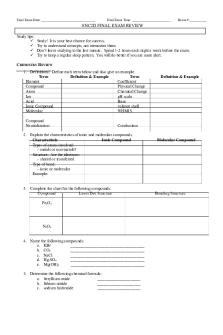

ECO 1002 - Final Exam Review PDF

| Title | ECO 1002 - Final Exam Review |

|---|---|

| Course | Macro-Economics |

| Institution | Baruch College CUNY |

| Pages | 25 |

| File Size | 506.7 KB |

| File Type | |

| Total Downloads | 11 |

| Total Views | 149 |

Summary

Final Exam Review...

Description

Chapter 1: Economics (Core Issues) Goals of the Course - Understand how individuals make economic decision - How markets shape economic outcomes - Examine the role that government plays in shaping economic performance - Understand how we, ourselves, make better decisions Core Issues: In a world of limited resources… - What to do produce with our limited resources? - How to produce the goods and services we select? - For whom goods and services are produced? -

-

-

Scarcity: lack of enough resources to satisfy all desired uses of resources. Factors of production: resource inputs used to produce goods and services 1) Land: ground and all natural resources 2) Labor: quantity and quality of human resources 3) Capital: final goods produced for use in the further production 4) Entrepreneurship: the person who sees the opportunity for new or better products and brings together the resources needed to produce them Economics: how best to allocate scarce resources among competing uses Opportunity Cost: the most desired goods or services that are forgone to obtain something else Sunk Cost: the cost you will never get back (loss of money) Production Possibilities: combinations of final goods and services that could be produced in a given time period 1) A PPC shows potential output not actual output. 2) Any point on the PPC are efficient and attainable. 3) Any point inside the PPC are inefficient but attainable. 4) Any point outside the PPC are unattainable. 5) An increase in output is caused by increase of available resources or technological advancements. Diminishing effect of marginal productivity: the opportunity cost of one unit of output is higher when production is higher Efficiency: maximum output of a good from the resources used in production Market Mechanism: use of market prices and sales to signal desired outputs and resource allocations

-

-

Adam Smith: author of The Wealth of Nations, believed in the “invisible hand”; believed the price signals and responses of the marketplace were likely to do a better job of allocating resources than any gov’t could Laissez Faire: “leave it alone”; nonintervention by gov’t in market mechanism Karl Marx: economist, wrote Communist Manifesto; believed that gov’t not only had to intervene but had to own all the means of production John Maynard Keynes: father of macroeconomics; believed that gov’t should play an active but not all-inclusive role in managing the economy Mixed Economy: an economy that uses both market signals and gov’t directives to allocate goods and resources Market Failure: an imperfection in the market mechanism that prevents optimal outcomes Gov’t Failure: gov’t intervention that fails to improve economic outcomes Positive Analysis: focuses on “what is”; based on facts Normative Analysis: focused on “what should be”; based on opinions and judgements Ceteris paribus: the assumption of nothing else changing

Chapter 3: Supply and Demand -

-

Law of Demand: in a given time period, the quantity demanded of a good increases as its price falls; inverse relationship between price and demand Market Demand: collective summation of all buyers’ individual demands Changes in Demand: Factors that set demand behavior: taste, income, expectations, substitutes, compliments, # of buyers Increase in demand shifts the curve to the right ● Taste for good increases ● Income increases ● Price of substitute rises ● Price of compliment falls ● Future prices are expected to rise ● Number of buyers increases Decrease in demand shifts the curve to the left ● VICE VERSA of when demand increases Movement on Demand Schedule: caused by a change in price or demand ** Shift in demand is NOT caused by a change in price Law of Supply: in a given time period, the quantity supplied of a good increases as price increases; direct relationship between price and supply

-

-

-

-

-

Changes in Supply: Factors that set supply behavior: technology, input costs, taxes and subsidies, expectations, other goods, # of sellers Increase in supply shifts the curve to the right ● New technology lowers operating costs ● Input costs decreases ● Taxes decrease or subsidies increase ● Future prices are expected to rise ● Price of alternative goods fall ● Number of sellers increases Decrease in supply shifts the curve to the left ● VICE VERSA of when supply increases Equilibrium: the one price and quantity combination that is compatible with the intentions of both buyers and sellers 1) Where supply and demand meet 2) No shortages or surplus exist 3) 𝑄 𝑑 = 𝑄 𝑠 = 𝑄 𝑒 Substitute: something that replaces another good 1) The more substitutes there are, the more elastic the demand. 2) The less substitutes there are, the more inelastic the demand. Compliment: something that is frequently consumed with another good 1) When the price of one good rises, the demand of the other falls 2) When the price of one good falls, the demand of the other rises Market Surplus: the amount by which quantity supplied exceeds quantity demanded at a given price (excess supply, price is too high) Market Shortage: the amount by which quantity demanded exceeds quantity supplied at a given price (excess demand, price is too low) Price Changes: occurs only when a market is in disequilibrium Price Controls: gov’t may impose an arbitrary maximum price (price ceiling) or minimum price (price floor) on a market. This prevents market from reaching equilibrium.

Chapter 4: The Role of the Gov’t -

Public Good: consumption by one person does not exclude another Private Good: consumption by one person excludes others Free Rider Dilemma: the communal nature of public goods may cause some consumers to try for a free ride

-

-

-

Gov’t Role: 1) Become the “buyer” 2) Producer then produces public good 3) Gov’t finance the purchase with taxes or user fees Externalities: costs or benefits borned by a 3rd party when a two-party (buyer or seller) transaction occurs 1) Positive Externality: you buy a house in south Bronx, you fix it up nice, value of the houses around yours goes up 2) Negative Externality: south Bronx in 1995, your house goes down, so does everyone else Gov’t should get involved in positive externalities (Ex: public education and inoculation) Income Redistribution: reduces the inequity in incomes, provides a minimum amount of merit goods, gov’t uses progressive income tax system Merit Goods: a good society believes everyone is entitled to some minimal quantity of Marginal Tax Rate: the ratio at which a business or person is taxed Progressive Tax System: tax system in which tax rates rises as income rises Regressive Taxes: tax system in which tax rates fall as incomes rise Corporate Taxes: a progressive tax system, passed to customer in higher prices Income taxes: the largest single source of gov’t revenue The top 1% pays over half of income tax, the top 10% pays 60% of all tax Excise Taxes: sales tax imposed on specific goods and services (Ex: liquor and cigarettes) Property Taxes: local funds (city and state) from real estate tax Sales Tax: poorer ppl tend to spend all their income than the rich

Chapter 5: National Income Accounting -

-

Gross Domestic Product (GDP): total dollar value of all final goods (retail profits) and services (commissions) produced within a nation’s borders in a given time period (one year) GDP per capita: GDP divided by total population 1) Average output per person 2) Used as a measure of a country’s standard of living

-

-

-

3) Does not indicate the disparity of output distributed to high-income earners and low-income earners in that country 4) Low GDP per capita indicates poverty Non Market Activities: GDP measures exclude most goods and services produced but not sold in the market 1) Unpaid production done at home or by volunteer workers 2) Unreported production done “off the books” or in the underground economy Intermediate Good: goods or services purchased for use as an input in the production of final goods or services, excluded in GDP Value Added: the increase in the market value of a product that takes place at each stage of the production process Nominal GDP: the value of final output produced in a given period, measured in the price of that period (current price) Real GDP: the value of final output produced in a given period, adjusted for changing prices Depreciation: decrease in the value of a long-term asset (Ex: real estate, buildings wear down and need construction) Net Domestic Product: NDP = GDP - Depreciation Net Domestic Product Examples: 1) GDP 1983: $3.65 trillion, 2018: $22.7 trillion CPI of 2018 / CPI of 1983 (250 / 100) X 3.65 trillion = 9.125 trillion The GDP of 1983 would be 9.125 trillion in today’s dollars In real terms, it increased 22.7-9.125 = 13.575 trillion dollars. 2) Babe Ruth’s Salary: $80k/year in 1931. CPI of 1931: 15, CPI of 2018: 250 CPI of 2018 / CPI of 1931 (250 / 15) X 80,000 = 1.333 million His salary today would be equivalent to 1.333 million dollars. Gross Investment: total investment expenditure in a given time period Net Investment: gross investment less depreciation Uses of Output: indicate what mix of output has been selected to produce GDP = C + I + G + (X - M) 1) Consumption (C): goods and services used by households (over ⅔ of GDP) 2) Investment (I): plant, machinery, and equipment produced (about ⅙ of GDP) 3) Government Spending (G): resources purchased by the public sector (about ⅕ of GDP)

-

-

4) Net Exports (X-M): the value of exports (X) minus the value of imports (M) Net Exports (X-M): 1) Imports (M): goods and services made in foreign lands but purchased in the US 2) Exports (X): goods and services produced in US by purchased by foreign lands 3) Trade Balance: US has a negative trade balance b/c we import more than export 4) We add exports to our GDP, subtract important from our GDP Personal Income (PI): pretax income received by households Disposable Income (DI): what remains of personal income after taxes are paid, either spent or saved PI = Consumption + Savings + Taxes DI = Personal Income - Personal Taxes DI = Consumption + Savings

Chapter 6: Unemployment -

-

Unemployment Rate: someone who isn’t working and is actively looking for work 1) Lagging Indicator (it doesn’t tell you what happens in the future, tells you of the recent past) 2) Increased last 2 months b/c (a) gov’t shutdown (b) higher minimum wage 3) Approximately 3.8%, close to full employment Participation Rate:

𝑙𝑎𝑏𝑜𝑟 𝑓𝑜𝑟𝑐𝑒 = -

-

𝑎𝑙𝑙 𝑡ℎ𝑒 𝑝𝑝𝑙 𝑤𝑜𝑟𝑘𝑖𝑛𝑔 + 𝑢𝑛𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑑 𝑡𝑜𝑡𝑎𝑙 𝑎𝑑𝑢𝑙𝑡 𝑝𝑜𝑝𝑢𝑙𝑎𝑡𝑖𝑜𝑛 (16 𝑦𝑟𝑠 +)

Duration: when the economy is growing, unemployment rate and duration decreases Discouraged Workers: former job seekers who have given up and no longer actively seeking employment (no longer count in unemployment statistics) 1) 63.12% come out to work 2) Unemployment goes up as they are looking for work 3) Not working → Unemployed Underemployment: want to work full-time, but only works part-time; counts as employed Phantom Unemployed: claim to look for work to receive public assistance Human Costs of Unemployment:

-

-

1) Loss of income 2) Loss of confidence 3) Social stress 4) Lost lives Phantom Unemployed: claim to look for work to receive public assistance Seasonal Unemployment: employed at certain times of the year, when labor demand is higher Frictional Unemployment: (good) left job for a better job, has confidence in the economy, voluntary Structural Unemployment: when an industry changes drastically, loss of jobs (Ex: printing jobs) 1) During periods of change, structural unemployment increases 2) When changes are fully absorbed, structural unemployment decreases Cyclical Unemployment: lack of job vacancies due to an inadequate level of demand (Ex: auto-mobile workers during the Great Recession) Full Employment: the lowest unemployment rate compatible with price stability, estimated between 4-6% unemployment Natural Rate of Unemployment: the long-term rate of unemployment determined by structural forces in labor and product market Non-Accelerating Inflation Rate of Unemployment (NAIRU): lowest employment rate when the inflation rate is not accelerating Outsourcing: relocation of production and jobs to other countries to take advantage of lower production costs Okun’s Law: estimates that there is a 2% decline in output for every 1% increase in unemployment

Chapter 7: Inflation -

-

Inflation: an increase in the average level of process, not a change in any specific price of a good 1) Prices of a market of goods are collected and computed into a avg price level for that market in a year 2) A rise in that avg price of all goods (not a market function) 3) Decrease in deflation (Ex: 1800’s Industrialization) 4) Inflation makes people who borrow money better off 5) Generally; the higher the interest rate, the higher the inflation Income Effects: people with nominal incomes rising more slowly than inflation end up worse off

-

-

-

-

-

-

Wealth Effects: those who own assets that are declining in real value end up worse off Deflation: a decrease in the average level of prices of goods and services 1) Sellers are reluctant to stock inventory 2) Buyers are reluctant to spend money Runaway Inflation: 1923 prices doubled in Germany, production halted → unemployment increased 10x; Zimbabwe and Venezuela in 2017 Stagflation: high inflation and high unemployment Relative Prices: the market mechanism causes the prices of individual goods and services to rise or fall; an essential market function 1) The price of one good compared to the price of other goods 2) Buyers switch from one good to another when their relative prices diverge Nominal Income: amount of income received measured in current dollars, adjusts for inflation Real Income: income in constant dollars Money Illusion: when the nominal amount went up but the real amount went down Hyperinflation: monetary inflation occurring at very high rate (Ex: Venezuela) Bracket Creep: in a progressive tax system, when nominal income rise, the taxpayer gets pushed into a higher tax bracket Base Year: index of where you begin Consumer Price Index (CPI): the basket of goods and services that an avg urban/suburban household buys on a regular basis 1) Housing 2) Transportation 3) Food CPI does not adjust: 1) If the price goes up but the product got better (Ex: Adapt BB) 2) If the price goes up but the demand is not reflected (barely changes) Chained CPI: takes into consideration the fact that the price goes up and demand goes down by some 1) Better than normal CPI b/c it adjusts to higher price 2) Chained CPI makes CPI lower 3) Reduces inflation rate Core Inflation Rate: changes in CPI, excluding food and energy Producer Price Index (PPI): changes in the avg prices at intermediate steps of production GDP Deflator: changes in prices of all goods and services included in GDP, used to adjust normal GDP to real GDP

-

Compute Inflation Rate from CPI:

𝐼𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑒 =

-

-

-

𝐶𝑃𝐼

𝑦𝑒𝑎𝑟 2

− 𝐶𝑃𝐼

𝐶𝑃𝐼

𝑦𝑒𝑎𝑟 1

× 100

𝑦𝑒𝑎𝑟 1

Example: If CPI of one year is 150 and 5 years later is 200, what is the change in inflation? 33% Measurement Concerns: 1) We are seeking price stability at the lowest rate of unemployment 2) From year to year, there are quality improvements in the basket of goods Demand-Pull Inflation: results from excessive pressure to buy on the demand side of the economy 1) A booming economy creates shortages 2) Too much money pumped into the economy by the Federal Reserve Cost-Push Inflation: results from higher production costs putting pressure on suppliers to push up prices Cost of Living Adjustment (COLA): automatic adjustments of nominal income to the rate of inflation (Ex: social security) Real Interest Rate: the nominal interest rate minus the anticipated inflation rate Adjustable Rate Mortgage (ARM): a mortgage (home loan) that adjusts the nominal interest rate to changing rates of inflation Virtues of Inflation: 1) A little inflation may be a good thing 2) The challenge is to find the optimal rate of inflation

Chapter 8: The Business Cycle -

-

-

Business Cycle: alternating periods of economic growth and contraction 1) How stable is a market-driven economy? 2) What forces cause instability? 3) What, if anything, can the gov’t do to promote steady economic growth? Prior to the 1930s: 1) Conventional wisdom was a market-driven economy 2) Economy was inherently stable 3) Business cycles were short-lived 4) Market seemed to correct itself 5) Laissez Faire: no need for gov’t intervention Classical Economics: believed the economy will self-regulate and gravitate towards full employment; wages and prices are flexible

-

-

-

-

-

-

-

Say’s Law: supply creates its own demand Great Depression: self-adjustment mechanism did not work John Maynard Keynes: analyzed the situation and concluded that self-adjustment could not occur b/c of an “insufficiency of effective demand” 1) A market-driven economy was, in fact, inherently unstable 2) Concluded that gov’t must intervene by increasing aggregate demand Gov’t Intervention for Underperforming Economy: 1) Buy more output 2) Employ more people 3) Provide more income transfers 4) Make more money available Parts of a Business Cycle: 1) Peak: where GDP maximizes 2) Contraction: where GDP declines 3) Trough: where GDP minimizes 4) Expansion/Recovery: where GDP increases Growing Economy: 1) Increase productivity 2) Increase labor force 3) Increase investment in technology Economic Growth: real GDP grows faster than 3% (Expansion) Recession: real GDP contracts (for two or more consecutive quarters) Unemployment compensation and welfare payments increase Growth Recession: economy expanding too slowly (0-2%) Depression: extremely deep recession, GDP per capita extremely low Macro Outcomes: 1) Output: total value of goods and services produced (real GDP) 2) Jobs: levels of employment and unemployment 3) Prices: avg price of goods and services (inflation) 4) Growth: year-to-year expansion in production capacity 5) International Balances: value of the dollar; trade balances Macro Determinants: 1) Internal market forces: population growth, spending behavior, invention and innovation 2) External shocks: wars, natural disasters, terrorist attacks, trade disruptions 3) Policy levers: tax policy, gov’t spending, changes in money supply and regulation Aggregate Demand: slopes downward b/c…

-

-

-

-

1) Real Balances Effect: the cash you hold is worth more when the price level falls, so you can buy more goods 2) Foreign Trade Effect: lower price levels in the US convince customers to buy more American goods and fewer foreign goods 3) Interest Rate Effect: lower interest rates promote more borrowing and more spending Aggregate Supply: slopes upward b/c… 1) Profit Effect: if there is no change in the cost of operations, rising prices will improve profits and suppliers will bring more products to the market 2) Cost Effect: cost increases make producing products more expensive. Producers will be willing to supply more only if prices also rise to cover those added costs Demand-Side Theory (Keynes): 1) Recession Policy: deficiency in spending → increase gov’t spending to shift demand back to the right 2) Inflation Policy: excess in spending → increase taxes to shift demand back to the left 3) “Tight” Money Policy: high interest rates, hard to get loans → increase money supply and lower interest rates to shift demand back to the right 4) “Easy” Money Policy: low interest rates, easy to get loans → decrease...

Similar Free PDFs

ECO 1002 - Final Exam Review

- 25 Pages

ECO 112- Final Exam -2017

- 8 Pages

Chem Final Exam Review

- 12 Pages

Final Exam - Review notes

- 92 Pages

Bio Final Exam Review

- 2 Pages

Final EXAM Review booklet

- 5 Pages

CHEM303 final exam review

- 4 Pages

Psychology Final Exam - Review

- 13 Pages

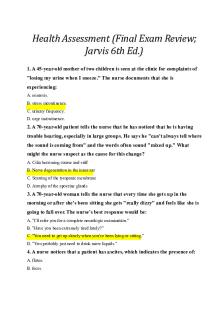

Jarvis Final Exam Review

- 12 Pages

Final exam review

- 96 Pages

Final Exam Review

- 48 Pages

Marketing Final Exam Review

- 15 Pages

Final exam review

- 8 Pages

Astronomy Final Exam Review

- 2 Pages

Final Exam Review Guide

- 4 Pages

Final exam review flsp4420

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu