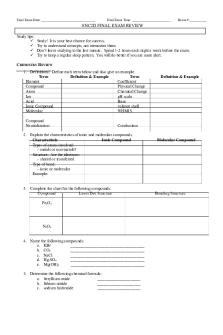

RMI 2302 Final Exam Review PDF

| Title | RMI 2302 Final Exam Review |

|---|---|

| Course | Risk In Business & Society |

| Institution | Florida State University |

| Pages | 41 |

| File Size | 668.6 KB |

| File Type | |

| Total Downloads | 80 |

| Total Views | 132 |

Summary

Final Exam...

Description

RMI 2302 Exam 3

Module 10A What is a derivative? According to Investopedia, “a derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset, index or security. Common underlying instruments include: bonds, commodities, currencies, interest rates, market indexes and stocks.” This is an example of organizational level risk. Important topic for finance majors. Common derivatives: Futures contracts Forward contracts Options Swaps Warrants A futures contract, for example, is a derivative because its value is affected by the performance of the underlying contract. Similarly, a stock option is a derivative because its value is "derived" from that of the underlying stock. Derivatives used as a hedge: Derivatives are great for hedging and it allows you to get rid of price risk by setting a price to sell product in the future. The value of the contract is unknown. This does not create risk. I am an airline and I will use 10 million barrels of aviation fuel this year. I don’t know what the price of aviation fuel will be when I need to buy it. I can enter into a futures contract to purchase the fuel at a specified price at a specified time. I have hedged my exposure to fuel price risk. If prices go up, I make money. If prices go down, I lose money. Derivatives used to speculate: Derivatives can also be used to speculate about future prices. Sell it now, high, and buy it again later, low. If prices are predicted to go down, I make money. If prices go up, I lose money. This creates risk by taking on exposure that I have never had. I think that the S&P index is going to go down, how can I make money on that? I can enter a derivative transaction where I “sell” the index at today’s prices. Problem: I don’t actually own shares of the index to “sell”

RMI 2302 Exam 3

Well, when the index goes down, I can enter into a different derivative transaction to “buy” at the lower price So I sell high, I buy low, I make money – without ever actually owning any shares of the index Or, the index goes up and I sell low and buy high, and lose money What is the risk? Since many trades are “unregulated”, there is little oversight to see how risky some of the “positions” that are being taken by individuals or organizations are. Domino effect and systemic risk are an issue. Orange County, CA loses over $1B and went bankrupt. Robert Citron got involved in derivatives, and for years he was beating the market. Eventually, his streak ended. They could no longer pay their municipal bonds. Barings Bank goes Bankrupt because Nick Leeson hid his billions of dollars speculative transactions of losing money in Singapore. Lehman Brothers were exposed to credit default swaps and subprime mortgages and were guaranteeing other financial institutions money. A 3-4% move in property values and they went bankrupt. Everyone saw this coming and a domino effect was created. The federal government did not bailout Lehman Brothers but it did help Bank of America. AIG Berkshire-Hathaway: Warren Buffet – “Derivatives are financial weapons of mass destruction” he said this 6 years before he caused his company to go bankrupt Why use them? Legitimate hedging function – they are a risk management tool Amplify (leverage) returns (both good and bad) All about risk/reward Help make money move faster Help make money work harder What don’t we know? What is the risk exposure in derivatives? No one knows exactly how big the derivatives market is because there is over the counter trades Estimated in 2007: $1.144 quadrillion (more than one thousand trillion) US GDP - $16.8 Trillion in 2013 US Real Estate: > $25 Trillion (Zillow) Global Real Estate > $180 Trillion (Global Citizens Report) Global Stock & Bond - $155 Trillion - 2012 Wikipedia, $212 Trillion - 2010 QVM Group How should they be regulated? If you want to speculate, shouldn’t you be allowed? o Speculators often help to make markets work Very complex, can they be regulated effectively?

RMI 2302 Exam 3

o Looking back at failures, if internal supervisors could not see the risk, how could an external regulator? Derivatives are a global product, who should regulate?

Reading: Are the Risks of Derivatives Manageable? Provides an explanation of the continuing national and global use of derivatives as safe instruments in hedge funds. Derivatives were estimated to be one of the largest potential disasters of business transactions in 2009. Derivatives are determined by what someone is willing to pay for a contract. Derivatives are financial instruments based on other products, both physical and financial. Yes: Yong Chen The financial derivatives are under attack as an important and ethical investment practice. Derivatives can be powerful investment devices, especially in hedge funds. 70% of hedge funds trade derivatives. He measured fund return, volatility, average market exposure, and market exposure during market downturns. Hedge funds using derivatives are not associated with heavy risk taking. Little is known about their effects on fund risk and performance. Derivatives derive their value from other assets and are derivatives are financial instruments that allow investors to speculate on the future price of an asset. Hedge means to insure against. The high-risk reputation spurred from financial failures which used derivative trading. No: Thomas A. Bass The recent market failures were due in to mismanagement of the derivative investments. Gambling risks (“world’s largest betting parlor” = derivatives) are similar to crystal meth. Widespread regulation should be instated or do not use them at all. Warren Buffet, the Oracle of Omaha, called derivatives “financial weapons of mass destruction” in 2002. In 2009, Buffet lost 67 billion dollars in derivatives transactions and stripped Berkshire Hathaway of its triple A debt rating. He said, “auditors can’t audit these contracts, and regulators can’t regulate them”. No one knows how big the market is in derivatives.

Module 10B

RMI 2302 Exam 3

This module deals with societal risk. Our Needs: We need food, water, shelter, and clothing. Our Insatiable Wants - our wants & desires spur economic activity We want entertainment, communication, variety, and brownies. Our wants are unlimited Our Limited Means: Resources, labor, capital and technology are scarce Our means are limited It is difficult to determine the right mix of production, i.e. how much of each product World Poverty and Economics: Resources available to produce to fulfill our wants/needs are limited and usually cannot be increased greatly at any given time. Technology is also usually subject to limited degrees of improvement. Technology refers to the known means and methods available for combining resources to produce goods and services. Labor – efforts of mind and muscle that can be used in production process Capital – all nonhuman ingredients that go into production The Capacity of the Economy to Produce: GDP is the primary measure of production. It is the total value of production using market prices. (production x market value) It doesn’t take into account ownership. Where it is manufactured is the place where its GDP is contributed. It is not take into account where the product is sold. GDP as the economic pie doesn’t tell us what is produced, all we know is the size of the pie. GDP is the economic pie – doesn’t tell us anything about how that pie is split up. Increases in GDP can be from production increases or price increases. Example: Toyota Camry’s produced in KY count as US GDP, not Japan

RMI 2302 Exam 3 Production Possibilities: Every economy has a stock of resources (labor & capital) and technology to produce How they are combined to produce products/services is virtually limitless If only two products, it can be represented by the production possibility curve Opportunity cost is not linear, marginal cost is increasing so curve is convex. It costs more education to produce the 90th million ton of food than the first ton of food and vice versa. What is optimal? What is the right level of production? It is impossible too tell. When you are near capacity, the cost moves a lot. Marginal Social Cost of education? Marginal Social Benefit of new schooling? MSC = MSB, but not real easy to figure out. If we only have 50 million tons but need 60 or people starve, then the marginal social benefit of the 50-60 million tons is high, but may not be for the 61st million. Economic Growth: Generic growth – the pie gets bigger: new resources, new technology, etc. Specific growth – education technology – food technology As GDP grows, the pie gets bigger. Can Governments use GDP to measure well being? Are we producing more? - Real GDP – make adjustments for inflation/price changes Are we using more (labor) resources? - Per capita real GDP – how much we can produce per person in our economy What Causes Poverty? Income is not evenly distributed. Income chart is divided into quintiles (First 20% - Poorest, Second 20 % - Second Poorest, Third 20% - Middle Class, Fourth 20% - Second Richest, Fifth 20% - Richest). How do you fix income disparity and should it be fixed?

Quality of the labor force - Quality of the labor force – education be careful type of education skills Capital = natural resources Stock of Capital / Capital Accumulation Technology Efficiency Population – highly effects growth of an economy

What Can Governments Do? The development chart looks at population, rate of population increase, life expectancy, per capital real GDP, and GDP growth rate.

RMI 2302 Exam 3

Less Developed Countries (Chile, China, Columbia, Egypt, El Salvador, Ethiopia, India, Indonesia, Kenya, Mexico, Nigeria, Peru, Philippines, South Africa, Thailand, Venezuela, and Zambia). These usually have higher population, higher rate of population increase, lower life expectancy, lower per capita real GDP, and higher GDP growth rate) -

Communism vs. Capitalism Planned vs. unplanned economy Involvement in education Infrastructure Attract FDI (Foreign Direct Investment) – developed countries invest, help train our workers, and update less developed countries’ infrastructure. Issue: nationalization – when host country takes over once it has been developed and kicks foreigners out.

Most of the U.S infrastructure was built under the Eisenhower reign and then was not updated for 50 years which led to bridges collapsing.

Developed Countries (Canada, France, Germany, Italy, Japan, Singapore, Sweden, Switzerland, United Kingdom, and United States) These usually have lower population, lower rate of population increase, higher life expectancy, higher per capita real GDP, and lower GDP growth rate – more efficient in production -

Humanitarian aid World Bank / loans to developing countries Partnerships / Cooperation Outsourcing

Reading: Alleviating Human Misery 2/3 of the world’s population goes to sleep hungry at night. 1/5 of the world survives on no more than $1 per day. Human beings want things that are necessary to keep them alive (food and protection). Wants are unlimited and insatiable due to variety. Labor resources – all of the efforts of mind and muscle that can be used in production processes. Capital resources – all the nonhuman ingredients that go into the production processes. Resources are always scarce relative to the sum of total of human wants. Technology – the known means and methods available for combining resources.

RMI 2302 Exam 3

GDP measures the total market value of all final goods and services produced within an economy during a specific time period. Increases in GDP can be caused by increases in production, or increase in average prices. Production possibilities curve s a graphical representation of the maximum quantities of the two goods that an economy can produce when its resources are used in the most efficient way possible. Opportunity Cost Principle is the true cost of producing an additional unit of a good or service is the value of the other goods and services that must be given up to obtain it. Increasing opportunity cost – as more of a particular good or service is produced, the cost in terms of other goods or services given up grows. This gives the productions possibilities curve its bow shape. Marginal social cost – the true cost born by society when the production of a good or service is increased by one unit. Marginal social benefit – the true benefit to society of a one unit increase in the production of a good or service. Cost benefit analysis – a technique for determining the optimal level of an economic activity. In general, an activity should be expanded so long as the expansion leads to greater benefits than costs. Real GDP – GDP in current dollars corrected for inflation. The correction required dividing each years GDP in current dollars by that years price index in decimal form Per capita real GDP – real GDP divided by population Per capita GDP – GDP in current dollars divided by population Causes of poverty and requisites of economic growth: 1. Quality of labor force 2. Stock of capital and capital accumulation 3. Technology 4. Efficiency 5. Population Q: What is not a cause of poverty? A: Health Care Q: GDP measures which of the following? A: Production

RMI 2302 Exam 3 Q: What depicts the combination of resources and technology to produce products and services? A: Production Possibilities Curve Q: What does Thomas Bass from "Derivatives: The Crystal Meth of Finance" mean when he says, "Derivatives do the work of Adam Smith's invisible hand principle?” A: Derivatives transmogrify individual greed in the collective good Q: Which of the following best describes an accurate implication of the resources and technology available to a producing country? A: The production combinations between resources and technology is virtually limitless Q: Which of the following is something less developed governments can do to alleviate poverty? A: Attract foreign direct investment Q: Which of the following best describes something developed governments can do to alleviate poverty in lesser developed countries? A: Humanitarian Aid Q: To what does Chen attribute the high-risk image of derivatives? A: A number of spectacular financial failures from 1994 to 2008 Q: GDP was referred to as the “economic pie.” One of the limitations, in this sense, is that we don’t know how the pie is split up. A: True Q: Each economy possesses resources and technology to use in production A: True Q: Which is greater, our wants or our means? A: Our wants Q: Wealthier nations have an obligation to help poorer nations A: False Q: Corporations have an obligation to help poorer nations. A: False Q: Countries can increase their GDP by: A: increase in capital, increase in labor, and improvement in technology Q: The US is the only country with an income inequity problem A: False

Module 11

RMI 2302 Exam 3 Survey of Global Risk: Many risks do not respect national borders. According to the annual Global Risk Survey of more than 700 experts It is important to orient & inform decision makers Objective of the survey is to explore nature of systemic risks, map out 31 global risks, and focus on the 3 constellations (youth, cyberspace, geopolitics) Underlying Themes in Report: 1. Trust (in other countries to do what they say) 2. Long-Term Thinking (problem: most risks are not immediate, but rather future risks) 3. Collaborative Multi-stakeholder Action (these problems cannot be solved solo) 4. Global Governance Global Risk – occurrence that causes significant negative impact for several countries and industries over a time frame of up to 10 years. Systemic Risk – breakdowns in an entire system, as opposed to breakdowns in individual parts or components Systemic Risks are characterized by: large failure Modest tipping points combining indirectly to produce large failures Risk-sharing or contagion, as one loss triggers a chain of others “Hysteresis”, or systems being unable to recover equilibrium after a shock 31 Global Risks (see Table 1.1) The 31 risks are divided into 5 categories: 1. Economic – biggest concern Risks in the economic category include fiscal and liquidity crises, failure of a major financial mechanism or institution, oil-price shocks, chronic unemployment and failure of physical infrastructure on which economic activity depends. 2. Environmental Risks in the environmental category include both natural disasters, such as earthquakes and geomagnetic storms, and man-made risks such as collapsing ecosystems, freshwater shortages, nuclear accidents and failure to mitigate or adapt to climate change. 3. Geopolitical – second biggest concern The geopolitical category covers the areas of politics, diplomacy, conflict, crime and global governance. These risks range from terrorism, disputes over resources and war to governance being undermined by corruption, organized crime and illicit trade. 4. Societal The societal category captures risks related to social stability – such as severe income disparities, food crises and dysfunctional cities – and public health, such as pandemics, antibiotic-resistant bacteria and the rising burden of chronic disease. 5. Technological – least concern

RMI 2302 Exam 3 The technological category covers major risks related to the growing centrality of information and communication technologies to individuals, businesses and governments. These include cyber attacks, infrastructure disruptions and data loss. Risks analyzed along 3 parameters: 1. Highest Concern (qualitative) 2. Likelihood and impact (quantitative) 3. Interdependencies (systemic) Top 10 highest concern systemic risks: 1. Fiscal Crisis in Key Economies 2. Structurally High Unemployment/Underemployment 3. Water Crises 4. Severe Income Disparity 5. Failure of Climate Change Mitigation & Adaptation 6. Greater Incidence of Extreme Weather Events 7. Global Governance Failure 8. Food Crises 9. Failure of a Major Financial Mechanism/Institution 10. Profound Political and Social Instability Figure 1.1 – The Global Risks Landscape The 31 risks are mapped based on likelihood and impact Includes the breakdown by the 5 categories 1. Economic 2. Environmental 3. Geopolitical 4. Societal 5. Technological Highest concern = biggest squares Figure 1.4 – The Global Risks 2014 Interconnections Map The 31 risks are mapped based on how interconnected they are with the other risks Includes the breakdown by the 5 categories 1. Economic 2. Environmental 3. Geopolitical 4. Societal 5. Technological Fiscal Crisis = Biggest risk #1 high concern systemic risk: Fiscal Crises - Box 1.2

RMI 2302 Exam 3 Causes of Fiscal Crises: Lack of confidence High level of government debt o Paid through inflation of the dollar or growing the economy to outweigh the debt Results of Fiscal Crises – unknown – we do not know Much of the economy is driven by consumer confidence. More confident = more purchase of durable goods. People lack confidence = more savings Biggest threat = lack of faith in the US dollar More than 100% of our GDP is in outstanding debt #3 high concern systemic risk: Water Crises - Box 1.3 Connected to extreme weather (global warming, hurricanes, typhoons, droughts, etc.) Water Security? Impact of food availability and prices (scarcity) Not just a third world concern – leads to geopolitical problems - CA – drought conditions - Florida – Apalachicola Bay #5 high concern systemic risk: Climate Change - Box 1.4 Economic Growth vs. Climate Change Trade off: what can we do? Stop production and economic growth in order to stop pollution? Vulnerability – who can adapt best? Cost - $100B per year for developing countries Time - 100 years until poorest countries can adapt as well as we can today Other risks Urbanization – not a big US problem, but a problem in poorer countries (pandemics, safety, etc.) Existential Threats – “unknown unknowns”, manmade viruses, computers taking over the world, alien invasions, etc. Trends to Watch: 1. Demographic Trends – aging population ...

Similar Free PDFs

RMI 2302 Final Exam Review

- 41 Pages

Exam 1 Review 2302 - Adam Fetterman

- 10 Pages

RMI 2101 Exam 2 Notes

- 15 Pages

Chem Final Exam Review

- 12 Pages

Final Exam - Review notes

- 92 Pages

Bio Final Exam Review

- 2 Pages

Final EXAM Review booklet

- 5 Pages

CHEM303 final exam review

- 4 Pages

Psychology Final Exam - Review

- 13 Pages

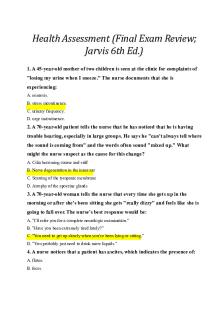

Jarvis Final Exam Review

- 12 Pages

Final exam review

- 96 Pages

Final Exam Review

- 48 Pages

Marketing Final Exam Review

- 15 Pages

Final exam review

- 8 Pages

Astronomy Final Exam Review

- 2 Pages

Final Exam Review Guide

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu