + i) n − 1 i(1 + i)n

Where,

viii.

i

=

Rate of interest

n

=

Number of years

Capital Recovery Factor n

A=

i(1 + i) (1+ i)n − 1

Where,

ix.

i

=

Rate of interest

n

=

Number of years

Present Value of a Perpetuity

1 i Where, i =

a∞ =

2.

Rate of interest.

Introduction to Annuities i.

Present Value of an Immediate Annuity Certain, a n =

(1 − vn ) i

Where,

ii.

an

=

Present value of an Annuity

vn

=

Present value of the nth payment payable at the end of the nth year

=

1/(1 + i) n

Present Value of a Deferred Annuity Certain = m a n = v

m

an

Where,

iii.

m

=

Deferment period

v

=

1 1+ i

i

=

Rate of interest

Accumulated Value of a Deferred Annuity Certain, (1 + i) m s n Where, m

iv.

=

Deferment period

n

=

Number of Annuity Installments

i

=

Rate of interest

sn

=

Accumulated value of an Annuity

Present Value of an Annuity Due, a n = (1 + i ) a n Where,

2

an

=

Present value of an Immediate Annuity Certain

n

=

The number of annuity installments

i

=

The rate of interest

Actuarial Principles and Practice

v.

Accumulated Value of an Annuity Due, s n = (1 + i)sn Where, =

sn

vi.

Present value of an Immediate Annuity Certain

n

=

The number of annuity installments

i

=

The rate of interest

Present value of a deferred annuity due of Re. one p.a. for a term of n years certain and the deferment period is being m years m = m an = v an

Where,

vii.

v

=

i

=

1 1+ i The rate of interest

= Present value of an Annuity due an Accumulated value of a deferred annuity due of Re. one p.a. for a term of n years certain and the deferment period is being m years = m s n = (1 + i) s n Where,

viii.

i

=

The rate of interest

sn

=

The accumulated value of an annuity

Present value of an immediate perpetuity, a∞ =

1 i

Where, i ix.

=

The rate of interest

Present value of a perpetuity due, a∞ =

1 d

Where,

i 1 +i Present value of a deferred Perpetuity with deferment period of m years, where the first payment is to be made immediately on completion of m years d

x.

=

= m a∞ = Where, i =

vm− 1 i The rate of interest

1 1+ i Present value of a deferred Perpetuity with deferment period of m years, where first

v xi.

The rate of discounting = v.i =

=

payment is made one year after completion of m years

v

m

i

Where, i

=

The rate of interest

v

=

1 1+ i 3

Formulae and Tables

xii.

Present Value of an Immediate Increasing Annuity

a n − nvn

i

a n − nv n i = a n + (Ia) n =

a.

Where,

an

=

The present value of an annuity due

an

=

The present value of an annuity certain

n

=

Number of installments

i

=

The rate of interest

v

=

1 1+ i

)n = an + Present value of an increasing annuity due ( Ia

b.

n a n − nv

i

Where,

c.

an

=

The present value of an annuity due

n

=

Number of installments

i

=

The rate of interest

v

=

1 1+ i

Accumulated value of an increasing annuity due

( Is ) n

= sn +

sn −n × (1 + i ) i

Where,

xiii.

sn

=

The Accumulated value of an annuity due

n

=

Number of installments

i

=

The rate of interest

Present Value of an Immediate Increasing Perpetuity, ( Ia )∞ = Where, i

xiv.

=

The rate of interest

Present Value of an Increasing Perpetuity Due, Where,

4

d

=

The rate of discounting =

i

=

The rate of interest

i 1 +i

(Ia ) ∞ =

1 d

2

1 1 + i i2

Actuarial Principles and Practice

xv.

The Present Value of an Increasing Annuity wherein the consecutive periodical a − nvn annuity payments are in an Arithmetic Progression = Aa n + D n i Where,

xvi.

A

=

The payment at the end of first year

D

=

The common difference

an

=

The present value of an Annuity certain

n

=

The number of installments

v

=

1 1+ i

i

=

The rate of interest

The Present Value of an Increasing Annuity wherein the consecutive periodical annuity payments are in a Geometric Progression

1 −R n v n = A (1 + i) − R Where,

xvii.

v

=

1 1+ i

R

=

The common multiple

i

=

The rate of interest

n

=

The number of installments

A

=

The amount of first installment

Accumulated Value of Increasing Immediate Annuity by Re. One per annum = (Is) n = sn

+

s n −n i

Where,

xviii.

sn

=

Accumulated value of an Annuity certain

n

=...

Similar Free PDFs

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time value of money

- 5 Pages

Time Value of Money Quiz

- 3 Pages

Oretan time value of money

- 30 Pages

04 Time Value of Money

- 45 Pages

Time value of money solutions gitman

- 31 Pages

Time Value of Money - Grade: A

- 4 Pages

214416988 04 Time Value of Money

- 45 Pages

Chapter 4 TIME Value OF Money

- 26 Pages

Statistical Tables

- 36 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu