Solution PYQ Incometax Tutorial with all the calculations and correction PDF

| Title | Solution PYQ Incometax Tutorial with all the calculations and correction |

|---|---|

| Author | Aiman Ahmad |

| Course | financial accounting & reporting |

| Institution | Universiti Teknologi MARA |

| Pages | 6 |

| File Size | 144.6 KB |

| File Type | |

| Total Downloads | 59 |

| Total Views | 487 |

Summary

INCOME TAX/JAN 2018/FARQUESTION 2B. Kanon Bhd, a public listed company based in Penang, manufactures a wide variety of stationeries for office use. Tax expense for the year 2016 was RM240,000 which excludes changes in deferred tax liability. The deferred tax liability on 31 December 2015 was estimat...

Description

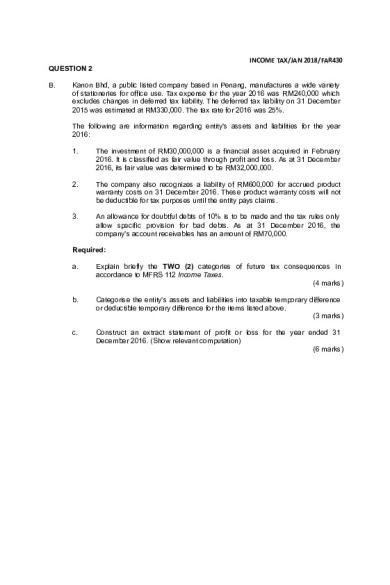

INCOME TAX/JAN 2018/FAR430 QUESTION 2 B.

Kanon Bhd, a public listed company based in Penang, manufactures a wide variety of stationeries for office use. Tax expense for the year 2016 was RM240,000 which excludes changes in deferred tax liability. The deferred tax liability on 31 December 2015 was estimated at RM330,000. The tax rate for 2016 was 25%. The following are information regarding entity’s assets and liabilities for the year 2016: 1.

The investment of RM30,000,000 is a financial asset acquired in February 2016. It is classified as fair value through profit and loss. As at 31 December 2016, its fair value was determined to be RM32,000,000.

2.

The company also recognizes a liability of RM600,000 for accrued product warranty costs on 31 December 2016. These product warranty costs will not be deductible for tax purposes until the entity pays claims.

3.

An allowance for doubtful debts of 10% is to be made and the tax rules only allow specific provision for bad debts. As at 31 December 2016, the company’s account receivables has an amount of RM70,000.

Required: a.

Explain briefly the TWO (2) categories of future tax consequences in accordance to MFRS 112 Income Taxes. (4 marks)

b.

Categorise the entity’s assets and liabilities into taxable temporary difference or deductible temporary difference for the items listed above. (3 marks)

c.

Construct an extract statement of profit or loss for the year ended 31 December 2016. (Show relevant computation) (6 marks)

Suggested solution B a) The two (2) types of deferred tax: Deferred tax liabilities - the amounts of income tax payables in future periods in respect of taxable temporary differences. Deferred tax assets - the amounts of income taxes recoverable in future periods in respect of deductible temporary differences; the carryforward of unused tax losses; and the carryforward of unused tax credits. (4 x 1 = 4 marks) b)

The tax base and temporary differences for each relevant item: Carrying Tax base TTD (RM) amount (RM) (RM) Investment - FVTPL 32,000,000 30,000,000 2,000,000 TTD Warranty 600,000 0 Account receivables

63,000

70,000 2,000,000

DTD (RM)

600,000 DTD 7,000 DTD 607,000

(6 x ½ =3 marks) c) Net temporary differences = 2,000,000 – 607,000 = 1,393,000 (TTD) of Deferred tax liability = 1,393,000 x 25% = 348,250 Deferred Tax A/C RM RM Balance b/d 330,000 Balance c/d 348,250 P&L - DTE 73,250 403,250 403,250 Extract of Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2016 RM Profit before tax Less: Tax expense Current tax expenses Deferred tax expense

240,000 73,250

RM xxxx

313,250 6 x1 = 6 marks)

INCOME TAX/JUN 2018/FAR430 QUESTION 2 B. In 2017, Loveletters Bhd entered into an agreement with its existing employees to provide healthcare benefits to retirees amounting to RM500,000. The entity recognised this amount as accrued healthcare benefits in the Statement of Financial Position as at 31 December 2017. The Inland Revenue Board has ascertained that healthcare costs are deductible for tax purposes when payments are made to retirees.

The entity also revalued its office building to its current fair value of RM1,500,000. This has resulted in revaluation surplus of RM700,000. The entity is undecided as to whether to use the office building for business expansion or to sell the office building to unrelated party at arm’s length. Tax rate applicable for the year is 26% while the real property gain tax is 5%. Required: a.

Briefly discuss two (2) types of temporary differences. (4 marks)

b.

Compute the amount of deferred tax asset/liability that shall arises from the healthcare benefit costs. (3 marks)

c.

Evaluate the deferred tax implication on the revaluation surplus of the entity’s decision as to whether: i. ii.

Utilise the office building for business expansion; or Sell to unrelated party. (6 marks)

Suggested solution Loveletters Bhd a. Briefly discuss two (2) types of temporary differences. i.

Taxable temporary differences, which are temporary differences that will result in taxable amounts in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled.

ii.

Deductible temporary differences, which are temporary differences that will result in amounts that are deductible in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled. (8 x ½ = 4 marks)

b. Compute the amount of deferred tax asset/liability that shall arises from healthcare benefits to retirees. Particulars

Carrying amount RM

Tax Base RM

DTD RM

Accrued healthcare benefits

500,000

-

500,000

Tax rate

26%

DTA

130,000 (3 x 1 = 3 marks) (3 marks) c. Evaluate the deferred tax implication on the revaluation surplus of the company’s decision as to whether: iii. Utilise the office building for business expansion; or Should the company decided to utilise the office building for business expansion, the revaluation surplus is said to be recover through use. Therefore, the company shall use the income tax rate of 26% to determine its deferred tax liability. iv. Sell to unrelated party at arm’s length. Should the company decided to sell to unrelated party at arm’s length, the revaluation surplus is said to be recover through sale. Therefore, the company shall use the real property gain tax rate of 5% to determine tax liability. (6 x 1 = 6 marks)

INCOME TAX/JUL 2017/FAR430 QUESTION 2 B.

Veeda Beauty Bhd is a manufacturing company producing health care products. The following information relates to the assets and liabilities of the company for the year ended 30 June 2016. i.

As at 1 July 2015, the net book value of a machinery was RM2 million. The machinery was purchased on 1 January 2014 at a cost of RM2,500,000. The machine is depreciated at 10% per annum on a straight line method yearly basis. The Inland Revenue Boards allows a capital allowance on such machine at 15% and initial allowance of 10%.

ii.

The research and development expenditure of RM2.4 million was incurred during the year. The tax authority allows all the research and development costs to be written off immediately in computing taxable profit.

Required: a.

Identify the amount of temporary differences for machinery and research and development for the year 2016. (4 marks)

b.

Analyze the calculated temporary difference in (a) above in order to determine the future tax consequences for Veeda Beauty Bhd as at 30 June 2016. (3 marks)

c.

Construct an extract statement of profit or loss and other comprehensive income for the year ended 30 June 2016. Given below is additional information that is useful in the preparation of the above statement. Show suitable computations where necessary. i. ii. iii.

The company made a profit of RM16.4 million for the financial year Deferred tax liability as at 1 July 2015 was RM500,000 Current tax expense is RM3,843,750 (6 marks)

Suggested solution B a)

Temporary difference Carrying Amount RM

Tax Base RM

Temporary Difference RM

Machine Net book value Less: Depreciation for the year (2,500,000x10%) Balance c/d

2,000,000 (250,000) 1,750,000

Cost Less: Initial Allowance (10%) Less: Accumulated AA (15% x 3 yrs)

2,500,000 250,000 1,125,000 1,125,000

Research & Development

2,400,000

-

625,000 2,400,000 3,025,000 8 x ½ = 4 marks

b)

c)

Deferred tax asset/liability Since the carrying amount of both assets > tax base of assets, hence both classified as taxable temporary difference (TTD) . TTD will give rise to deferred tax liability 3 x 1 = 3 marks Suitable computations RM DTL – bal b/d (1/7/2015) 500,000 DTE (balancing figure) 256,250 Balance c/d 756,250 (625,000+2400,000) x 25% 3,025,000 x 25%

Extract Profit or Loss and OCI for the year ended 30 June 2016

6x

RM Profit before tax Less: Tax expense Current tax expense Deferred tax expense Profit after tax

3,843,750 256,250

RM 16,400,000

4,100,000 12,300,000

1 = 6 marks...

Similar Free PDFs

Correction CB3 all - Disserte

- 2 Pages

Incometax notes

- 2 Pages

Week All Tutorial - bmet4961

- 4 Pages

Tutorial Questions ALL

- 37 Pages

All questions WITH answers

- 22 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu