Cost-Volume-Profit Relationship - Google Docs PDF

| Title | Cost-Volume-Profit Relationship - Google Docs |

|---|---|

| Course | Intro Managerial Accounting |

| Institution | George Washington University |

| Pages | 3 |

| File Size | 111.1 KB |

| File Type | |

| Total Downloads | 6 |

| Total Views | 143 |

Summary

professor sul...

Description

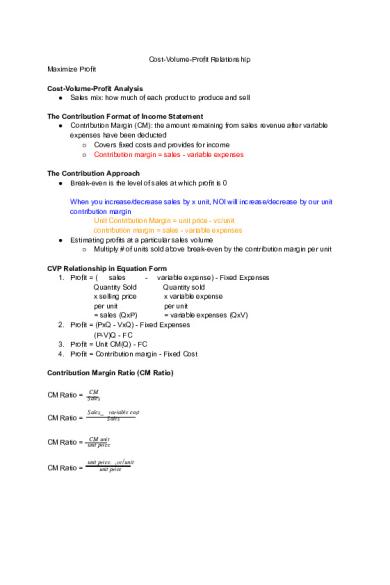

Cost-Volume-Profit Relationship Maximize Profit Cost-Volume-Profit Analysis ● Sales mix: how much of each product to produce and sell The Contribution Format of Income Statement ● Contribution Margin (CM): the amount remaining from sales revenue after variable expenses have been deducted ○ Covers fixed costs and provides for income ○ Contribution margin = sales - variable expenses The Contribution Approach ● Break-even is the level of sales at which profit is 0

●

When you increase/decrease sales by x unit, NOI will increase/decrease by our unit contribution margin Unit Contribution Margin = unit price - vc/unit contribution margin = sales - variable expenses Estimating profits at a particular sales volume ○ Multiply # of units sold above break-even by the contribution margin per unit

CVP Relationship in Equation Form 1. Profit = ( sales - variable expense) - Fixed Expenses Quantity Sold Quantity sold x selling price x variable expense per unit per unit = sales (QxP) = variable expenses (QxV) 2. Profit = (PxQ - VxQ) - Fixed Expenses (P-V)Q - FC 3. Profit = Unit CM(Q) - FC 4. Profit = Contribution margin - Fixed Cost Contribution Margin Ratio (CM Ratio) CM

CM Ratio = Sales CM Ratio =

Sales variablecost Sales

CM unit CM Ratio = unitprice

CM Ratio =

unitprice vc /unit unitprice

5. Profit = CM ratio x Sales - Fixed Costs Target Profit in Units Profit = unit CM x Q - Fixed Expenses P rof it+F ixedExpenses unitCM

Q=

Unit Sales =

how many units you need to sell to reach target profit

P rof it+F ixedExpenses unitCM

Dollar Sales =

P rof it+F ixedExpenses CM Ratio

Break-Even Analysis in Units ● To determine unit sales and dollar sales needed to achieve a target profit of 0 ○

Break Even (Unit Sales) =

○ Break Even ($ Sales) =

F ixedExpenses unitCM

F ixedExpenses CM Ratio

Margin of Safety ($, units, %) Margin of safety ($) = Total Budgeted (actual) sales - break-even sales Margin of safety (units) = Total # of units - break even units Marginof saf etyin$

Margin of safety (%) = Actual budgetedsales / Ex: if margin of safety was 20%, it means you can have a 20% decrease in sales and still be able to break-even Operating Leverage ● Measure of how sensitive net operating income is to percentage changes in sales ● Measure at any given level of sales of how a percentage change in sales volume will affect profits

●

ContributionMargin

Degree of Operating Leverage = NetOperatingIncome So if D.O.L is 2, if sales increase by 10%, NOI will increase by 20%

Sales Mix ● Relative percentage in which company sell its products ● Sales mix is important because different products often have very different contribution margins ○ Sell more of the more profitable product

●

Sales mix is a calculation that determines the proportion of each product a business sells relative to total sales ○ Significant because some products or services may be more profitable than others, and if a company’s sales mix changes, its profit also changes ○ Look at contribution ratio of each individual product

Company CM Ratio =

CompanyCM (CompanyT otalSales T otalV ariableExpenses) CompanyT otalSales

...

Similar Free PDFs

Untitled document - Google Docs

- 3 Pages

Shame Final - Google Docs

- 3 Pages

History Notes - Google Docs

- 22 Pages

Philosophy Lecture - Google Docs

- 39 Pages

HDFS Notes - Google Docs

- 8 Pages

Screenplay - Google Docs

- 3 Pages

Spatial Histories - Google Docs

- 6 Pages

Socialism - Google Docs

- 1 Pages

Maslow Activity - Google Docs

- 1 Pages

Pregrancy bp - Google Docs

- 5 Pages

Aristocracy - Google Docs

- 1 Pages

CM6.odt - Google Docs

- 4 Pages

Draft poem - Google Docs

- 2 Pages

Lab #5 - Google Docs

- 3 Pages

Building DNA - Google Docs

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu