Time Value of Money Practice Problems and Solutions PDF

| Title | Time Value of Money Practice Problems and Solutions |

|---|---|

| Course | Financial Management Ii |

| Institution | Wichita State University |

| Pages | 11 |

| File Size | 192 KB |

| File Type | |

| Total Downloads | 93 |

| Total Views | 151 |

Summary

Download Time Value of Money Practice Problems and Solutions PDF

Description

Finance 440 Review: Time Value of Money Practice Problems Multiple Choice 1. True or false? If the discount (or interest) rate is positive, the future value of an expected series of payments will always exceed the present value. True False ANS: TRUE 2. You plan to analyze the value of an ordinary annuity investment by calculating the sum of the present values of its expected cash flows. Which of the following would lower the calculated value of the investment? Assume a positive interest rate. A. The discount rate decreases. B. The riskiness of the investment’s cash flows decreases. C. Reducing the size of the annual payments by half (e.g., reducing the annual payment from $100 to $50) while doubling the number of annual payments (e.g., doubling the number of annual payments from 10 to 20). D. Doubling the size of the annual payments (e.g., doubling the annual payment from $100 to $200) while reducing the number of annual payments by half (e.g., reducing the number of annual payments from 10 to 5). ANS: C

3. Which of the following statements is CORRECT? A. The cash flows of an annuity due occur at the end of each period. B. If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity. C. The cash flows for an ordinary annuity remain constant from period to period and they occur at the end of each period. D. If a series of equal cash flows occurs at regular intervals, such as once per year, then the series must not be an annuity. ANS: C 4. By increasing the number of compounding periods in a year, while holding the stated annual interest rate constant, you will..... A. B. C. D.

decrease the effective annual rate increase the effective annual rate not change the effective annual rate There is not enough information to answer the question

E. increase the dollar return on an investment but will decrease the effective annual rate ANS: B 5. Which of the following statements is TRUE? Statement I: Statement II: Statement III:

A. B. C. D. E. F.

The future value of a lump sum and the future value of an annuity will both increase as you increase the interest rate. As you increase the length of time from now until the time of receipt of a lump sum, the present value of the lump sum increases. The present value of a lump sum to be received at some point in the future decreases as you increase the interest rate, but the present value of an annuity increases as you increase the interest rate.

Statement I only Statement II only Statement III only Statements I and II only Statements I and III only Statements II and III only

ANS: A 6. Which of the following best describes the structure of an annuity? A. B. C. D.

a series of payments to be received during a period of time. a series of payments to be received at a common interval during a period of time. a series equal payments to be received at a common interval during a period of time. the present value of a set of payments to be received during a future period of time.

ANS: C 7. True or false? If the discount (or interest) rate is positive, the present value of a series of expected cash flows will always exceed the future value of the same series. True False ANS: FALSE

8. True or false? If a bank compounds interest on savings accounts quarterly, the stated annual interest rate (sometimes called the APR) will exceed the effective annual interest rate. True False

ANS: FALSE

9. Your bank account pays a 6% stated annual interest rate (or APR). The interest is compounded quarterly. Which of the following statements is CORRECT? a. b. c. d. e.

The quarterly interest rate is 1.5% and the effective annual interest rate is 3%. The quarterly interest rate is 6% and the effective annual interest rate is greater than 6%. The quarterly interest rate is 1.5% and the effective annual interest rate is greater than 6%. The quarterly interest rate is 3% and the effective annual interest rate is 6%. The quarterly interest rate is 6% and the effective annual interest rate is 6%.

ANS: C 10. Which of the following investments would have the highest future value at the end of 10 years? Assume that the effective annual interest rate for all investments is the same and is greater than zero. a. Investment A pays $250 at the beginning of every year for the next 10 years (a total of 10 payments). b. Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments). c. Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments). d. Investment D pays $2,500 at the end of 10 years (just one payment). e. Investment E pays $250 at the end of every year for the next 10 years (a total of 10 payments). ANS: A 11. Which of the following cannot be calculated? a. b. c. d. C

The future value of an annuity at the end of its life. The present value of an annuity. The future value of a perpetuity at the end of its life. The present value of a perpetuity.

ANS:

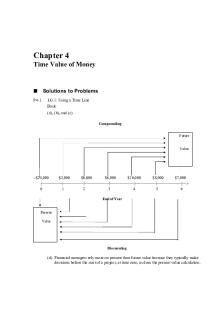

ANS: C Problems P1.

Robert Blanding’s employer offers its workers an optional two-month unpaid vacation after 7 years of service to the firm. Robert, who just started working for the firm, plans to spend his vacation touring Europe at an estimated cost of $24,000. To finance his trip, Robert plans to make an annual deposit of $2,500 into a savings account at the end of each of the next seven years (the first deposit will occur one year from today). The account pays 8% annual interest. a. Will Robert’s account balance in seven years be enough to pay for his trip?

b. Suppose Robert increases his annual deposit to $2,700. How large will his account balance be in seven years?

A1.

a.

Robert needs $24,000 at the end of Year 7. Robert will make seven end-of-year payments, with the first payment occurring one year from today. You can treat this as an annuity and calculate the FV of this annuity at the end of Year 7: On the Calculator: N=7 I/Y=8 PMT=-2,500 PV=0 (he didn’t invest any money today) Solve for FV = 22,307.01 So Bob’s account balance will be $22,307.01 at the end of seven years, which is not enough to pay for the trip that costs $24,000.

b. On the calculator: N=7 I/Y=8 PMT= -2,700 PV=0 Solve for FV = 24,091.57 Now Bob will have enough to pay for the Eurotrip.

P2.

Given the uneven streams of cash flows shown in the following table, answer parts (a) and (b):

EndofYe ar 1 2 3 4 5 Undi s c ount e d Tot a l

Cash Flow Stream A $50, 0 00 40, 000 30, 000 20, 000 10, 000 $150, 000

B $10 , 000 20, 000 30, 000 40, 000 50, 000 $150, 000

a. Find the present value of each stream, using a 15 percent discount rate.

b. Compare the calculated present values, and discuss them in light of the fact that the undiscounted total cash flows amount to $150,000 in each case.

A2.

Calculating by hand a.

Cash Flow Stream A

Year (n) 1 2 3 4 5

CF n x [1 / (1+.15)n] =

Present Value

$50,000 × .869565 = $40,000 × .756144 = $30,000 × .657516 = $20,000 × .571753 = $10,000 × .497177 = Total =

Cash Flow Stream B

Year (n) 1 2 3 4 5

CF n x [1 / (1+.15)n ] =

$ 43,479 30,246 19,725 11,435 4,972 $109,857

Present Value

$10,000 × .869565 = $20,000 × .756144 = $30,000 × .657516 = $40,000 × .571753 = $50,000 × .497177 = Total =

$ 8,696 15,123 19,725 22,870 24,859 $ 91,273

b. Cash flow stream A has a higher present value ($109,857) than cash flow stream B ($91,273) because cash flow stream A has larger cash flows in the early years. So stream A gets more of the $150,000 sooner. Although both cash flow streams total $150,000 on an undiscounted basis, the large early-year cash flows of stream A result in its higher present value. *Note: You could also solve this problem using the CF and NPV registers on the calculator. See the solution to Problem 4 for an example of how to compute the present value of an uneven stream of cash flows with the calculator.

P3.

Assume that you just won the state lottery. Your prize can be taken either in the form of $40,000 at the end of each of the next 25 years or as a single payment of $500,000 paid immediately. a. If you expect to be able to earn 5 percent annually on your investments over the next 25 years (i.e. 5 percent is the appropriate discount rate), ignoring taxes and other considerations, which alternative should you take? Assume that your only decision criteria is selecting the option with the highest present value. b. Would your decision in part (a) be altered if you could earn 7 percent rather than 5 percent on your investments over the next 25 years?

A3.

a.

Finding the present value of this annuity on the calculator: N=25 I/Y=5 PMT=40,000 FV=0 (*Note: Here I am setting FV to zero because we are not using it. If you cleared the TVM registers prior to beginning the problem, FV should already be set to zero and you don’t have to manually set it to zero. To clear your TVM registers, hit the 2nd button and then hit the FV button.) Solve for PV => PV=563,758 At 5%, taking the award as an annuity is better because its present value of $563,578 is larger than the $500,000 single-payment amount.

b. N=25 I/Y=7 PMT=40,000 FV=0 Solve for PV => PV=466,143 At 7%, taking the award as a lump sum is better because the present value of the annuity of $466,144 is less than the $500,000 lump-sum payment. *Note: You could also solve this kind of problem by calculating future values (instead of present values as we’ve done here), and you would always arrive at the same answer if you pick the option with the higher future value.

P4.

Calculate the present value of the following uneven stream of cash flows. Assume an 8 percent discount rate. End of Year 1 2 3 4 5 6 7 8 9 1 0

Cas hFl ow $1 0, 000 10, 000 10, 000 12, 000 12, 000 12, 000 12, 000 15, 000 15, 000 15, 000

A4. Using the Calculator: For this uneven stream of cash flows, you’ll have to use the CF and NPV registers. First, you can do it as follows, which is the long way: CF0=0 C01=10,000 C02=10,000 C03=10,000 C04=12,000 C05=12,000 C06=12,000 C07=12,000 C08=15,000 C09=15,000 C10=15,000 I=8 Solve for NPV = 79,877.91 = PV This PV is a little higher than what we calculated by hand because of rounding. Second, you can also do it as follows, which is the short way. Make sure to clear the CF register by hitting CF, then hit 2nd, then hit CLR WORK (CE/E) before starting this: CF0=0 C01=10,000 F01=3 C02=12,000 F02=4 C03=15,000 F03=3 I=8 Solve for NPV = 79,877.91 = PV

P5.

You plan to invest $2,000 in an individual retirement arrangement (IRA) today that pays a stated annual interest rate of 8 percent, which is expected to apply to all future years. a. How much will you have in the account at the end of 10 years if interest is compounded as follows? (1) Annually (2) Semiannually (3) Monthly b. What is the effective annual rate (EAR) for each compounding frequency in part a?

A5.

a. (1) Annual Compounding FV10 = $2,000 (1.08)10 FV10 = $4,317.85

(2) Semiannual Compounding FV10 = $2,000 (1+0.08/2)2*10 FV10 = $2,000 (1+0.04)20 FV10 = $4,382.25

(3) Monthly Compounding FV10 = $2,000 (1+0.08/12)12*10 FV10 = $4,439.28

b. (1) Annual Compounding EAR = (1 + .08/1)1 –1 EAR = (1 + .08)1 - 1 EAR = (1.08) – 1 EAR = .08 = 8%

(2) Semiannual Compounding EAR = (1 + .08/2)2-1 EAR = (1 + .04)2 - 1 EAR = (1.0816) - 1 EAR = .0816 = 8.16%

(3) Monthly Compounding EAR = (1 + .08/12)12 – 1 EAR = 0.083 = 8.3%

P6.

A6.

To supplement your planned retirement in exactly 42 years, you estimate that you need to accumulate $1 million by the end of 42 years from today. You plan to make equal annual end-of-year deposits into an account paying 4 percent annual interest. a. How large must the annual deposits be to create the $1 million amount by the end of 42 years? b. If you can afford to deposit only $5,000 per year into the account, how much will you have accumulated by the end of the forty-second year?

a. Using the calculator: N=42 I/Y=4 FV=1,000,000 PV=0 Solve for PMT => PMT=9,540.20 So you would need to invest $9,540.20 at the end of each year for 42 years in order to reach your goal of $1 million.

b. N=42 I/Y=4 PMT=5,000 Solve for FV = 524,097.99 With annual end-of-year deposits of $5,000, you would have $524,097.99 at the end of 42 years.

P7.

Suppose you have $10,000 to invest today. Use your calculator to find the annual rates of return (interest rates) required to do the following. Assume annual compounding. a. Double the investment in 4 years (so that you have $20,000 in four years) b. Triple the investment in 10 years

A7. a. N=4 PV= -10000 FV= 20000 PMT= 0 Solve for I/Y => I/Y = 18.92% b. N=10 PV= -10000 FV= 30000 PMT= 0 Solve for I/Y => I/Y = 11.61%

P8.

Jill Chew is a retired nurse and wishes to choose the best of four immediate retirement annuities available to her. In each case, in exchange for paying a premium today (i.e., some single amount today), she will receive equal annual end-of-year cash flows for a specified number of years. She considers the annuities to be equally risky and is not concerned about their differing lives. Her decision will be based solely on the rate of return she will earn on each annuity. The key terms of each of the four annuities are shown in the following table. Premium Annual Life Annuity Paid Today Cash Flow (years) A $30,000 $3,100 20 B 25,000 3,900 10 C 40,000 4,200 15 D 35,000 4,000 12 a. Calculate to the annual rate of return on each of the four annuities Jill is considering. b. Given Jill’s stated decision criterion, which annuity would you recommend?

A8.

a. Annuity A

Calculator: PV = -30,000 PMT = 3,100 N = 20 FV = 0 Solve for I/Y = 8.19% Annuity B Calculator: PV = -25,000 PMT = 3,900 N = 10 FV = 0 Solve for I/Y = 9.03% Annuity C Calculator: PV = -40,000 PMT = 4,200 N = 15 FV = 0 Solve for I/Y = 6.30% Annuity D Calculator: PV = -35,000 PMT = 4,000 N = 12 FV = 0 Solve for I/Y = 5.23% b. Annuity B gives the highest rate of return at 9.03% and would be the one selected based upon Jill’s criteria.

P9.

Janky Real Estate is considering selling an apartment property that it owns. A buyer is willing to pay $2,000,000 for the property, all of which would be paid to Janky upfront (today). Determine what Janky should do under the following scenarios. a. Janky expects the property to generate a cash inflow of $150,000 every year, forever, with the first cash flow occurring one year from today. The applicable discount rate is 10%. b. Janky expects the property to generate a cash inflow of $150,000 one year from today, and this amount will grow by approximately 3% every year thereafter, forever. The applicable discount rate is 10%.

A9. a. In this case, the property can be valued as a perpetuity with constant annual payment of $150,000. Using

the constant perpetuity formula, we compute the present value of the property as: 150,000/0.1 = $1,500,000 This is less than the $2,000,000 that the buyer is willing to pay, so Janky should take the buyer’s offer and sell today for $2,000,000. b. In part b we have a growing perpetuity. The present value of the growing perpetuity is calculated as follows: 150,000/(0.1 – 0.03) = $2,142,857 In this case, the present value of the cash flows generated by the property is higher than the offer from the buyer. So Janky should not sell the property....

Similar Free PDFs

Time value of money

- 5 Pages

Time value of money solutions gitman

- 31 Pages

Time Value of Money Quiz

- 3 Pages

Oretan time value of money

- 30 Pages

04 Time Value of Money

- 45 Pages

TVM Tables (Time Value of Money Tables)

- 129 Pages

Time Value of Money - Grade: A

- 4 Pages

214416988 04 Time Value of Money

- 45 Pages

Chapter 4 TIME Value OF Money

- 26 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu