4e. Minions Eng - Applied Financial Management for following topics 1. Time Value of Money 2. PDF

| Title | 4e. Minions Eng - Applied Financial Management for following topics 1. Time Value of Money 2. |

|---|---|

| Course | Applied Geography |

| Institution | North-West University |

| Pages | 1 |

| File Size | 63.1 KB |

| File Type | |

| Total Downloads | 7 |

| Total Views | 140 |

Summary

Applied Financial Management for following topics

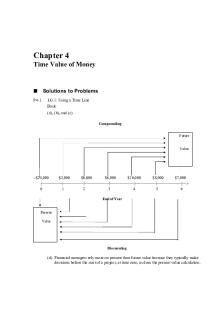

1. Time Value of Money

2. Leases

3. Working Capital and Current Assets

4. Cost of Capital

5. Capital Investment...

Description

MINIONS

20 MARKS

The current policy of Minions (Pty) Ltd (“Minions”) is to only accept projects with a positive return exceeding the weighted average cost of capital by at least 1.5%. Minions currently have a project in which they can invest with an estimated yield of 16%. The directors are however unsure about the exact figure that they should compare it to. They have provided you with the following information to assist in the calculation. Details (Book values)

2015 R’000

Ordinary share capital (20 million shares) Preference shares (2 million shares) 14% Debentures (300 debentures)

20 000 184 000 21 000

Earnings per share (EPS) for the current year amounted to 40 cents. Minions has indicated that their EPS will grow by 6.5% per year starting in 2016. They have also indicated that they will only be able to apply a dividend pay-out ratio of 35% in 2017 and 40% in 2018. No dividends will be paid in 2015 and 2016. From 2019 onwards they will be able to apply a more stable pay-out ratio of 60%. Dividend growth will be in line with growth in EPS. Should Minions issue shares the market will require a premium of 7.9% above the risk free rate. Minions is also seen as 1.72 times more risky relative to the market. The preference shares are non-cumulative, non-redeemable and are currently trading at R44 per share. Should Minions however decide to issue new preference shares, the new shares will be issued at market value less a flotation cost of 5%. The preference share dividends are 10.5%. Debentures are redeemable in 6 years’ time. Interest is paid quarterly and the debentures are redeemable at a discount of 5%. Similar debentures earn interest of 11% per year, compounded quarterly, in the market. The South African government has recently issued bonds with a similar useful life as the projects of Minions with a coupon rate of 5.94%. The target capital structure of Minions is in line with the market values of the capital structure components. You may assume that the current year is 2015 and the tax rate is 28%. REQUIRED: Write a report to the directors of Minions (Pty) Ltd where you address the following: i. The current weighted average cost of capital weighed at market values; ii. If the project should be accepted or not.

(18) (2)...

Similar Free PDFs

Time value of money

- 5 Pages

Time Value of Money Quiz

- 3 Pages

Oretan time value of money

- 30 Pages

04 Time Value of Money

- 45 Pages

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time value of money solutions gitman

- 31 Pages

Time Value of Money - Grade: A

- 4 Pages

214416988 04 Time Value of Money

- 45 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu