Lecture notes, lecture 9 - Property And Valuation Mathematics: Time Value Of Money & DCF’s – An Introduction PDF

| Title | Lecture notes, lecture 9 - Property And Valuation Mathematics: Time Value Of Money & DCF’s – An Introduction |

|---|---|

| Course | Valuations and Property Principles |

| Institution | Royal Melbourne Institute of Technology |

| Pages | 2 |

| File Size | 55.5 KB |

| File Type | |

| Total Downloads | 4 |

| Total Views | 67 |

Summary

Property And Valuation Mathematics: Time Value Of Money An Introduction Why Do We Need Financial Do understand that the value of a dollar moves in time. What a dollar will buy you today will not buy next year. Time Value Of Money 6 Functions of the 1. Future value of (FV) amount to which will grow i...

Description

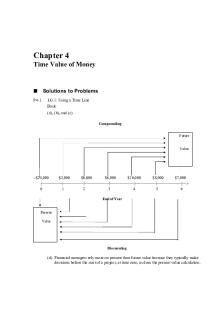

Property And Valuation Mathematics: Time Value Of Money & DCF’s – An Introduction Why Do We Need Financial Math’s Do understand that the value of a dollar moves in time. What a dollar will buy you today will not buy next year. Time Value Of Money ‘The 6 Functions of the Dollar’; 1. Future value of $1 (FV) -The amount to which $1 will grow in a given period of time including the accumulation of interest at a given rate -FV = PV * (1 + i)^n 2. Future value of $1 per period - annuities or regular payments (FVA) -The amount to which a series of $1 installments will grow in a given number of periods with interest at a given rate -((1 + i)*n – 1 Earning is the total earned minus total invested 3. Sinking fund factor -Allocation of funds set aside for capital expenses -Tells you have much you need to set aside to have a specific amount at any future time -PMT = FV * i/(1 + i)*n – 1 ) 4. Present value of $1 (PV) -FV/(1 +i)*n 5. Present value of $1 per period (PVA) -The present value of a series of future $1 payments for a given period of time discounted at a given rate of interest -(1 – ((1 + i) – n ) 6. Partial payment – mortgage payments (PMT) -The level of periodic payment required for both principle and interest on a loan for $1 for a given period of time with interest at a given rate -Partial payment factor (partial interest and principle) – any more is solely on interest -The more you pay the quicker the loan is payed off Time allows the opportunity to postpone consumption and earn interest. Types of Interest Simple Interest – Interest paid only on original amount Compound Interest – Interest paid on both original amount and interest

Discounted Cash Flow (DCF) An investment evaluation technique based upon the time value of money. Used to consider what to pay for a property, all things considered. Enables us to consider; Timing issues (duration of exposure) Risk factors (tenant moving out, equipment failure) To construct a DCF you need to have an appreciation for market value, interest rates etc. Still however just an educated guess. Steps to build a DCF; 1. Set up cash flow over period of time (Cash flow = money going in and out) 2. Determine the net income for each period 3. Calculate the discount factor for each period 4. Calculate the PV for each period 5. Add up all of the PV’s 6. Deduct any acquisition costs 7. Answer = maximum price payable OR expected return Net Present Value/IRR Both are investment hurdles/Green lights NPV – Sum of all present values minus capital expenses IRR (Internal Rate of Return) Green lights; The IRR must equal the hurdle rate or more The NPV must be 0 or greater Hurdle rate - % - A risk free rate + inflation + non-systemic (specific property) and systemic risk (risk of buying into property market)...

Similar Free PDFs

Time value of money

- 5 Pages

Time Value of Money Quiz

- 3 Pages

Oretan time value of money

- 30 Pages

04 Time Value of Money

- 45 Pages

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time value of money solutions gitman

- 31 Pages

Time Value of Money - Grade: A

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu