Macro Final Exam Review PDF

| Title | Macro Final Exam Review |

|---|---|

| Course | Principles Of Macroeconomics |

| Institution | Old Dominion University |

| Pages | 6 |

| File Size | 117.4 KB |

| File Type | |

| Total Downloads | 52 |

| Total Views | 136 |

Summary

final exam review....

Description

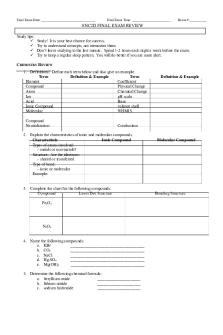

MACRO Final Exam Review Chapters 1, 2, 8 1. Explain the role of scarcity in Economics Scarcity in economics is the condition of having limited resources and unlimited wants 2. Explain the role of opportunity cost in Economics. Opportunity cost is the value of the next best thing 3. Explain the rationality assumption as it relates to Economics. Rationality assumption is purposeful behavior based on weighing perceived cost with perceived benefits. Economic agents don’t intentional make a decision to make themselves worse off. 4. Normative vs Positive Economics Normative economics is making a statement of what should be and it gives a value judgment. Positive economics is making a statement of what is and it is based off of facts, not opinions. 5. Direct vs Indirect relationships Direct relationship in economics mean that the change of one thing has a idmediate effect on another thing. Indirect relationship in economics means that the change of one thing leads to a change in another but it doesn’t directly affect it. 6. What is a budget constraint? a budget constraint shows the potential combinations of 2 goods available with a given money income. It illustrates an individual’s economizing problem. 7. What is a Production Possibilities Frontier? What are the underlying assumptions? What is its shape? Why does it have this shape? The ppf is a curve showing all possible combinations you can produce with your resources. The underlying assumptions are full employment, fixed resources, fixed technology and 2 goods.It’s a concave shape because the law of increasing opportunity cost makes production possibility curve concave. 8. Under what conditions would an economy be operating inside its PPF? On its PPF? Outside its PPF? 9. What are the 4 factors of production? Land, labor (amount of people), capital, entrepreneurial ability 10. Command economy vs market economy a. Differences in economic systems In command economy, government owns the factors of production while in market economy, you can have private property, freedom of enterprise and choice, competition is encouraged b. Advantages to each system (if any) c. Disadvantages to each system Disadvantage of market economy Is market failures and income inequalities d. Role of property rights in each system In a command system, government owns most things and there’s not much private ownership. In a market system people can own their own property and private ownership is encouraged. 11. Circular Flow

Circular flow is the flow of resource market into the product market. In the resource market, household sell and businesses buy. In the product market, businsesses sell and households buy 12. Institutional structure that promote economic growth Strong property rights, patents and copyrights, efficient financial institutions, literacy and widespread education, free trade and a competitive market system 13. Illustrating economic growth on a PPF

Chapter 3 and 21 14. Explain the Law of Demand. Explain the Law of Supply. The law of demand states the if all things are equal (ceteris paribus) there is a negative/ inverse relationship between price and quantity demanded. The law of supply state that all other things being equal, there is a direct/ positive relationship between price and the quantity supplied of a good. 15. List the Determinants of Demand. The determinants of demand include buyers taste, prices of related goods, buyers income, number of buyers and buyers expectations a. Differentiate between a normal good and an inferior good The difference between a normal and inferior good is that normal goods demand varies directly with money income and inferior goods demand varies inversely with money income. 16. List the Determinants of Supply. The determinants of supply include resource prices, (cost of production, input of production), technology, taxes and subsidies, related goods (from producers standpoint), producer expectation 17. Changes in equilibrium (equation format too) Changes in equilibrium come from changes in supply or demand 18. Surplus and shortages in freely moving market Surplus is an excess in supply while a shortage means that there is too little supply 19. Explain a price ceiling. A price ceiling is the maximum legal price a seller can charge. This would cause the quantity demand to be greater than the quantity supplied which would lead to a shortage. 20. Explain a price floor. A price floor is the minimum legal price a seller can charge. Price floor would cause a surplus because quantity supplied would be greater than quantity demanded 21. Explain appreciation and depreciation of a nation’s currency. Appreciation means an increase in the value of exchange rate. Depreciation means a fall in value of exchange rate. When appreciation happens, exchange rates become stronger and when depreciation happens, exchange rate becomes weaker. 22. What type of exchange rate system do we currently use? We currently use a floating exchange rate. 23. Explain the impact of an appreciation in a nation’s currency on trade. How can the depreciation of a currency be good for an economy (such as the example in Iceland)? If a country currency depreciates, it makes it more desirable for other countries to buy their exports because it is cheaper.

24.

25.

26.

27.

28.

29.

30. 31.

32.

33.

34.

35.

Chapter 7,9, and 10 Goals of the Economy What are the 3 basic macroeconomic goals? How is each measured? The 3 basic macroeconomic goals are output growth, full employment and price stability. Output growth is measured by finding the gdp, full employment is found by the unemployment rate and price stability is found by the inflation rate Output What is Gross Domestic Product? What are the two methods for calculating Gross Domestic Product? Gdp is defining aggregate output as the dollar value of all final goods and services produced within the borders of a country during a specific period of time. The two methods of calculating gdp are through the expenditures approach or the income approach What is each component of GDP using the expenditure approach? Explain what is included and what is not included. Each component of gdp using the expenditure approach is consumption by household, investment by businesses, government purchases and expenditures by foreigners Explain the differences between nominal GDP and real GDP. How do you calculate the real GDP growth rate? Nominal gdp uses prevailing price while real gdp shows the changes in price. You find the real gdp by dividing nominal gdp by the price index (in hundredths) What are some of the issues with GDP? Nonmarket activites, leisure, improved product quality, underground economy, gdp and the environment, composition and distribution of the output, noneconomic sources of well-being Unemployment How is unemployment measured in the United States? How is the unemployment rate calculated? Unemployment is measured by the unemployment rate and its calculated by dividing the # of unemployed by the labor force, then multiplying it times 100 What are the types of unemployment? Cyclical, structural and frictional unemployment What are some reasons the official unemployment rate may be understated? The official unemployment rate can be understated by discouraged workers and workers who are underemployed Who is included in the labor force? What is the labor force participation rate? The labor force includes people 16 or older, non-institutionalized, not in the military, available for work, looking for work (within last 4 weeks) or employed. The labor force participation rate is labor force divided by the working age civ population * 100 What is the natural rate of unemployment? The natural rate of unemployment is the full employment level of unemployment Inflation What is inflation? How is it calculated? Why is inflation a problem? Who is hurt by inflation? Is anyone helped by inflation? Inflation is the general rise in the price level. It is calculated by dividing the price of the most recent market basket in the particular year by price estimate of the market times 100. It’s a problem because it reduces the purchasing power of money. The people that are hurt are fixed income receivers, creditors/lenders and savers. The people that are helped are those with COLA and debtors and borrowers. What is demand pull inflation? What is cost push inflation?

36.

37.

38.

39.

40.

41.

Demand pull inflation occurse when theres more spending than production and it raises prices. Cost push inflation occurs because prices are rising and it reduces output. Consumption Schedule, Investment Demand Curve and Mulitplier What is the consumption schedule? What is the savings schedule? What do we call the slope of each schedule? The consumption schedule reflects the the various amounts that households would plan to consume at each of the various levels of disposable income that might prevail at some specific time. The savings schedule shows the disposable income minus consumption Explain marginal propensity to consume and marginal propensity to save. How is each calculated? Mpc is the amount people are willing to consume and you calculate it by change in consumption divided by the change in income. Mps is the amount people are willing to save and its found by dividing the change in saving by the change in income What are the determinants of the consumption schedule? Determinants of the consumption schedule include wealth, borrowing, expectations, and real interest rate Explain the Investment demand curve. The investment demand curve shows the relationship between the interest rate and the amount of investment demanded What is the primary determinant of the investment demand curve? What are the other determinants of the investment demand curve? Determinants of demand include the acquisition, maintenance and operating costs, business taxes, technological change, stock of capital goods on hand, planned inventory changes and expectations Explain the spending multiplier. How is it calculated?

Aggregate Expenditures Model 42. Explain the assumptions of the AE model. Fixed prices and gdp is equal to disposable income 43. Explain why unplanned changes in inventory occur in this model. Unplanned changes happen when there is disequilibrium 44. Identify equilibrium GDP on this model. Equilibrium gdp is equal to ae and its were c + ig crosses ae 45. Explain the differences in leakages and injections. Leakage is a withdrawl from spending and injection is an addition to spending 46. Explain the multiplier effect in this model. Multiplier effect an initial change in spending can increase real output by a “multiplied” amount AD/AS Model 47. Explain Aggregate Demand. Why does the AD curve slope downward? What would increase AD? What would decrease AD? Aggregate demand is a schedule or curve that shows the amount of a nation’s output that buyers collectively desire to purchase at each possible price level. Its downsloping because the relationship between the price level and the amount of real gdp is inverse or negative. Curve is downward because of income and substitution effect. 48. Explain Aggregate Supply. What are the 3 different shapes of the AS curve? What would increase AS? What would decrease AS?

49.

2. 3. 52.

53. 54. 55. 56. 57. 58.

59.

60. 61. 62.

63. 64.

65.

Aggregate supply is the schedule or curve that shows the total output produced at various price levels. Three different shapes are idmediate short run, short run and long run aggregate supply. An increase in ad will increase as Using the AD/AS model illustrate the following scenarios: i. Increase in AD ii. Decrease in AD iii. Increase in SRAS iv. Decrease in SRAS v. Long-run economic growth with stable prices vi. Secular Deflation vii. Appreciating Currency viii. Depreciating Currency ix. Cost-push inflation x. Demand pull inflation Illustrate and explain a recessionary gap. lllustrate and explain an inflationary gap. Fiscal Policy What is fiscal policy? Deliberate changes in government spending and taxes that is designed to achieve full employment, control inflation and encourage output growth How can Fiscal Policy be used to meet macroeconomic goals? Who enacts fiscal policy? Fiscal policy is enacted by the president and congress What are the possible offsets to fiscal policy? Problems, Conflicts . . . Make sure to understand how multiplier is incorporated into fiscal policy Explain deficit, debt, and surplus Banking System and Fed Explain Functions of money Money is used as a unit of account, medium of exchange and store of value. Liquidity Liquidity is the ease of acquiring or disposing without high transaction costs and with little loss of nominal value Make-up of Federal Reserve Fed reserve is made up of 12 banks around the country. They are controlled by the board of governors Political independence of Fed Required Reserves, Excess Reserves, money multiplier Monetary Policy What is monetary policy? Monetary policy is the use of changes to the money supply and the interest rates to influence aggregate demand in order to meet macroeconomic goals of output growth, full employment and price stability Who enacts monetary policy? The federal reserve enacts monetary policy Explain each of the tools of monetary policy and how each works. Changing the reserve ratio, changes to discount rate, term auction facility and open market operations What are the advantages of monetary policy?

All decisions are made by the Federal Reserve, it’s faster to enact policy that fiscal policy and its independent of political pressure, meaning that political campaigns wont inflate prices. 66. Demand of Money, Supply of Money, Interest rate Dt + Da = Dm, interest rates are the price paid for money 67. How does monetary policy work (restrictive and expansionary)? Expansionary monetary policy is used when the economy faces a recession. It lowers target for federal funds rate, fed will buy securities, it expands money supply and It put downward pressure on other interests rates. Restrictive monetary policy is used when there are periods of rising inflation and it increases federal funds rate, decreases money supply and increases other interest rates....

Similar Free PDFs

Macro Final Exam Review

- 30 Pages

Macro Final Exam Review

- 6 Pages

Chem Final Exam Review

- 12 Pages

Final Exam - Review notes

- 92 Pages

Bio Final Exam Review

- 2 Pages

Final EXAM Review booklet

- 5 Pages

CHEM303 final exam review

- 4 Pages

Psychology Final Exam - Review

- 13 Pages

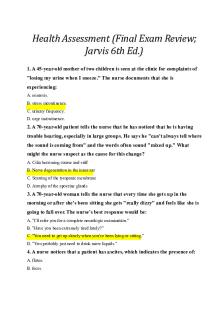

Jarvis Final Exam Review

- 12 Pages

Final exam review

- 96 Pages

Final Exam Review

- 48 Pages

Marketing Final Exam Review

- 15 Pages

Final exam review

- 8 Pages

Astronomy Final Exam Review

- 2 Pages

Final Exam Review Guide

- 4 Pages

Final exam review flsp4420

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu