Time Value of Money - Grade: A PDF

| Title | Time Value of Money - Grade: A |

|---|---|

| Course | Business Finance |

| Institution | California State University Dominguez Hills |

| Pages | 4 |

| File Size | 65.1 KB |

| File Type | |

| Total Downloads | 7 |

| Total Views | 164 |

Summary

Mandatory Essay on the Time Value of Money...

Description

Time Value of Money

The time value of money is the concept that the money available today can be worth more in the future due to its potential earning capacity. In finance, the ideal is that a certain dollar amount has a different value today, depending on when it is received. For example, let’s say person A owes money to person B and tells them that they can pay them the full amount today or next year, person B will most likely say today. The role can also be reversed, let’s person B now owes person A money, would person B be more willing to pay them today or next year? More than likely person B will say next year. Whether today or next year is chosen, the important factor to consider is the interest rate or also known as the discount rate. In this essay, we will discussion more in depth the definition of time value of money as well as why it is important to finance and how does it influence financial decision making for businesses and individuals. So, what exactly is the time value of money? Per textbook definition it is “The difference in value between money received today and money received in the future; also, the observation that two cash flows at two different points in time have different values” (page 78). To better understand this, we can use another basic scenario. Let’s say friend A owes friend B $1,000 and friend A tells them that he can pay them the $1,000 today or he can pay friend B $1,200 in a year. Most people will want to take the $1,000 now not understanding the concept of the time value of money. If friend B were to take the $1,000 now, he would lose the $200 (20% interest rate) but there’s another option. Let’s say friend B knows a bank offering a 35% interest rate of return for a $1,000 deposit of a year. Now, taking the $1,000 from friend A and waiting the same year they would of for the $1,200, the $1,000 can now earn them $150 more from investing with that bank.

So, it is a case by case whether friend B should take the money now or later based on the return. This is also known as the opportunity cost. Time value of money is a very important factor of finance because it helps companies make decisions whether to invest their money now or later. It also helps companies by making yes-or-no decisions on capital projects. For example, a hospital (a business) is planning on expanding their emergency center, knowing that construction will not start for another year. They currently have the funds to complete the project at present time but decide that saving the money will increase their funds by adding few little features or adding more medical equipment. The wise choice in this scenario is to save the money. As mentioned in the textbook “A dollar received today is worth more than a dollar received I one year: If you have $1 today, you can invest it now and have more money in the future” (page 78). Another important factor about time value of money is why it is important to in influencing financial decision making for businesses and individuals. Businesses not only consider the time value of money concept to pay for services or products but also to be paid for their accounts receivable. For example, a business that offers their customers a credit line for products or services must consider whether it is a higher return to collect payment now or in six months for example. The same scenario goes for individuals not only for businesses. If an individual comes across some money or is owed money, considering the time value of money concept can help them determine how much of a return they can earn and help them make a wiser choice. “We can use the interest rate to determine values in the same way we used competitive market prices. Once we quantify all the costs and benefits of an investment in terms of dollars today, we can rely on the Valuation Principle to determine whether the investment will increase the firm’s value” (page 79).

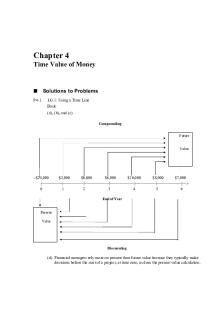

Now, reading all of this information on how the time value of money concept can help, here’s how to calculate it. The formula for the time value of money is as follows: FV=PV (1+r) ^n FV stands for future value, PV stands for present value, r stands for interest rate and n stands for number of payments. Depending on the scenario, there will be different formulas needed will need to use to calculate the information needed. In conclusion, understanding what is the time value of money is and why is it important to not only businesses but to individuals too is very useful knowledge. Deciding whether to take or pay the money is the biggest factor to consider if the interest rate to compare what the return will be. By understanding and using the time value of money concept, we can make better financial decisions.

Reference:

Berk, Jonathan, De Marzo, Peter, Hardford, Jarrad (2018) Business Finance. Cal State Dominguez Hills edition, 2018....

Similar Free PDFs

Time Value of Money - Grade: A

- 4 Pages

Time value of money

- 5 Pages

Time Value of Money Quiz

- 3 Pages

Oretan time value of money

- 30 Pages

04 Time Value of Money

- 45 Pages

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time value of money solutions gitman

- 31 Pages

214416988 04 Time Value of Money

- 45 Pages

Chapter 4 TIME Value OF Money

- 26 Pages

Economic Value Of Time

- 8 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu