Final Exam Review PDF

| Title | Final Exam Review |

|---|---|

| Author | Brycson Mathewz |

| Course | Introduction to Managerial Accounting |

| Institution | Texas State University |

| Pages | 3 |

| File Size | 70.4 KB |

| File Type | |

| Total Downloads | 49 |

| Total Views | 125 |

Summary

Final review...

Description

FINAL EXAM REVIEW – SPRING 2019 Chapter 1 - Introduction to Managerial Accounting Objective 1: Identify managers three primary responsibilities Plan, Direct, and Control Objective 2: Distinguish financial accounting from managerial accounting External vs Internal Perspective Objective 4: Describe the role of the Institute of Management Accountants (IMA) and apply its ethical standards IMA: US professional association for management accountants. Four ethical standards: professional competence, confidentiality, integrity, and credibility Chapter 2 - Building Blocks of Managerial Accounting Objective 1: Distinguish among service, merchandising, and manufacturing companies Service Companies: Sell intangible services. No inventory Merchandising Companies: Resell tangible products bought from suppliers. Manufacturing Companies: Convert raw material into finished goods using labor, plant, and equipment Objective 4: Identify product costs and period costs Product Costs: Direct Materials, Direct Labor, and Manufacturing Overhead Period Costs: Every other cost that is not a product cost Conversion Costs vs Prime Costs Objective 5: Prepare the financial statements for service, merchandising, and manufacturing companies Manufacturing Company: Raw Materials Used, Cost of Goods Manufactured, Finished Goods Inventory, and Cost of Goods Sold Chapter 3: Job Costing Objective 1: Distinguish between job costing and process costing Job Costing - Used by companies that produce unique, custom-ordered products, or small batches of different products. Process Costing - Used by manufacturers who produce large numbers of identical units. Objective 3: Compute a predetermined manufacturing overhead rate and use it to allocate MOH to jobs. Total Estimated Overhead Costs / Total Estimated Allocation Base = Predetermined Overhead Rate Predetermined Overhead Rate * Actual Amount of Allocation Base = Allocated Overhead Objective 4: Determine the cost of a job and use it to make business decisions Direct Materials + Direct Labor + Manufacturing OH applied Objective 5: Compute and dispose of overallocated or underallocated manufacturing overhead IF: MOH Allocated < Actual MOH, then underallocated. Increase Cost of Goods Sold for the variance IF: MOH Allocated > Actual MOH, the overallocated. Decrease Cost of Goods Sold for the variance Chapter 4: Activity-Based Costing Objective 2: Develop and use activity-based costing (ABC) to allocate indirect costs Total Estimated Overhead Costs per activity / Total Estimated Allocation Base per Activity = Activity Cost Allocation Rate Activity Allocation Rate * Actual Amount of Allocation Base = Allocated Overhead per activity *Done for each activity

Chapter 6: Cost Behavior Objective 1: Describe key characteristics and graphs of various cost behaviors Fixed Costs: Do not change in total with volume but per unit amount changes Variable Costs: Change in total with volume but per unit amount does not change Mixed Costs: Change in total with volume but not proportionately Step Costs: Fixed over a small range of activity and then increase to a new fixed level with changes in volume Objective 2: Use cost equations to express and predict costs Total Cost = Variable Cost per unit (X) + Fixed Costs Objective 4: Use the high-low method to analyze cost behavior 1.

(High cost – Low cost) / (High activity – Low activity) = VC per unit *Find values based on volume

2. Plug high or low values into total cost formula to find FC TC = VC(x) + FC 3. Use total cost formula to find total cost at any volume level Objective 6: Describe variable costing and prepare a contribution margin income statement Absorption Costing: Variable Costing: Sales Revenue Sales Revenue -COGS - Variable Costs Gross Profit Contribution Margin -Operating Expenses -Fixed Costs Operating Income Operating Income Difference in Operating Income = (Change in inventory level, in units) X Fixed MOH/unit Chapter 7: Cost-Volume Profit Analysis Objective 1: Calculate the unit contribution margin and the contribution margin ratio Selling Price per unit - Variable Cost per unit = CM per unit Contribution Margin / Sales Revenue = CM Ratio Objective 2: Use CVP Analysis to find breakeven points and target profit volumes 3 Approaches to find Breakeven Point: Income Statement Approach: Sales Revenue - Variable Expenses - Fixed Expenses = Operating Income Contribution Margin per unit shortcut: (Fixed Expenses + Operating Income) / Contribution Margin per unit Contribution Margin Ratio shortcut: (Fixed Expenses + Operating Income) / Contribution Margin Ratio Objective 3: Use CVP analysis to measure the impact of changing business conditions Using the above formulas, change different variables to determine the change in output: What-if Analysis Chapter 8: Relevant Costs Objective 1: Describe and identify information relevant to short-term business decisions Must be future data that differs among alternatives Objective 2: Describe and apply different approaches to pricing Target Pricing Cost-Plus Pricing Objective 3: Decide whether to accept a special order If incremental revenue exceeds incremental costs, accept order Objective 4: Decide whether to discontinue a product, department, or store If cost savings exceeds the lost revenue, then discontinue Objective 6: Analyze outsourcing (make-or-buy) decisions Outsource if incremental costs of making the product exceeds the incremental costs of outsourcing

Chapter 9: The Master Budget Objective 2: Prepare the operating budgets Sales Budget, Production Budget, Direct Materials Budget, Direct Labor Budget, Manufacturing Overhead Budget, Operating Expenses Budget, and Budgeted Income Statement Objective 3: Prepare the financial budgets Capital Expenditures Budget, Cash Collections, Cash Payments, Combined Cash Budget, and Budgeted Balance Sheet Objective 4: Prepare budgets for a merchandiser Cost of Goods Sold, Inventory, and Purchases Budget Chapter 10: Performance Evaluation Objective 1: Understand decentralization and describe different types of responsibility centers Decentralization: Splitting operations into different segments. Four responsibility centers: Cost, Revenue, Profit, and Investment Objective 2: Develop performance reports Comparing actual to budgeted and finding the variance amount and percentage Direct Fixed Expenses vs Common Fixed Expenses Segment Margin Performance Report: Sales Revenue -Variable Costs =Contribution Margin -Direct Fixed Expenses =Segment Margin -Common Fixed Expenses =Operating Income Objective 3: Calculate ROI, sales margin, and capital turnover Objective 5: Prepare and evaluate flexible budget performance reports Master Budget Variance - Difference between Actual Results and the Master Budget Volume Variance - Difference between Flexible Budget and Master Budget Flexible Budget Variance - Difference between Actual Results and the Flexible Budget Chapter 11: Standard Costs and Variances Objective 2: Compute and evaluate direct materials variances DM Price Variance = (Actual Price - Standard Price) * Actual Quantity Purchased DM Quantity Variance = (Actual Quantity - Standard Quantity) * Standard Price Objective 3: Compute and evaluate direct labor variances DL Rate Variance = (Actual Rate paid - Standard Rate) * Actual Hours DL Efficiency Variance = (Actual Hours worked - Standard Hours) * Standard Rate Objective 4: Explain the advantages and disadvantages of using standard costs and variances Advantages: Creates cost benchmarks, usefulness in budgeting, motivation for employees, and simplifies bookkeeping Disadvantages: Can result in outdated standards, lack of timeliness, greater focus on operational performance measures, lean thinking, increase in automation, and unintended behavioral consequences...

Similar Free PDFs

Chem Final Exam Review

- 12 Pages

Final Exam - Review notes

- 92 Pages

Bio Final Exam Review

- 2 Pages

Final EXAM Review booklet

- 5 Pages

CHEM303 final exam review

- 4 Pages

Psychology Final Exam - Review

- 13 Pages

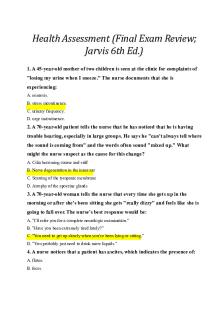

Jarvis Final Exam Review

- 12 Pages

Final exam review

- 96 Pages

Final Exam Review

- 48 Pages

Marketing Final Exam Review

- 15 Pages

Final exam review

- 8 Pages

Astronomy Final Exam Review

- 2 Pages

Final Exam Review Guide

- 4 Pages

Final exam review flsp4420

- 5 Pages

Theo Final Exam Review

- 16 Pages

Entrepreneurship final exam review

- 33 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu