Final Exam Review PDF

| Title | Final Exam Review |

|---|---|

| Author | Rachel Brener |

| Course | Business Finance |

| Institution | Florida Gulf Coast University |

| Pages | 21 |

| File Size | 273.2 KB |

| File Type | |

| Total Downloads | 82 |

| Total Views | 128 |

Summary

NEW Final Exam Review to Practice...

Description

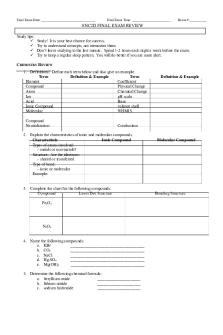

These are practice questions in order for you to review material from chapters 1-11, and 16. This does not cover all the material we have reviewed, so please review chapter PowerPoints and SI Kahoots. Please try your hardest to only use the formula sheet. This will assist you in determining what you need to review for the final exam excluding chapters 12 and 18. 1. Which of the following are listed within the Balance Sheet? a. Assets b. Depreciation c. Equity d. Debt e. All of the Above f. A, C, and D only

2. Can you break down the different elements of the Balance Sheet? Item 1

Item 2

Item 3

3. What is the main goal of finance?

4. The difference between market value and book value is: a. Book value is the total value found on the balance sheet vs market value is what the value is in the competitive open market. b. Market value is the total value found on the balance sheet vs book value is what the value is in the competitive open market. c. Book value holds greater significance than market value d. None of the above

5. Net Working Capital is used to measure the short-term liquidity of a firm. What does this include? Give two examples of each element involved in Net Working Capital.

6. Which of the following is NOT included in an Income Statement? a. Sales b. Assets c. Interest d. Cost of Goods Sold e. Depreciation f. Taxes

7. Walgreens Inc., has common stock of $5,426, long-term debt of $3,090, current liabilities of $1,372, and paid-in-surplus of $8,561. a) What is the value of the assets account for Walgreens?

b) If current assets are $3,512, how much is net working capital? 8. Macy’s Corporation has sales of $539,000, costs of $146,000, depreciation expense of $79,500, interest expense $48,050, and a tax rate of 45%. What is the net income? What is Operating Cash Flow?

9. In 2018, Zoom Video Communications Inc.’s beginning fixed assets were $1,250,000. Zoom’s ending fixed assets were $3,000,000. The depreciation expense for Zoom in 2018 was $90,000. Based on this information, what can we conclude was Zoom’s Net Capital Spending?

10. With the given information find the depreciation expense: costs of goods sold = $89,000; sales = $102,000, interest expense of $3,000, dividends paid of $2,500, addition to retained earnings of $3,200, and tax rate of 40% a) If there were 1,000 shares outstanding, what were the dividends per share?

b) If there were 5,000 shares outstanding, what were the earnings per share?

11. Subway’s December 2027 balance sheet showed $174,000 in common stock and $3,300,000 in the additional paid-in-surplus account. The December 2028 balance sheet showed $187,000 and $3,500,000 in the same two accounts, respectively. If the company paid out $262,000 in cash dividends during 2028, what was the cash flow to stockholders for the year?

12. What would the operating cash flow of Tops Inc. be if it had sales of $21,000, costs of $8,000, depreciation expense of $1,900, interest expense of $1,300, and taxes of 30%?

13. If Hertz Inc. had $11,000 of long-term debt in 2018 and $17,250 of long-term debt in 2019, what would be their cash flow to creditors assuming they paid out $10,920 in interest expense?

14. Carlos is single and has $320,000 of taxable income. Using the tax table, calculate the company’s income taxes. ___________________. a) What is their average tax rate? __________________. b) What is their marginal tax rate? ___________________.

15. If the change in Net Working Capital is $2,340, the net income is $7,390, with a depreciation expense of $1,032, and beginning fixed assets were $22,608 while ending fixed assets were $19,876, what is the Cash Flow from Assets?

16. If IKEA has accounts receivables of $1000, fixed assets of $200, accounts payable of $800, notes payable of $400, inventory of $300, long-term debt of $900 and total assets of $2,500, what is their cash balance? 17. What is the purpose of common-size financial statements? a. What is the basis to common size the balance sheet?

b. What is the basis to common-size the income statement?

18. What is the difference between average and marginal tax?

19. Birthday corp. has Net Working Capital of $2,648, current liabilities of $5,819, and inventory of $1,463. The current ratio and quick ratio are: a. CR 1.455 and QR 1.204 b. CR 1.946 and QR 1.318 c. CR 2.08 and QR 1.036 d. None of the above

20. What happens to the current ratio if … (assuming net working capital is positive) a) If a long-term debt is paid _____________. b) Pay a notes payable _____________. c) Inventory is sold above cost ____________.

21. What are the two methods to find ROE?

22. Profit margin represents: a. How much sales is generated b. How much profit is generated per each dollar of sale c. How liquid the firm is d. All of the above 23. Total Asset turnover measures: a. The valuation of the organization b. The profitability of the organization c. The value of a company’s sales relative to its assets d. How an organization is using its assets in order to generate revenue e. Only C and D f. Only A and B

24. What does Equity Multiplier indicate?

25. Return on equity measures the rate of __________ that the owners of stock receive on their shareholdings. It signifies how well the firm is generating returns on the investment it has received from the shareholders.

26. Remi Inc., has sales of $19 million, total assets of $14 million, and total debt of $4.8 million. If the profit margin is 8 percent. a) What is net income?

b) What is ROA?

c) What is ROE?

27. Allen, Inc., has a total debt ratio of .25. a) What is its debt-equity ratio? b) What is its equity multiplier?

28. Jiminy Cricket Removal has a profit margin of 12 percent, total asset turnover of 1.13, and ROE of 14.86 percent. What is this firm’s debt-equity ratio?

29. If Nuber, Inc., has a ROA of 6.7 percent and a payout ratio of 21 percent. What is its internal growth rate?

30. If the Crash Davis Driving School has a ROE of 15.5 percent and a payout ratio of 54 percent. What is its sustainable growth rate?

31. Calculate the profit margin if sales are $3,780, cost of goods sold are $2,340, depreciation is $480, interest paid is $210 and taxes are calculated at a flat rate of 34%. a. If $170 are paid out in dividends, how much is added to retained earnings?

32. Glory Road Company has the following financial statement information. Beginning Ending Inventory

$1,543

$1,669

Accounts Receivable

4,418

3,952

Accounts Payable

2,551

2,673

Net Sales Cost of Goods Sold

$11,500 8,200

Calculate the operating cycle and cash cycle.

33. Calculate the days’ sales in inventory if cost of goods sold for the year was $1,230,488 and the ending inventory balance was $429,130.

34. ABC Co. forecasts sales for quarter 1 of $300,000 and estimate sales will increase by 5% each quarter. What will cash collections be in quarter 3, assuming a 30-day collection period if beginning accounts receivable is $90,000.

35. DEF Industries has the following quarterly sales forecasts. Beginning accounts receivables are $280, and the firm has a 30-day collection period. Sales for Q1, Q2, Q3, and Q4 are $720, $750, $830, and $910 respectively. a) How much cash will the firm collect in the quarter 2?

b) What is the firms ending accounts receivable for quarter 3? 36. Hewlett Packard, has a cash cycle of 43 days, an operating cycle of 62 days, and an inventory period of 26.5 days. The company reported cost of goods sold in the amount of $341,000, and credit sales were $564,000. What is the company’s average balance in accounts payable and accounts receivable?

37. What is simple interest? a. Interest earned on principal and on interest that is received b. Interest earned on reinvestment of previous interest payments c. Interest on interest d. Interest that is earned only on the original principal

38. What is compound interest?

39. What is the definition of Future Value? a. The amount an investment is worth after one or more periods b. The value at t=0 on a time line c. “Later” money on a time line d. The current value of future cash flows discounted at the given discount rate

40. What are four other words for interest rate?

41. What does a negative number represent?

42. Ture or False: Investors typically receive more with simple interest over compounding interest/

43. What is the definition of discounting?

44. How does one lower their principal? a. Deposit less initially b. Make more payments c. Decrease the interest rate d. Decrease the future value

45. The Effective Annual Rate is: a. The annual rate quoted by law b. The annual rate divided by 12 c. The annual rate multiplied by 12 d. The interest rate expressed as if it were compounded once per year

46. Find the EAR in each of the following cases. Stated Rate (APR) 8.50% 17.50% 14.50% 10.50%

# of times Compounded Quarterly Monthly Daily Semiannually

Effective Rate (EAR)

47. A bond is a ______ contract and an _______-only loan. 48. Does a bond holder have voting rights? 49. The yield to maturity is: a. The market required rate of return implied by the overall payments b. The market required rate of return implied by the current bond price c. The rate of a bond with semi-annual payments d. The rate of a bond with monthly payments

50. Do bond prices and interest rates have a(n) positive relationship or inverse relationship?

51. Which of the following are bond classifications? a. Registered bonds b. Security bonds c. Bearer bonds d. Seniority bonds e. All of the above 52. True or False Short-term bonds have more reinvestment risk than long-term bonds.

53. Suppose you want to buy a car for $45,000 in 6 years. If you can invest at 6.3% annually how much will you need to deposit right now?

54. You are valuing an investment that will pay you $12,000 the first year, $14,000 the second year, $17,000 the third year, $19,000 the fourth year, $23,000 the fifth year, and $29,000 the sixth year (all payments are at the end of each year). What it the value of the investment to you now is the appropriate annual discount rate is 11.00%?

55. How many years will it take for $197,000 to grow to be $554,000 if it is invested in an account with a quoted annual interest rate of 8% with monthly compounding of interest?

56. In an attempt to bribe your finance professor, you purchase a U.S. Savings Bond for him. U.S. Savings Bonds are zero coupon bonds. Specifically, you pay $125 for a $250 face value

bond that matures in 20 years. What is the annual rate of return (i.e., yield to maturity) on this investment?

57. You plan to borrow $389,000 now and repay it in 25 equal annual installments (payments will be made at the end of each year). If the annual interest rate is 14%, how much will your annual payments be?

58. You plan to buy a car that has a total "drive-out" cost of $25,700. You will make a down payment of $3,598. The remainder of the car’s cost will be financed over a period of 5 years. You will repay the loan by making equal monthly payments. Your quoted annual interest rate is 8% with monthly compounding of interest. (The first payment will be due one month after the purchase date.) What will your monthly payment be?

59. PK Software has 6.3 percent coupon bonds on the market with 22 years to maturity. The bonds make semi-annual payments and currently sell for 97 percent of par. What is the current yield on PK’s bonds? The YTM? The effective annual yield?

60. Say you own an asset that had a total return last year of 11.7%. If the inflation rate last year was 2.3%, what was your real return?

61. XYZ Co. wants to issue new 25-year bonds for some much needed expansion projects. The company currently has 4.9% coupon bonds on the market that sell for $1123, make

semiannual payments, have a $1000 par value, and mature in 19 years. What coupon rate should the company set on its new bonds if it wants to sell them at par?

62. What is the difference between a yield to maturity and a coupon rate? a) What happens to a bond’s price when the YTM>Coupon Rate? b) What happens to a bond’s price when the YTM...

Similar Free PDFs

Chem Final Exam Review

- 12 Pages

Final Exam - Review notes

- 92 Pages

Bio Final Exam Review

- 2 Pages

Final EXAM Review booklet

- 5 Pages

CHEM303 final exam review

- 4 Pages

Psychology Final Exam - Review

- 13 Pages

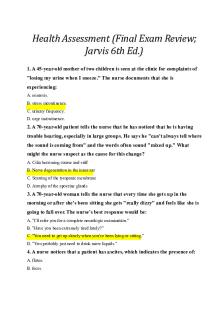

Jarvis Final Exam Review

- 12 Pages

Final exam review

- 96 Pages

Final Exam Review

- 48 Pages

Marketing Final Exam Review

- 15 Pages

Final exam review

- 8 Pages

Astronomy Final Exam Review

- 2 Pages

Final Exam Review Guide

- 4 Pages

Final exam review flsp4420

- 5 Pages

Theo Final Exam Review

- 16 Pages

Entrepreneurship final exam review

- 33 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu