Revision Quiz 2 3 Time Value of Money 23 PDF

| Title | Revision Quiz 2 3 Time Value of Money 23 |

|---|---|

| Author | bread buy |

| Course | Fundamentals of Business Finance |

| Institution | University of Technology Sydney |

| Pages | 4 |

| File Size | 382.3 KB |

| File Type | |

| Total Downloads | 30 |

| Total Views | 138 |

Summary

Download Revision Quiz 2 3 Time Value of Money 23 PDF

Description

Revision Quiz 2 3 – Time Value of Money 2 & 3 What is the value today of $800 paid every six months forever, with the first $800 payment occurring nine years from today. Interest rates are 6% p.a. compounded half-yearly. $16,133.77 n = 9 years x 2 = 18 BUT PV Perpetuity one period before SO 17 PMT = 800 I = 6% p.a. = 0.06/2 = 0.03 PV = PMT/I = 26,666.67 PV = 26,667.67(1+0.03)^-17 What is the value today of $800 per month forever, with the first $800 payment occurring two months from today. Interest rates are 6% p.a. compounded monthly. $159,203.98 n = 2 BUT one before SO 1 PMT = 800 I = 0.06/12 PV = PMT/I = 160,000 PV = 160,000(1+0.06/12)^-1 You borrow $200,000. The loan requires 20 quarterly repayments at an interest rate of 8% p.a. compounded quarterly. What amount of principal is repaid in the first three months? $8,231.34

You borrow $200,000. The loan requires 20 quarterly repayments at an interest rate of 8% p.a. compounded quarterly. What amount of interest is repaid in the first three months? $4,000.00 = $200,000 x 0.02

You borrow $200,000. The loan requires 20 quarterly repayments at an interest rate of 8% p.a. compounded quarterly. What is the loan outstanding after the first quarterly repayment? $191,768.66 Your yearly loan repayments on a $500,000 loan over ten years are $72,842.96. If the interest rate is 7.5% p.a., what is the loan outstanding at the end of the first year? $464,657.04

Your yearly loan repayments on a $500,000 loan over ten years are $72,842.96. If the interest rate is 7.5% p.a., what is the amount of interest paid in the first year? $37,500.00 = 500,000 x 0.075 You borrow $100,000. You make monthly repayments over the next five years at a monthly interest rate of 2%. What is the amount of each monthly repayment? $2,876.80 PV = 100,000 I = 0.02 n = 5 years x 12 = 60 PV = PMT[1-(1+i)-n/i] What is the value today of $4,000 payments per year, at a discount rate of 5% p.a. if the first payment is received five years from now and the final payment is received 20 years from now?

$35,665.04

What is the value in the year 2040 of a $200 a year annuity with the first payment in 2023 and the final payment in 2039? The interest rate is 7% p.a. $6,599.81 PMT = 200 I = 0.07 n = 17 as 2039-2023+1 FV = 200(1+0.07)^17-1/0.07 FV = 6168.04 FV = 6168.04(1+0.07)^1 Your goal is to accumulate $75,000 in five years' time. What monthly deposit must you make into a savings account to reach your goal? Interest rates are 8% p.a. compounded monthly. $1,020.73 PMT = ? I = 8% p.a. = 0.08/12 n = 5 years x 12 = 60 FV = 75,000 Ordinary Annuity – Future Value – Find PMT Your goal is to accumulate $60,000 in seven years' time. What monthly deposit must you make into a savings account to reach your goal? Interest rates are 12% p.a. compounded monthly. $459.16 PMT = ? I = 12% p.a. = 0.12/12 = 0.01 n = 7 years x 12 = 84 FV = 60,000 Ordinary Annuity – Future Value – Find PMT

A contractual arrangement requires payments of $10,000 on 7 October 2019 and $7,000 on 7 October 2024. What is an equivalent single amount payable on 7 October 2026 at an interest rate of 12% p.a. compounding quarterly? $31,746.67...

Similar Free PDFs

Time Value of Money Quiz

- 3 Pages

Time value of money

- 5 Pages

Oretan time value of money

- 30 Pages

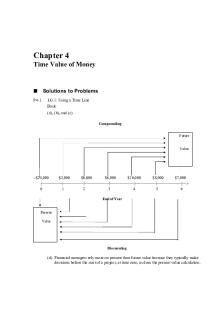

04 Time Value of Money

- 45 Pages

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time value of money solutions gitman

- 31 Pages

Time Value of Money - Grade: A

- 4 Pages

214416988 04 Time Value of Money

- 45 Pages

Chapter 4 TIME Value OF Money

- 26 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu