Engineering Economics Module 1 - Time Value of Money PDF

| Title | Engineering Economics Module 1 - Time Value of Money |

|---|---|

| Author | QUANG NGUYEN |

| Course | Engineering Cooperative Ed |

| Institution | Michigan State University |

| Pages | 6 |

| File Size | 193.1 KB |

| File Type | |

| Total Downloads | 33 |

| Total Views | 150 |

Summary

Engineering Economics Module 1 - Time Value of Money...

Description

Co-op Course Academic Component Engineering Economics Module 1 Basic Concepts: Time Value of Money As most engineering students learn after entering an organization during co-op, engineering involves much more than designing/re-designing products or processes. All organizations, whether for-profit or governmental/non-profit, must be focused on the economic components of daily operations. In engineering, some of the key aspects of most any project include budgeting, economic efficiency of systems and operations, purchasing, sourcing, economic evaluation of alternatives in decision making, quoting, marketing/sales – and the list goes on. In short, engineers need to understand many „business-related‟ concepts and practices in particular, economics, finance, management, and accounting - in order to be successful in their roles. The goal of this module is to introduce some basic concepts of engineering economics. Basic concepts that will be discussed include: Cost vs. Price Time Value of Money (cash flow diagrams, simple and compound interest) Cost vs. Price1 Price is defined as the amount of money that is given up to acquire a good or service. Cost is the amount paid to produce a good or service. The cost represents the sum of the value of the inputs in production – land/materials, labor, capital and enterprise/profit. Consider the following example: An entrepreneurial group of engineering students develops a new platform training device for wheelchairs that allows children to learn how to operate a powered wheelchair. The cost of making one of these devices is the sum of: Materials – all physical components needed to build one of the devices (steel for the frame, motors, controllers, sensors, wheels, etc.); Capital - all the buildings that make up the business, the machinery, equipment used in the manufacture of the device as well as all the vehicles and so on involved in the distribution of the finished product and the offices and administration buildings that support the business; Labor – all of the people involved with the design, manufacture, and distribution of the device along with the people who administer the operation of the organization; and, 1

Excerpts of definitions and concepts are from http://www.bized.co.uk/glossary/whatis/pricecost.htm accessed on 10/17/10.

Engineering Economics Module 1 - Basic Concepts - Plouff

Page 1 of 6

Profit – the amount left over when all costs have been paid, and is the reward of the enterprise. The price is the amount of money that a customer must pay to purchase one of the devices. Time Value of Money2 Engineering projects often take place over some period of time and involve cash flows throughout the life of the project. Cash flows can include payments for purchases, income from revenue, deposits to a bank, loans from a bank, operating and maintenance costs, and trade-in salvage on equipment. Because these actions occur throughout the life of the project, it is important to understand the time value of money. Cash Flow Diagrams: Often when analyzing an engineering economics problem it is helpful to represent the problem graphically using a horizontal line to represent the time and vertical vectors to represent dollar amounts. Income is represented by an upward vector, expenditures are represented by a downward vector, and the length of the arrow is proportional to the magnitude of the corresponding cash flow. It is important that the point of view is noted, for example, whether the diagram represents the point of view of the lender or the borrower. Figure 1 is a representation of a simple cash flow scenario. This diagram shows initial revenue of $500 and a withdrawal or expenditure of $1,000 at the end of two years. $500

1

2

$1,000 Figure 1: Cash Flow Diagram Example

2

Excerpts for this section are taken from the following sources: “Schaum‟ outline of theory and problems in engineering economics,” Sepulveda, J.A., Souder, W.E., and Gottfried, B.S., 1984; “Fundamentals of engineering review,” Potter, M.C., 1990; and, “FE review manual,” Lindeburg, M.R., 2004.

Engineering Economics Module 1: Basic Concepts - Plouff

Page 2 of 6

Interest: Interest is the fee that is charged for the use of someone else‟s money. The size of the fee depends on the total amount of money borrowed and the length of time over which it is borrowed. The lender is the owner of the money and the borrower pays interest to the lender for use of the lender‟s money. Interest Rate: The interest rate is the percentage of the money charged by the lender for a given amount of money that is borrowed for a specified period of time (typically, one year). Interest rates are influenced by economic conditions and the degree of risk the lender assumes by lending the money. Example 1: A company borrows $5,000 to purchase a new piece of equipment at an interest rate of 6% per year. What amount of money must be repaid to the lender at the end of one year? Year 1: $5,000 + $5,000*0.06 = $5,300 Answer: $5,300 Figure 2 represents the cash flow from the perspective of the borrower. $5,000 1

$5,300 Figure 2: Cash Flow Diagram for Example 1 from the Borrower‟s Perspective

Engineering Economics Module 1: Basic Concepts - Plouff

Page 3 of 6

Figure 3 represents the cash flow from the perspective of the lender. $5,300

1

$5,000 Figure 3: Cash Flow Diagram for Example 1 from the Lender‟s Perspective Simple Interest: Simple interest is a fixed percentage of the principal (the amount of money borrowed), multiplied by the life of the loan. (1) where: I = total amount of simple interest n = life of the loan i = interest rate (in decimal format) P = principal (present value of money) (where n and i are in the same unit of time – for example, per year) With simple interest loans, nothing is repaid until the end of the loan period when both the principal and the accumulated interest are repaid. The total amount due is: (2) where: F = future value of money, or future worth Example 2: A company takes out a 3-year loan to borrow $5,000 to purchase a new piece of equipment at an interest rate of 6% per year. If the lender agrees to a simple interest arrangement, what amount of money must be repaid to the lender at the end of three years? F = $5,000(1 + 3*0.06) = $5,900 Compound Interest: Compounded interest refers to the situation where the total time period of the loan or investment is subdivided into interest periods (e.g. one year, one month), and interest is credited at the end of each interest period. In this situation, interest is allowed to accumulate from one interest period to the next. Engineering Economics Module 1: Basic Concepts - Plouff

Page 4 of 6

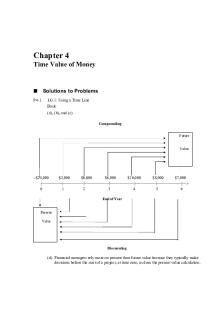

Example 3: A company takes out a 3-year loan to borrow $5,000 to purchase a new piece of equipment at an interest rate of 6% per year. If the lender agrees to a compounded interest arrangement, what amount of money must be repaid to the lender at the end of three years? Year 1: $5,000 + $5,000*0.06 = $5,300 Year 2: $5,300 + $5,300*0.06 = $5,618 Year 3: $5,618 + $5,618*0.06 = $5,955 Answer: $5,955 Mathematically, a simpler way to represent the calculations in Example 3 is what is called the law of compound interest: (3) Using Equation (3) to solve Example 3, results in: F = $5,000(1 + 0.06)3 = $5,955 Note the difference in accumulated debt to the organization for the purchase of equipment when borrowing using simple interest versus compound interest. There is $55 more due at the end of the 3-year borrowing period using a compound interest scenario compared to using simple interest. Since money has the ability to gain interest over time, its value increases over time. Therefore, an amount of money today has an increased value at some point in the future depending on the interest rate and the time period. This concept is represented by the relationship presented in Equation (3). In other words, the future worth of $5,000 is $5,955 if the interest rate is 6% per year over three years. Likewise, the value of money decreases from the future to the present under these circumstances. Equation (3) can be solved for P (present worth of money): (4) Thus, the present worth of $5,955 is $5,000 if the interest rate is 6% per year over three years.

Engineering Economics Module 1: Basic Concepts - Plouff

Page 5 of 6

The typical cash flow diagram representing a future worth scenario is shown in Figure 4, and for a present worth scenario in Figure 5. P

1 2 3 4 …. n Figure 4: P-pattern: a single present amount P occurring at the beginning of n years

F

1 2 3 4 …. n Figure 5: F-pattern: a single future amount F occurring at the end of n years

Engineering Economics Module 1: Basic Concepts - Plouff

Page 6 of 6...

Similar Free PDFs

Time value of money

- 5 Pages

Time Value of Money Quiz

- 3 Pages

Oretan time value of money

- 30 Pages

04 Time Value of Money

- 45 Pages

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time value of money solutions gitman

- 31 Pages

Time Value of Money - Grade: A

- 4 Pages

214416988 04 Time Value of Money

- 45 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu