QUIZ 2 16 October 2018, questions and answers PDF

| Title | QUIZ 2 16 October 2018, questions and answers |

|---|---|

| Course | Management Accounting I |

| Institution | George Brown College |

| Pages | 7 |

| File Size | 158.6 KB |

| File Type | |

| Total Downloads | 327 |

| Total Views | 368 |

Summary

Warning: TT: undefined function: 32 1Units Cost Work in process on October 1 6,000 $3, Units started during October50,000 $25,Units completed and transferred to the next Department during October44,What was the materials cost of work in process on October 31? A. $3,060. B. $5,520. C. $6,000. D. $6,1...

Description

QUIZ 2

Ver C

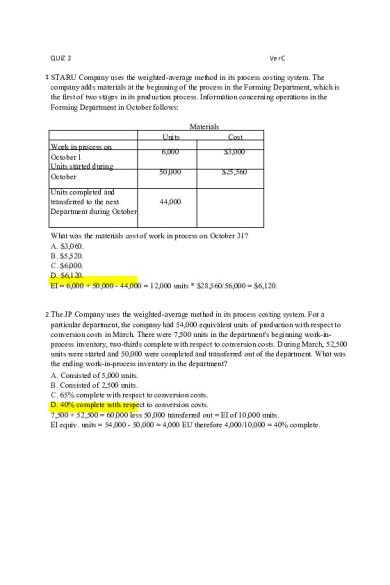

1 STARU Company uses the weighted-average method in its process costing system. The

company adds materials at the beginning of the process in the Forming Department, which is the first of two stages in its production process. Information concerning operations in the Forming Department in October follows: Materials Work in process on October 1 Units started during October Units completed and transferred to the next Department during October

Units

Cost

6,000

$3,000

50,000

$25,560

44,000

What was the materials cost of work in process on October 31? A. $3,060. B. $5,520. C. $6,000. D. $6,120. EI = 6,000 + 50,000 - 44,000 = 12,000 units * $28,560/56,000 = $6,120.

2 The JP Company uses the weighted-average method in its process costing system. For a

particular department, the company had 54,000 equivalent units of production with respect to conversion costs in March. There were 7,500 units in the department's beginning work-inprocess inventory, two-thirds complete with respect to conversion costs. During March, 52,500 units were started and 50,000 were completed and transferred out of the department. What was the ending work-in-process inventory in the department? A. Consisted of 5,000 units. B. Consisted of 2,500 units. C. 65% complete with respect to conversion costs. D. 40% complete with respect to conversion costs. 7,500 + 52,500 = 60,000 less 50,000 transferred out = EI of 10,000 units. EI equiv. units = 54,000 - 50,000 = 4,000 EU therefore 4,000/10,000 = 40% complete.

QUIZ 2

Ver C

3 Assume that there is no beginning work-in-process inventory, and the ending work-in-process

inventory is 50% complete with respect to conversion costs. What would be the number of equivalent units of production with respect to conversion costs under the weighted-average method? A. The same as the units completed. B. The same as the units started during the period. C. Less than the units completed. D. Less than the units started during the period.

4 Which of the following is true about process costing?

A. Unit costs are computed by job on the job cost sheet B. The department production report is the key document showing the accumulation and disposition of costs by a department. C. Costs are accumulated by individual job, regardless of the accounting period during which the work is done. D. All units of product are different.

5 Jawson Company uses the weighted-average method in its process costing system. Operating

data for the Painting Department for the month of April appear below:

Beginning work in process inventory Transferred in from the prior department during April Ending work in process inventory

Units

Percentage complete

6,300

10%

65,600 4,600

70%

What were the equivalent units of production for conversion costs in the Painting Department for April? A. 67,300 units. B. 68,820 units. C. 70,520 units. D. 63,900 units. (6,300 + 65,600 - 4,600) * 100% + 4,600 * 70% = 70,520 units.

6 Huffer Company uses the weighted-average method in its process costing system. The

following information pertains to Processing Department D for the month of May:

QUIZ 2

Beginning work in process Started in May Units completed Ending work in process

Ver C

Number of units 30,000 80,000 85,000 25,000

Cost of materials $11,000 $36,000

All materials are added at the beginning of the process. Which of the following costs is closest to the cost per equivalent unit for materials? A. $0.43. B. $0.45. C. $0.55. D. $0.59. ($11,000 + 36,000)/(85,000 + 25,000) = $0.43.

QUIZ 2

Ver C

Activities in the Challenger Company's Assembly Department for the month of March follow:

Number of Units Work in process inventory, March 1 Started into production during March Work in process inventory, March 31

5,000

Percent Completed Materials Conversion 65%

30%

35%

25%

65,000 3,000

7 Using the weighted-average method, what are the equivalent units of production for materials

for March? A. 65,000 units. B. 67,000 units. C. 68,050 units. D. 70,000 units. 67,000 * 1 + 3,000 *.35 = 68,050 units. 8 Using the FIFO method, what are the equivalent units of production for conversion for March?

A. 66,250 units. B. 67,000 units. C. 64,250 units. D. 67,750 units. 5,000 *.7 + 62,000 * 1 + 3,000 *.25 = 66,250 units.

QUIZ 2

Ver C

Kimbeth Manufacturing makes Dust Density Sensors (DDS), a safety device for the mining industry. The company uses a process costing system and has only a single processing department. The following information pertains to operations for the month of May: Units Beginning work in process inventory Started into production during May Completed during May Ending work in process inventory

16,000 100,000 92,000 24,000

The beginning work-in-process inventory was 60% complete with respect to materials and 20% complete with respect to conversion costs. The ending work-in-process inventory was 90% complete with respect to materials and 40% complete with respect to conversion costs. The costs were as follows:

Beginning work-in-process inventory Costs incurred during May

Materials

Conversion

$54,560

$35,560

$468,000

$574,040

9 Using the weighted-average method, the cost per equivalent unit of materials for May is closest

to which of the following? A. $4.12. B. $4.50. C. $4.60. D. $5.03. ($54,560 + 468,000)/(92,000 + 24,000 *.9) = $4.60. 10 Using the weighted-average method, the cost per equivalent unit of conversion cost for May is

closest to which of the following? A. $5.65. B. $5.83. C. $6.00. D. $6.41. ($35,560 + 574,040)/(92,000 + 24,000 *.4) = $6.00. 11 Using the weighted-average method, the total cost of the units in ending work-in-process

inventory is closest to which of the following? A. $156,960.

QUIZ 2

Ver C

B. $86,400. C. $153,960. D. $154,800. (24,000 *.9 * $4.60/Eu (from 77) + 24,000 *.4 * $6/EU (from 78) = $156,960.

12 Costs incurred at which of the following activity levels should NOT be allocated to products for

decision-making purposes? A. Unit-level activities. B. Batch-level activities. C. Product-level activities. D. Organization-sustaining activities.

13 Which of the following is NOT a limitation of activity-based costing?

A. Maintaining an activity-based costing system is more costly than maintaining a traditional direct labour-based costing system. B. Changing from a traditional direct labour-based costing system to an activity-based costing system changes product margins and other key performance indicators used by managers. Such C. In practice, most managers insist on fully allocating all costs to products, customers, and other costing objects in an activity-based costing system. This results in overstated costs. D. More accurate product costs may result in increasing the selling prices of some products.

QUIZ 2

Ver C

Escalona Company is a wholesale distributor that uses activity-based costing for all of its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity-based costing system:

Overhead costs: Wages and salaries Other expenses Total

$580,000 200,000 $780,000

Distribution of Resource Consumption:

Wages and salaries Other expenses

Filling Orders 40% 35%

Activity Cost Pools Customer Support 50% 45%

Other Total 10% 100% 20% 100%

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows: Activity Cost Pool Filling orders Customer support

Activity 1,000 orders 30 customers

14 What would be the total overhead cost per order according to the activity-based costing system,

rounded to the nearest whole cent? In other words, what would be the overall activity rate for the Filling Orders activity cost pool? A. $273.00. B. $292.50. C. $302.00. D. $312.00 (580,000 *.4 + 200,000 *.35)/1,000 = $302. 15 What would be the total overhead cost per customer according to the activity-based costing

system, rounded to the nearest whole dollar? In other words, what would be the overall activity rate for the Customer Support activity cost pool? A. $11,700. B. $12,350. C. $12,667. D. $13,000. (580,000 *.5 + 200,000 *.45)/30 = $12,667....

Similar Free PDFs

QUIZ 2018, questions and answers

- 3 Pages

Quiz 2018, questions and answers

- 14 Pages

Quiz 2018, questions and answers

- 93 Pages

Quiz 2018, questions and answers

- 9 Pages

Exam October 2018, questions

- 11 Pages

Exam October 2018, questions

- 19 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu