Time Value of Money Formulas Sheet PDF

| Title | Time Value of Money Formulas Sheet |

|---|---|

| Course | Accounting (minor:FINANCE) |

| Institution | University of Mauritius |

| Pages | 1 |

| File Size | 78.9 KB |

| File Type | |

| Total Downloads | 39 |

| Total Views | 157 |

Summary

formula...

Description

Time Value of Money Formula Sheet #

Time Valu Value e of Money Formula for

Annual

Intra Yea Yearr

Continuous

Future and Present Value of Lump Sum: 1

Future Value by Sample Interest

SIn = P + (P * i * n)

2

Future Value by Compound Interest

FVn = PV * (1 + i) n

FVn = PV * (1 + i / m) n * m

FVn = PV * e i * n

3

Future Value by Factor Formula

FVn = PV * (FVIF i , n)

FVn = PV * (FVIF i

FVn = PV * e (i/m)

4

Present Value of Single Cash Flow

PVn = FV / (1 + i) n

PVn = FV / (1 + i / m) n*m

PVn = FV / e i*n

5

Present Value by Factor Formula

PVn = FV * (PVIF i, n)

PVn = FV * (PVIF i/m, n*m)

PVn = FV / e (i/m)* (n*m)

6 7 8

Future Value of Constant Cash Flow (CCF) O. Annuity

FVAn = CCF [(1 + i) n - 1 / i]

FVAn = CCF [(1 + i/m) n * m - 1 / i/m]

FVAn = CCF [(ei * n - 1) / (ei - 1)]

Future Value of Ordinary Annuity by Factor Formula

FVAn = CCF * (FVIFA i, n) FVADue = CCF [(1 + i) n - 1 / i] * (1+i)

FVAn = CCF * (FVIFA i/m, n*m) FVADue = CCF [(1 + i/m) n*m - 1 / (i/m)] * (1+i/m)

FVAn = CCF [(e (i/m)

Future Value of Constant Cash Flow (CCF) Annuity Due

9

Future Value of Annuity Due by Factor Formula

FVADue = CCF * (FVIFA i, n) * (1 + i)

Present Value of Constant Cash Flow (CCF) O. Annuity

PVAn = CCF [1-{1 / (1+i) n} / i]

Present Value of Ordinary Annuity by Factor Formula

PVAn = CCF * (PVIFA i, n)

Nil

Nil

/ m , n * m)

* (n*m)

#

Future and Present Value of Annuity:

10 11

n

12

Present Value of Constant Cash Flow (CCF) Annuity Due

PVADue = CCF [1-{1 / (1+i) } / i] * (1+i)

13

Present Value of Annuity Due by Factor Formula

PVADue = CCF * (PVIFA i, n) * (1+i)

%

%%

* n*m )

FVADue = CCF * (FVIFA i/m, n*m) * (1 + i/m) #

##

- 1) / (ei/m - 1)]

Nil

PVAn = CCF [1-{1 / (1+i/m) n*m} / i/m]

PVAn = CCF [{(1-e)-i*n} / {(e i – 1)}]

PVAn = CCF * (PVIFA i/m, n*m)

PVAn = CCF [{(1-e)-(i/m) * (n*m)} / {(e i/m – 1)}]###

PVADue= CCF [1-{1 / (1+i/m)

n*m

Nil

} / i/m] * (1+i/m)

PVADue = CCF * (PVIFA i/m, n*m) * (1+i/m)

Nil

Special Applications: 14

Perpetuity

PVp = CCF / i

Effective Annual Rate when Annual Percentage Rate is given

EAR = i

EAR = (1 +APR / m) m - 1

Nil

Annual Percentage when Effective Annual Rate is given

i = EAR

i = m [(1 + EAR) 1/m - 1]

Nil

17

Real Interest Rate

RIR = NR - IR

18

Rule of Doubling

n = 72 / i

n = 0.35 + 69 / i

19

The length of time required for a single cash flow to grow to a specified future amount at a given rate of interest

n = {Log (FV / PV)} / {Log (1 + i)}

n = {Log (FV / PV)} / {m * Log (1 + i/m)}

n = 1/i {Log (FV / PV)

20

The simple rate of interest required for a single cash flow to grow to a specified future cash flow.

i = {(FV/PV) 1 / n} - 1

i = m {(FV / PV) 1 / (n * m)} - 1

i = 1/n {In (FV / PV)}

15 16

21 22

The length of time required for a series of constant cash flows to grow to a specific future amount. Present value of a finite series of cash flows growing at a constant rate (g) for (n) periods with constant (i).

Nil

n

PV = {CCF (1 + g) / (i - g)} * [1-{1+g) / (1 + i} ]

%% # ##

Nil Nil

n = In {(i/m) (FVA/CCF) + m/i} / [m * {In (1 + i\m}]

Nil

Nil

Nil

#, ##, ### %

Nil

Nil

n = In {(FVA) (i) / CCF + 1} In (1 + i)

Continuous Compound and Discounting do not have factor formulas. These line use for Intra Year in case of continuous compounding and discounting. FVAn = CCF (1 + i) n-1 + CCF (1 + i) n-2 + CCF (1 + i) n-3 + ………. + CCF (1 + i) n-n FVADue = CCF (1 + i) 1 + CCF (1 + i) 2 + CCF (1 + i) 3 + ………. + CCF (1 + i) n or FVADue = Future Value of Ordinary Annuity (1 + i) PVAn = CCF (1/1+i) 1 + CCF (1/1+i) 2 + CCF (1/1+i) 3 + ………. + CCF (1/1+i) n PVAn = CCF (1/1+i) n-1 + CCF (1/1+i) n-22 + CCF (1/1+i) n-3 + ………. + CCF (1/1+i) n-n or PVADue = Present Value of Ordinary Annuity (1 + i)

www.accountancyknowledge.com

##

Nil

(Note that our notations are different from those used by text book)...

Similar Free PDFs

Time value of money

- 5 Pages

Time Value of Money Quiz

- 3 Pages

Oretan time value of money

- 30 Pages

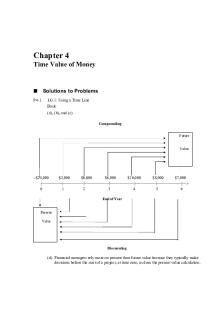

04 Time Value of Money

- 45 Pages

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time value of money solutions gitman

- 31 Pages

Time Value of Money - Grade: A

- 4 Pages

214416988 04 Time Value of Money

- 45 Pages

Chapter 4 TIME Value OF Money

- 26 Pages

Economic Value Of Time

- 8 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu