Beta (levered and Unlevered with defintion) PDF

| Title | Beta (levered and Unlevered with defintion) |

|---|---|

| Course | Accountant in Business ACCA |

| Institution | Federal Urdu University Of Arts, Science and Technology |

| Pages | 3 |

| File Size | 71.2 KB |

| File Type | |

| Total Downloads | 41 |

| Total Views | 137 |

Summary

Beta (levered and Unlevered with defintion) for systmetic risk of the businss...

Description

Beta is a measure of market risk. Unlevered beta (or asset beta) measures the market risk of the company without the impact of debt. In simple language, it is the beta of a company without considering the debt. A levered beta greater than positive 1 or less than negative 1 means that it has greater volatility than the market. A levered beta between negative 1 and positive 1 has less volatility than the market. Equity Beta or Levered Beta measures the risk of a firm with debt and equity in its capital structure to the volatility of the market. A key determinant of beta is leverage, which measures the level of a company's debt to i t s e q u i t y. Define Levered Beta: LB means an investment measurement used to calculate the risk involved with purchasing an asset with debt. Levered beta is a measure of the systematic risk of a stock t h a t i n c l u d e s r i s k d u e t o m a c r o e c o n o m i c e v e n t s l i k e w a r, political events, recession, etc. Systematic risk is the risk that is inherent to the entire market and is also known as the undiversifiable risk. It cannot be reduced through diversification. Levered beta is a financial calculation that indicates the systematic risk of a stock used in the capital asset pricing model (CAPM). Ra = Expected return on a security Rrf = Risk-free rate Ba = Beta of the security Rm = Expected return of the market Note: “Risk Premium” = (Rm – Rrf) An unlevered beta will always be lower than the levered beta since it strips off the debt component, which adds to the risk. If it is positive, investors will invest in this particular stock when the prices are expected to rise. If the unlevered beta is negative, investors will invest in the stock when the prices are expected to fall. U s u a l l y, a b e t a e q u a l t o 1 i n d i c a t e s a s t o c k ’ s r i s k e q u a l t o t h e m a r k e t r i s k ; a b e t a o f l e s s t h a n 1 i n d i c a t e s a s t o c k ’s risk lower than the market risk, and a beta of greater than 1

i n d i c a t e s a s t o c k ’s r i s k g r e a t e r t h a n t h e m a r k e t r i s k . To calculate the leveraged beta, we need to know the unlevered beta and the debt-to-equity ratio. Mark calculates the unlevered beta formula of the stock beta / 1 + (1 – tax rate) x (debt / equity) = 1.25 / 1 + (1 – 35%) x 13% = 1.33. Then, he calculates the levered beta formula of the stock unlevered beta (1+ (1-t) (Debt/Equity)) = 1.33 x (1 + (1-35%) x 13% = 1.45. Explanation of Levered Beta Formula In order to calculate the levered beta, use the following steps: Step 1: Find out the Unlevered Beta Step 2: Find out the tax rate for the stock. The tax rate is represented by t. Step 3: Find out the total debt and equity value. The formula for calculating total debt is: Debt = Short term debt + Long term debt Step 4: Calculation using the formula: Levered Beta = Unlevered Beta (1 + (1-t)(Debt/Equity)) In order to calculate the unlevered beta, we just adjust the above formula. The steps for calculation of the unlevered beta are as under: Step 1: Calculate the levered beta. Step 2: Find out the tax rate for the organization. The tax rate is represented by t.

Step 3: Find out the total debt and equity value. Step 4: Calculation of the unlevered beta using the formula: Unlevered Beta =Levered Beta (1 + (1-t)(Debt/Equity))...

Similar Free PDFs

Alpha Beta and Beta Structures

- 7 Pages

Kinetics definition - defintion

- 3 Pages

Estimasi Beta

- 5 Pages

BETA BLOQUEANTES

- 13 Pages

Beta y Beta ll ficha tecnica

- 10 Pages

Beta oxidación (Resumen)

- 6 Pages

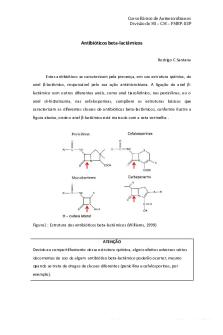

01. Antibióticos beta-lactâmicos

- 6 Pages

Riesgo, coeficiente beta.

- 13 Pages

U1 S2 Funcion Gammay Beta

- 13 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu